SSS Circular No. 2022 – 009: Online Filing of Social Security (SS) and Employees Compensation (EC) Death Benefit Claim through the My.SSS portal

Pursuant to Social Security Commission (SSC) Resolution No. 39-s.2022 dated 26 January 2022, and Section 13 of the Social Security Act of 2018 or Republic Act No. 11199 and to comply with the Ease of Doing Business and Efficient Government Services Delivery Act of 2018 or Republic Act No. 11032 through streamlining , simplification and automation of benefit processes.

The following guidelines for the online filing of SS and EC death benefit claim through the My.SSS portal are hereby issued:

A. Coverage

All qualified dependent legal spouses of deceased SSS members who have not re-married, cohabited or entered in “live-in” relationships.

B. Definition of Terms

Cohabitation refers to relationship where a man and a woman live together as husband and wife without the benefit of marriage.

C. Pre-Requisites for Online Filing

- Claimant must have an SS Number and registered in the SSS Website.

- Claimant must have a UMID card enrolled as ATM or an approved disbursement account in the Disbursement Account Enrollment Module (DAEM).

D. Policies on the Online Filing of Death Benefit Claim

1. The claimant shall provide the active/retained SS Number of the deceased SSS Member.

2. The claimant shall upload the documentary requirement/s for SS and/or EC death benefit claim.

3. The claimant shall confirm online the deletion of all posted contribution/s applicable after the month of death of the SSS member and that he/she understands that the SSS shall determine the handling thereof based on applicable policies.

4. The claimant shall execute an online certification with undertaking that he/she is a dependent legal spouse of the deceased SSS member and has not re-married , cohabited or entered in a “live-in” relationship before or after the members’ death.

5. The claimant may be required to upload supporting document/s and/or execute an online certification with undertaking or may receive notification to file at any SSS Branch office / Foreign representative Office for the following conditions/cases:

a. With dependent child/children;

b. Date of death does not match the contingency date of settled funeral benefit claim;

c. With in-process /settled death benefit claim;

d. EC death benefit claim is due to illness/sickness requiring medical evaluation;

e. Invalid membership coverage

f. Other conditions /cases as may be determined by the SSS.

6. The claimant shall be required to certify that the information provided in his/her online filing of death benefit claim through my.SSS are true, correct and accurate. The claimant including any person/s involved will be held liable under all circumstances for any false information, misrepresentation and fraud in accordance with Section 28 of Republic Act No. 11199 and other applicable laws.

7. Death benefit claims filed online through the My.SSS or SSS BO/FRO shall be subject to the following validation/review and processing prior to approval for payment:

a. Evaluation of uploaded documentary requirement/s;

b. Determination of primary beneficiary/ies;

c. Verification of fact of death;

d. Deduction of overlapping/overpaid benefits; and

e. Other controls as may be determined by the SSS.

8. The processing time shall start upon the acknowledgement of the online submission of claimant’s death benefit claim.

9. The following email and notifications shall be sent to claimants regarding their death benefit claims:

a. Acknowledgement of successful submission;

b. Approval/Rejection of claim

c. Other notifications as deemed necessary by the SSS.

10. The death benefit shall be credited to the claimant’s UMID card enrolled as ATM or the preferred disbursement account in DAEM.

11. Death benefit claims with any of the following conditions/cases shall be filed at any SSS BO/FRO:

a. Deceased SSS member has outstanding loan balance under the Stock Investment Loan Program (SILP)/ Privatization Loan Program/Educational Loan/ Vocational Technology Program;

b. Claimant is incapacitated , under guardianship or confined in an applicable institution;

c. Application of Portability Law or Bilateral Social Security Agreements;

d. Non-availability or late registration of death certificate issued by Local Civil Registrar or Philippine Statistics Authority; and

e. With adjustment of for re-adjudication of claim.

E. Implementation

Mandatory online filing of all qualified dependent legal spouses of deceased SSS members, shall be implemented six (6) months after the effectivity of this circular.

All other existing Circulars, implementing rules and guidelines not contrary to or inconsistent with the provisions hereof shall remain valid and in effect.

This Circular shall take effect immediately following its publication in a newspaper of general circulation and the registration and filing of three (3) copies of the published Circular with the Office of the National Administrative Register.

Please be guided accordingly.

