-

Audit approach overview

Our audit approach will allow our client's accounting personnel to make the maximum contribution to the audit effort without compromising their ongoing responsibilities

-

Annual and short period audit

At P&A Grant Thornton, we provide annual and short period financial statement audit services that go beyond the normal expectations of our clients. We believe strongly that our best work comes from combining outstanding technical expertise, knowledge and ability with exceptional client-focused service.

-

Review engagement

A review involves limited investigation with a narrower scope than an audit, and is undertaken for the purpose of providing limited assurance that the management’s representations are in accordance with identified financial reporting standards. Our professionals recognize that in order to conduct a quality financial statement review, it is important to look beyond the accounting entries to the underlying activities and operations that give rise to them.

-

Other Related Services

We make it a point to keep our clients abreast of the developments and updates relating to the growing complexities in the accounting world. We offer seminars and trainings on audit- and tax-related matters, such as updates on Accounting Standards, new pronouncements and Bureau of Internal Revenue (BIR) issuances, as well as other developments that affect our clients’ businesses.

-

Tax advisory

With our knowledge of tax laws and audit procedures, we help safeguard the substantive and procedural rights of taxpayers and prevent unwarranted assessments.

-

Tax compliance

We aim to minimize the impact of taxation, enabling you to maximize your potential savings and to expand your business.

-

Corporate services

For clients that want to do business in the Philippines, we assist in determining the appropriate and tax-efficient operating business or investment vehicle and structure to address the objectives of the investor, as well as related incorporation issues.

-

Tax education and advocacy

Our advocacy work focuses on clarifying the interpretation of laws and regulations, suggesting measures to increasingly ease tax compliance, and protecting taxpayer’s rights.

-

Business risk services

Our business risk services cover a wide range of solutions that assist you in identifying, addressing and monitoring risks in your business. Such solutions include external quality assessments of your Internal Audit activities' conformance with standards as well as evaluating its readiness for such an external assessment.

-

Business consulting services

Our business consulting services are aimed at addressing concerns in your operations, processes and systems. Using our extensive knowledge of various industries, we can take a close look at your business processes as we create solutions that can help you mitigate risks to meet your objectives, promote efficiency, and beef up controls.

-

Transaction services

Transaction advisory includes all of our services specifically directed at assisting in investment, mergers and acquisitions, and financing transactions between and among businesses, lenders and governments. Such services include, among others, due diligence reviews, project feasibility studies, financial modelling, model audits and valuation.

-

Forensic advisory

Our forensic advisory services include assessing your vulnerability to fraud and identifying fraud risk factors, and recommending practical solutions to eliminate the gaps. We also provide investigative services to detect and quantify fraud and corruption and to trace assets and data that may have been lost in a fraud event.

-

Cyber advisory

Our focus is to help you identify and manage the cyber risks you might be facing within your organization. Our team can provide detailed, actionable insight that incorporates industry best practices and standards to strengthen your cybersecurity position and help you make informed decisions.

-

ProActive Hotline

Providing support in preventing and detecting fraud by creating a safe and secure whistleblowing system to promote integrity and honesty in the organisation.

-

Accounting services

At P&A Grant Thornton, we handle accounting services for several companies from a wide range of industries. Our approach is highly flexible. You may opt to outsource all your accounting functions, or pass on to us choice activities.

-

Staff augmentation services

We offer Staff Augmentation services where our staff, under the direction and supervision of the company’s officers, perform accounting and accounting-related work.

-

Payroll Processing

Payroll processing services are provided by P&A Grant Thornton Outsourcing Inc. More and more companies are beginning to realize the benefits of outsourcing their noncore activities, and the first to be outsourced is usually the payroll function. Payroll is easy to carve out from the rest of the business since it is usually independent of the other activities or functions within the Accounting Department.

-

Our values

Grant Thornton prides itself on being a values-driven organisation and we have more than 38,500 people in over 130 countries who are passionately committed to these values.

-

Global culture

Our people tell us that our global culture is one of the biggest attractions of a career with Grant Thornton.

-

Learning & development

At Grant Thornton we believe learning and development opportunities allow you to perform at your best every day. And when you are at your best, we are the best at serving our clients

-

Global talent mobility

One of the biggest attractions of a career with Grant Thornton is the opportunity to work on cross-border projects all over the world.

-

Diversity

Diversity helps us meet the demands of a changing world. We value the fact that our people come from all walks of life and that this diversity of experience and perspective makes our organisation stronger as a result.

-

In the community

Many Grant Thornton member firms provide a range of inspirational and generous services to the communities they serve.

-

Behind the Numbers: People of P&A Grant Thornton

Discover the inspiring stories of the individuals who make up our vibrant community. From seasoned veterans to fresh faces, the Purple Tribe is a diverse team united by a shared passion.

-

Fresh Graduates

Fresh Graduates

-

Students

Whether you are starting your career as a graduate or school leaver, P&A Grant Thornton can give you a flying start. We are ambitious. Take the fact that we’re the world’s fastest-growing global accountancy organisation. For our people, that means access to a global organisation and the chance to collaborate with more than 40,000 colleagues around the world. And potentially work in different countries and experience other cultures.

