(Revenue Regulations No. 18-2025 issued on August 5, 2025)

This Tax Alert is issued to inform all concerned on the repeal of exemption from excise tax of pick-ups pursuant to Sections 18 and 25 of Republic Act (RA) No. 12214, otherwise known as the Capital Markets Efficiency Promotion Act (CMEPA) and amend certain provisions of RR 25-2003 as amended in relation to RR 05-2018.

As implemented by Revenue Regulations No. 18-2025, pick-ups are no longer included in the list of automobiles exempt from excise tax. Pick-ups, as defined in the regulations, shall refer to motor vehicles having enclosed cabs and open bodies with low sides and tailgates.

Effective July 1, 2025, there shall be levied, assessed and collected an ad valorem tax on pick-ups based on the manufacturer’s/assembler’s or importer’s selling price, net of excise and value-added tax in accordance with the following schedule:

Electric Vehicles

Purely Electric Vehicle shall be exempt from the Excise Tax on Automobiles.

Hybrid Vehicles shall be subject to Fifty Percent (50%) of the applicable excise tax rates on automobiles.

The Department of Energy (DOE) shall publish an electric vehicle recognition list which contains the information and classification for battery electric vehicles (purely electric vehicles/BEV), plug-in hybrid electric vehicles (PHEV), and hybrid electric vehicles (HEV).

The BIR shall make a determination whether the automobile is exempt from excise tax or subject to 50% excise tax, respectively, on the basis of the DOE's list of recognized electric vehicles, without prejudice to the BIR's authority to conduct any post-verification assessment of the automobiles.

For purposes of keeping up to date with the latest publications of the list of recognized electric vehicles, the DOE shall furnish the BIR with a certified true copy of an updated list of recognized electric vehicles.

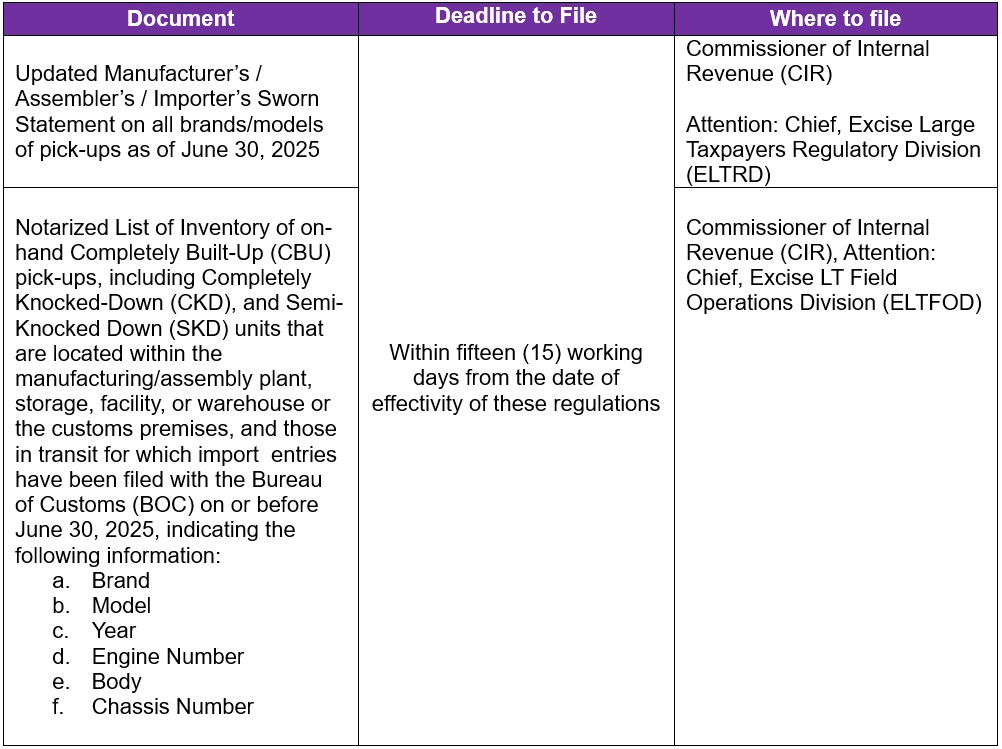

Manufacturers, Assemblers and Importers are required to submit Inventory List

Entities engaged in the manufacturing, assembly, or importation of pick-ups are required to submit the following documents:

Failure to submit the inventory list shall be deemed that the concerned manufacturers, assemblers or importers do not have any inventory on hand or in transit of CBUs, CKDs, and SKDs as of June 30, 2025.

Transitory Provision

The imposition of excise tax on pick-ups shall not apply to:

- Units included in the inventory list as of June 30, 2025 duly submitted to the BIR with the prescribed period; and

- Units in transit for which import entries have been filed with the BOC on or before June 30, 2025 and withdrawn on or after July 1, 2025

These Regulations take effect on July 1, 2025, following its publication in the Official Gazette or the Bureau of Internal Revenue’s official website, whichever comes first.