Philippine SSS Advisory: Employees Compensation (EC) Death Benefit Claims

Ang mga DEPENDENT LEGAL SPOUSE lamang ng namatay na miyembro ang maaaring mag-file ng EC Death Benefit claim online, kung ang mga ito ay:

- Hindi nag-asawang muli

- Hindi nag-cohabit o kasmaang nanirahan ang isang taong hindi niya asawa

- Hindi pumasok sa isang “live-in” relationship bago o pagkatapos ng pagkamatay ng asawang miyembro

Sa anong mga kondisyon hindi maaring mag-file ng EC Death Benefit Claim Online?

- Kung ang namatay na miyembro ay may outstanding loan balance sa ilalim ng Stock Investment Loan Program (SILP)/Privatization Loan Program/Educational Loan/Vocational Technology Program

- Kung ang claimant ay may kapansanan, nasa pangagalaga ng isang guardian o naka-confine sa isang institusyon gaya ng penitentiary, correctional institution, o rehabilitization center

- Kung ang claim ay sa ilalim ng Portability Law or Bilateral Social Security Agreements

- Kung hindi available o late registration ang death certificate mula sa Local Civil Registrar (LCR) o Philippine Statistics Authority (PSA)

- Kung kasalukuyang may adjustment o for re-adjudication ang claim

Mga Dapat Ihanda bago mag-file ng EC Death Benefit Claim Online

- SS Number at My.SSS account ng claimant

- UMID Card nan aka-enroll bilang ATM o aprubadong bank/ e-wallet/RTC/CPO* account sa Disbursement Account Enrollment Module (DAEM) ng My.SSS portal

- Active/retained SS number ng namatay na miyembri

- Documentary requirements para sa EC Death Benefit Claim application

Para mag-file ng EC Death Benefit Claim:

1. Mag-log in sa iyong My.SSS Member account. I-type ang Username at password, i-tick ang box na katabi ng “I’m not a robot”, pagkatapos ay i-click ang “Submit”.

![]()

2. Sa ilalim ng E-services tab, piliin ang “Benefits”, pagkatapos ay i-click ang “Submit Death Claim Application”.

![]()

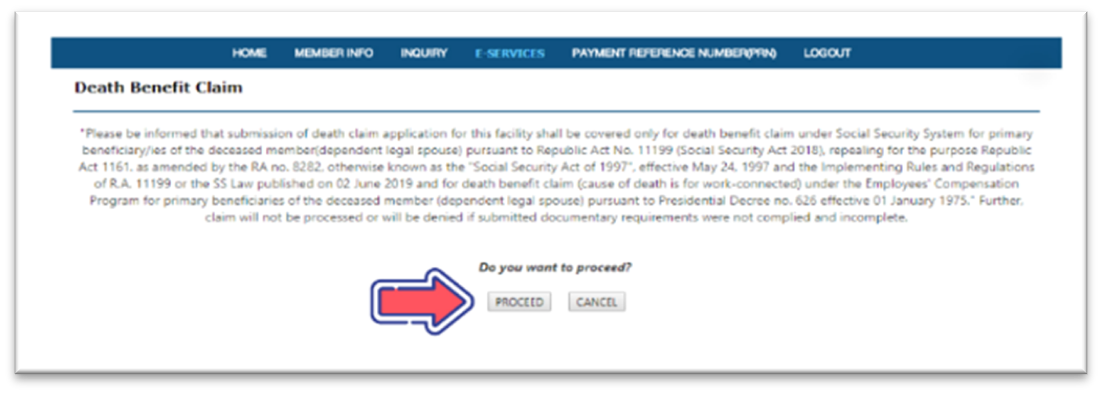

3. I-click ang “Proceed”

![]()

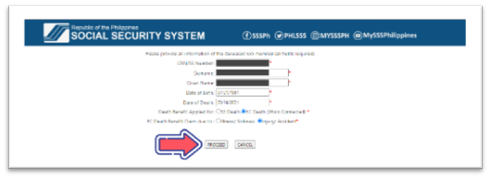

4. Ibigay ang lahat ng hinihinging impormasyon tungkol sa namatay na miyembro. Piliin and Death Benefit Claim Type (EC Death), pagkatapos ay i-click ang “Proceed”.

![]()

5. Piliin ang sanhi ng pagkamatay, pagkatapos ang i-click ang “Proceed”.

![]()

6. Kung ang pagkamatay ay dahil sa pagkakasakit, kailangang pumunta ng claimant sa pinakamalapit na SSS branch para sa medical evaluation na isasagawa ng Medical Evaluation Section ng nasabing branch. I-click ang “OK” para i-cancel ang online transaction.