-

Experienced hires

P&A Grant Thornton offers something you can't find anywhere else. This is the opportunity to develop your ideas and thinking while having your efforts recognised from day one. We value the skills and knowledge you bring to Grant Thornton as an experienced professional and look forward to supporting you as you grow you career with our organisation.

With the Duterte government’s aggressive pursuit of reforms to bring about a simpler, more equitable and more efficient tax system that can encourage investment, job creation and poverty reduction, the Department of Finance (DoF) recently presented its proposed Tax Policy Reform Program as of Sept. 28. The proposed tax policy packages cover several areas of the tax system such as the personal income, consumption, corporate income, property and capital income taxes.

From these tax policy propositions, it is apparent that the administration is thinking about extensively revamping the Philippine tax system. This big move is highly commendable. However, the question is, can this tax reform be really accomplished within a span of the President’s term? Or are we becoming too idealistic about it that we overlook the setbacks that the country may encounter along the way? In short, what is the best possible way to do it?

One of the leading proponents of tax reform since the previous administration, Marikina Rep. Miro Quimbo has re-filed his proposal in the 17th Congress to index the individual income tax brackets to inflation based on the Consumer Price Index (CPI). Rep. Quimbo’s House Bill 20 proposes a simpler, more efficient, and equitable tax system that primarily aims to reduce the tax burden of more than six million Filipino workers. Further, his proposal to execute the tax reform in stages in order not to risk the country’s fiscal position should be given ample consideration. In fact, the government has recognized the proposal and made it a part of its 10-point economic agenda.

However, although DoF’s proposed Tax Policy Reform Program is structured to initially have six packages, with each package to constitute a separate house bill, it may still take a great amount of time, and not to say, numerous legislative deliberations and revisions before a single house bill can be passed into law. Considering that each package involves modifying several areas of the existing tax laws in order to balance the trade-offs of implementing revenue-eroding measures, the Congress will have to carefully scrutinize and evaluate each package, and this will clearly take time.

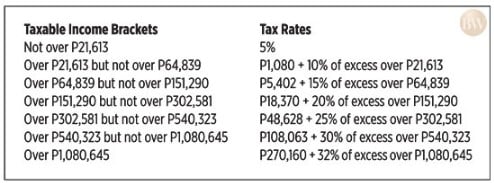

Let’s take as an example the first package in the program. This comprises the personal income tax and the consumption tax. In this package, the income tax brackets will be adjusted; the personal income tax maximum rate will be increased from 32% to 35% but you have to earn an annual income of more than P11 million before you feel a higher tax hit; and there will be a shift to a modified gross system to simplify the personal income tax. However, in order to offset the possible revenue loss on the part of the government, the package is integrated with some measures to mitigate the effects of the proposed adjustments. These offsetting measures include expanding the VAT base by limiting exemptions to raw food and other necessities; increasing the excise on all petroleum products; and increasing excise on automobiles. Considering that these various measures will be incorporated in a single house bill, it is doubtful that the same will be passed into law in the near future.

So how can the Duterte administration immediately implement a tax reform?

According to Mr. Quimbo, while his initial proposal was to overhaul the entire income tax system, the indexing of the income tax brackets to inflation is the most urgent step in the quest for genuine reform. He further explained that once the tax brackets have been adjusted, a Teacher I earning P241,137 per annum who currently pays P14,231 in taxes will only be taxed P9,935. The additional take home pay of P4,296 can be used to increase his family’s budget for education and savings. The savings become even more significant for those who have higher salaries.

The proposed indexation of the income tax brackets is shown below.

This particular modification in the income tax brackets will greatly improve the spending capacity of every Filipino worker, especially the low to middle income earners.

Moreover, it is more likely Congress will enact tax reform if the house bill only covers the adjustments in the income tax brackets. This might be the most urgent step that the government may take in order to achieve a tax reform. The amendments in the other areas of the tax system may then be pursued afterwards.

One of the challenges for this proposition to amend the income tax table is the reduction in the revenue of the government. But this may be addressed through a more effective and efficient collection system of the tax administrations of the government such as the Bureau of Internal Revenue (BIR) and Bureau of Customs (BoC). At present, we have other sources of revenue that the government may exploit to minimize the adverse effects of the adjustments in the income tax brackets.

Regardless of the revenue loss that the government might possibly suffer upon implementing these proposed income tax brackets, the Congress should always be mindful of the Constitution’s mandate that taxation be uniform and equitable and that Congress promote a progressive system of taxation.

Besides, it is about time that we revisit our existing income tax table. This has been in our tax system since 1997. Economic and financial conditions way back then were entirely different from today. Nevertheless, all the amendments and improvements in the DoF’s proposed Tax Policy Reform Program are something worthy of our attention and, more importantly, of our support. This most-awaited tax reform may take time, but we hope it will happen in the near future.

Doris Moriel B. Tampis is an associate of the Tax Advisory and Compliance Division of Punongbayan & Araullo.

As published in Business World, dated 18 October 2016.