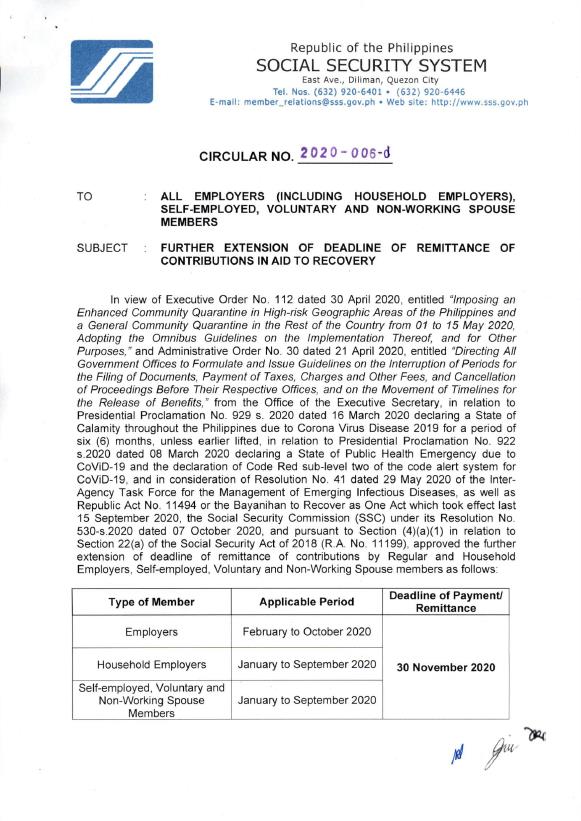

The further extension of deadline of remittance of contributions by Regular and Household Employers, Self-employed, Voluntary and Non-Working Spouse members has been approved by the Social Security Commission (SSC).

The SSC further approved the following:

1. The 2% penalty on unpaid contributions shall not accrue within the period heretofore stated, provided the payment thereof is made in accordance with the schedule stated above.

2. Employers with approved installment proposal under Circular No. 2018-008 and Circular No. 2019-004, their post-dated checks which fall due from March to October 2020 shall be deposited on 30 November 2020

PROVIDED THAT:

a. No contributions paid retroactively by a self-employed, voluntary or non-working spouse member shall be used in determining his/her eligibility to any benefit arising from a contingency wherein the date of payment is within or after the semester of contingency;

b. In case payment deadline falls on a Saturday, Sunday or holiday, payment may be made on the next working day;

c. Payment deadlines of regular employers for applicable months after October 2020 as prescribed under SSS Circular No. 2019-012 shall apply;

d. Payment deadlines of household employers for applicable months or applicable quarter after September 2020 as prescribed under Circular No. 2019-012 shall apply;

e. Payment deadlines of a self-employed, voluntary or non-working spouse member for applicable months or applicable quarter after September 2020 shall apply.