![]()

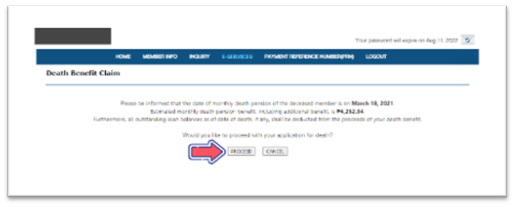

7. Kung kwalipikado para sa buwanang death benefit pension, ang petsa at ang tinatayang halaga nito (kasama na ang P1,150 karagdagang benepisyo),ay makikita sa screen. Ipagpatuloy ang aplikasyon sa pamamagitan ng pag-click ng “Proceed”

![]()

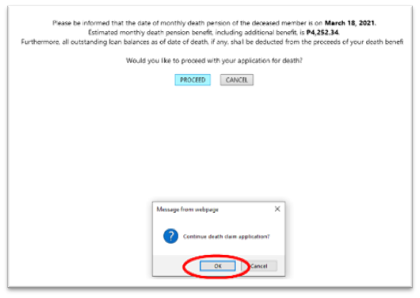

8. I-click ang “OK” para magpatuloy sa online filing ng Death Benefit claim,

![]()

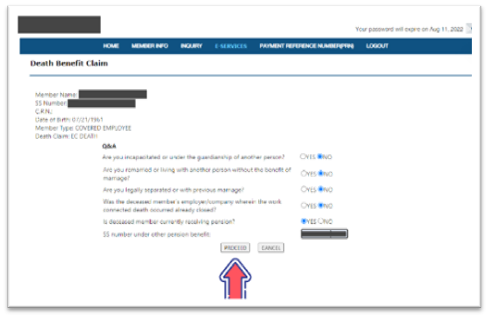

9. Piliin ang sagot (“Yes” or “No”) sa mga tanong na makikita sa screen at i-type ang hinihinging “SS Number under other pension benefit”, kung mayroon, pagkatapos ay i-click ang “Proceed”.

![]()

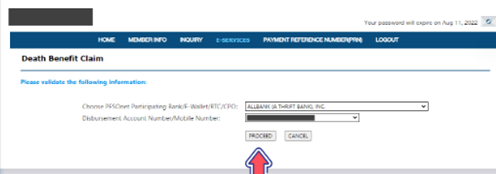

10. Piliin mula sa dropdown menu ang Disbursement Account kung saan nais matanggap ang benepisyo, pagkatapos ay i-clcik ang: Proceed”.

![]()

11. I-click ang “OK”.

![]()

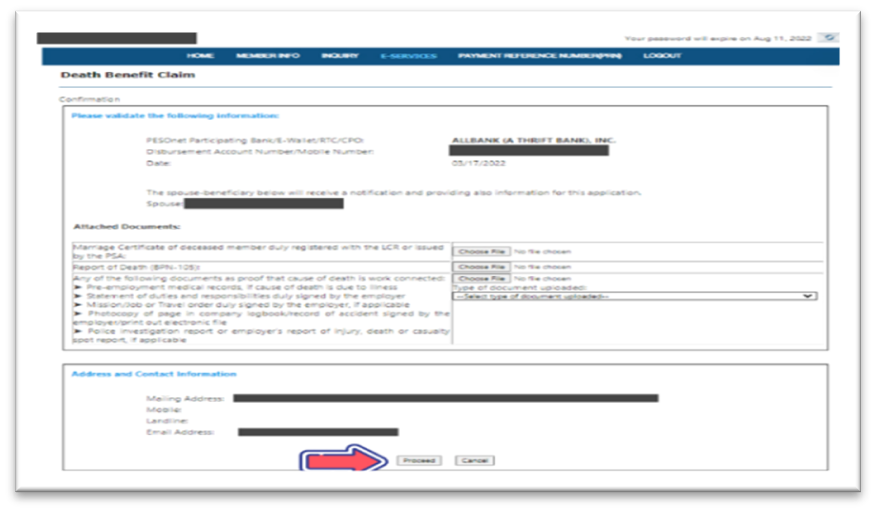

12. I-upload ang JPEG o PDF file ng kaukulang documentary requirement para sa EC Death Benefit Claim, pagkatpos ay i-click ang “Proceed”. (Paalala: Limitahan sa 1MB ang document file size).

Kung ang claimant ang siya ring nag-file ng Funeral Benefit claim, i-upload ang Marriage Certificate ng namatay na miyembro, Report of Death (BPN-105), at iba pang supporting documents.

