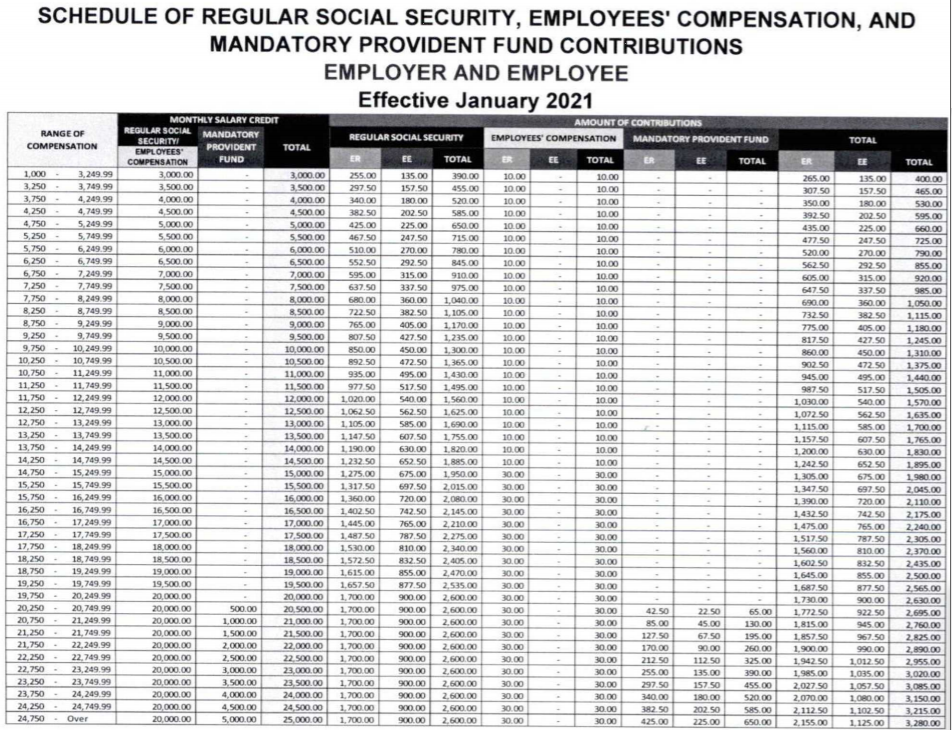

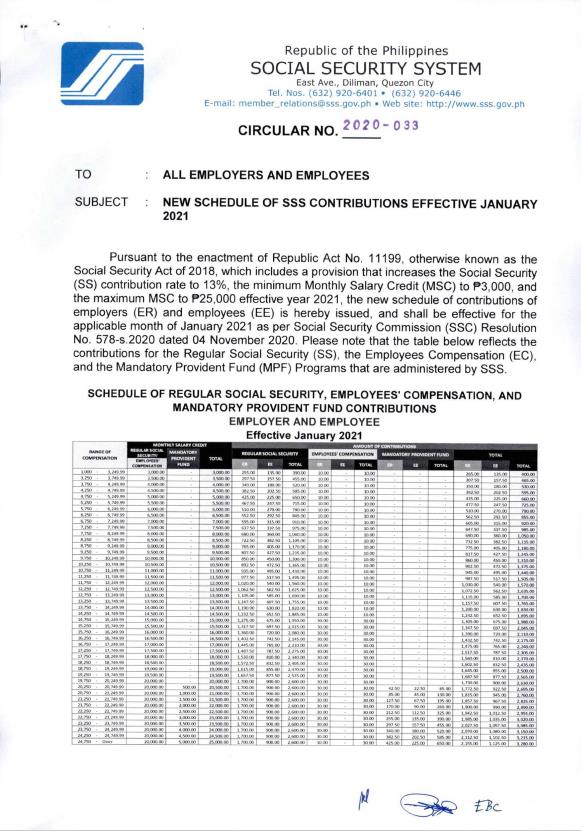

This outsourcing alert is in relation to the SSS monthly contribution effective January 2021 pursuant to Social Security Commission (SSC) Resolution No. 458-s.2020 dated 09 September 2020.

Aside from the increase in the monthly contributions, there is a Mandatory Provident Fund (MPF) which shall be automatic when the Monthly Salary Credit of the member exceeds P20,000. The following guidelines are hereby issued:

A. Coverage

1. The MPF Program covers all SSS members who have met the following qualifications:

a. Have no final claim in the Regular SSS Program; and

b. Have contribution(s) in the Regular SSS Program and whose monthly salary credit (MSC) exceeds P20,000.

2. Enrollment in the MPF Program shall be automatic when MSC exceeds P20,000 starting applicable month of January 2021.

B. Contributions

1. MPF contributions shall be the prescribed contribution rate times MSC in excess of P20,000 up to the prescribed maximum MSC.

2. MPF contributions shall always be paid together with contributions under the Regular SSS Program.

C. Withdrawal

Withdrawal of contributions is not allowed.

D. Benefits

1. MPF benefit shall be automatically processed when the member (or his/her beneficiary/ies) files for retirement, total disability or death benefit claim under the Regular SSS Program.

2. The MPF benefit shall be paid together with the SSS regular benefit. Initial disbursement of MPF benefits shall coincide with the Regular SSS Program, including the case when the member opts to receive the first 18 months pension in advance or has accrued pension.

3. The MPF benefit shall be given either in lump sum or annuity depending on whether the member’s regular SSS pension is in lump sum or annuity.

4. The annuity shall be given in the form of a fixed amount of monthly pension equal to the member’s total accumulated account value (AV) divided by 180. The pension will be paid until the member’s AV is fully settled, covering at least 15 years.

5. Upon the death of an MPF pensioner, any remaining balance in the accumulated AV will be paid to his/her beneficiary in lump sum.

![]()