![]()

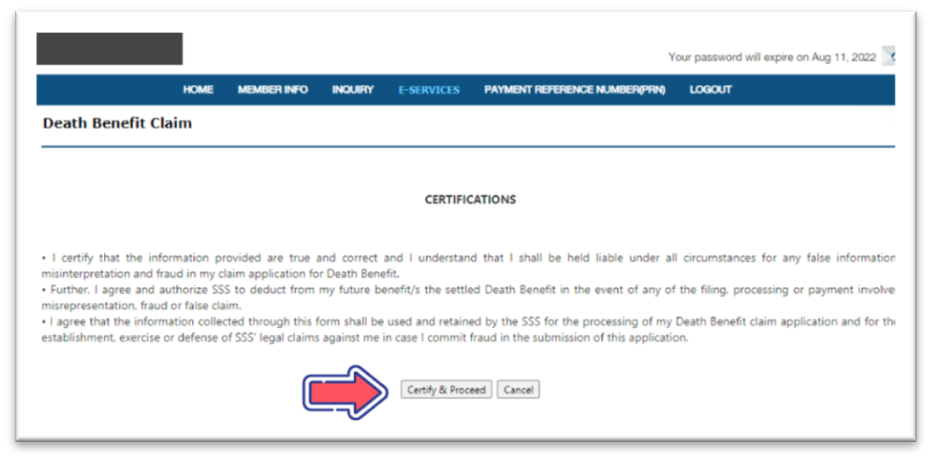

13. I-click ang “Certify & Proceed” para kumpirmahin ang Certification.

![]()

14. Matagumoay nang nai-submit ang EC Death Benefit Claim APPLICATION! I-click ang “OK” para kumpirmahin ang pagsusumite ng EC Death Benefit Claim, pagkatapos ay i-click ang “PRINT” para makapag-generate ng acknowledgement receipt na naglalaman ng detalye ng isinumiteng Death Benefit Claim.

![]()

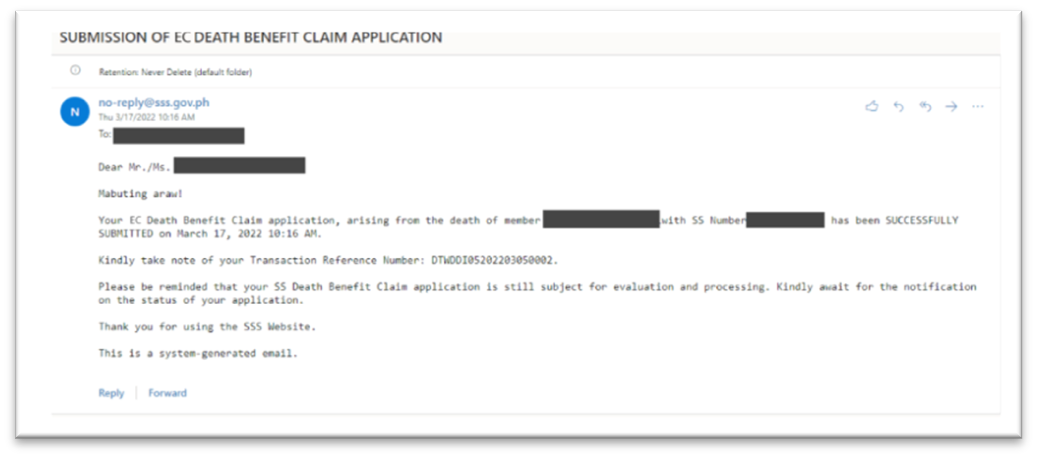

15. I-check ang iyong email para sa notipikasyon mula sa SSS tungkol sa matagumpay na pagsusumite ng EC Death Benefit Claim.

![]()

Mahalagang Paalala:

- Ang processing para sa EC Death benefit claims ay magsisimula sa pagtanggap ng kumpletong aplikasyon at requirements para sa EC Death Benefit Claims online sa pamamagitan ng My.SSS portal.

- Ang EC Death Benefit ay iki-credit sa UMID Card ng claimant na naka-enroll bilang ATM o sa piniling disbursement account na naka-enroll sa DAEM.

Philippine SSS Advisory: New Requirement for SSS Short-term Member Loans

All individually paying members (Self-Employed, Voluntary, including Non-Working Spouse, and land-based OFW-Members) are now required to have at least 6 posted monthly contributions under their current coverage or membership type before the month of filing application for Salary, Calamity, or other short-term loans of SSS.

For example, an employee who resigns and becomes a Voluntary Member (VM) starting July 2022 may file a short-term loan application starting only on January 2023, six (6) months after regularly contributing as a VM.

All other guidelines on Short-Term Member Loans remain the same.