(Revenue Regulation (RR) No. 21-2025 issued on August 05, 2025)

This Tax Alert is issued to inform all concerned about the implementation of the amendments to Sections 22, 24, 25, 27, 28, 32, 35, 38, 39, and 42 of the Tax Code pursuant to Republic Act No. 12214, otherwise known as the Capital Markets Efficiency Promotions Act (CMEPA).

A. Definition of Terms

1. Shares of stock shall refer to shares of stock of a corporation, warrants, options, as well as units of participation in a partnership (except general professional partnerships), joint stock companies, joint accounts, joint ventures taxable as corporations, associations, recreation or amusement clubs (such as golf, polo or similar clubs), and mutual fund certificates

2. Shareholder shall refer to holders of shares of stock, warrants, options, as well as holders of a unit of participation in a partnership (except general professional partnerships), joint stock company, joint account, taxable joint venture, and holder of a mutual fund certificate, joint-stock company, or insurance company, or member in an association, recreation, or amusement club, such as golf, polo, or similar clubs.

3. Securities shall refer to shares, participation, or interest in a corporation, commercial enterprise, or profit-making venture evidenced by a certificate, contract, or instrument, whether written or electronic in character which shall include:

a. Shares of stock, bonds, debentures, notes, evidence of indebtedness, and asset-backed securities;

b. Investment contracts, certificates of interest, or participation in a profit-sharing agreement, such as certificates of deposit for a future subscription;

c Fractional undivided interests in oil, gas, or other mineral rights;

d. Certificates of assignment, certificates of participation, trust certificates, voting trust certificates, or similar instruments;

e. Proprietary or non-proprietary membership certificates in corporations; and

f. Other similar instruments as may be determined by the securities and exchange commission.

4. Deposit Substitute refers to an alternative form of obtaining funds from the public other than deposits, through the issuance, endorsement, or acceptance of debt instruments for the borrower’s own account, for the purpose of relending or purchasing of receivables and other obligations.

Provided, that the term ‘public’ shall mean twenty (20) or more individual or corporate lenders at any given time. Thes instruments may include, but need not be limited to bankers’ acceptances, promissory notes, repurchase agreements, excluding reverse repurchase agreements entered into by and between the Bangko Sentral ng Pilipinas (BSP) and any authorized agent bank, certificates of assignment or participation and similar instruments with recourse.

Provided, however, that debt instruments issued for interbank call loans with maturity of not more than five (5) days to cover deficiency in reserves against deposit liabilities, including those between or among banks and quasi-banks shall not be considered as deposit substitute debt instruments.

5. Passive Income refers to any income that is earned from sources that do not require a taxpayer’s active pursuit and performance of trade or business and is not subject to value-added tax imposed in the Tax Code.

6. Equity-based compensation covers all types of employee equity schemes that come in different forms such as stock options, restricted share awards which may or may not pertain to the shares of stock of the grantor itself, but which all have the common feature of being granted to existing employees of the grantor as a performance incentive for services rendered by the employees and are typically dependent on performance, outstanding business achievements and exemplary organizational, technical or business accomplishments.

7. Stock options are merely entitles the employee to purchase shares at a future dat. Thus, unless the options are exercised, the employees do not become shareholders. The period between the grant of stock options and the date when they become exercisable represents the vesting period.

8. Restricted stock units are stock units may or may not be subject to a vesting period, as will be specified in the grant. Settlement of vested stock may be made in the form of (i) shares, (ii) cash or (iii) a combination of shares and cash.

9. Stock appreciation rights – the terms and conditions are similar to stock options. However, under the stock appreciation rights, the optionee may receive (i) shares, (ii) cash or (iii) combination of shares and cash, as determined by the grantor.

10. Mutual Fund Company is an open-end and close-end company as defined under the Investment Company Act

11. Unit Investment Trust Fund is an open-ended pooled trust fund denominated in peso or any acceptable currency, which is established, operated, and administered by a trust entity and made available by participation.

B. Certain Passive Income

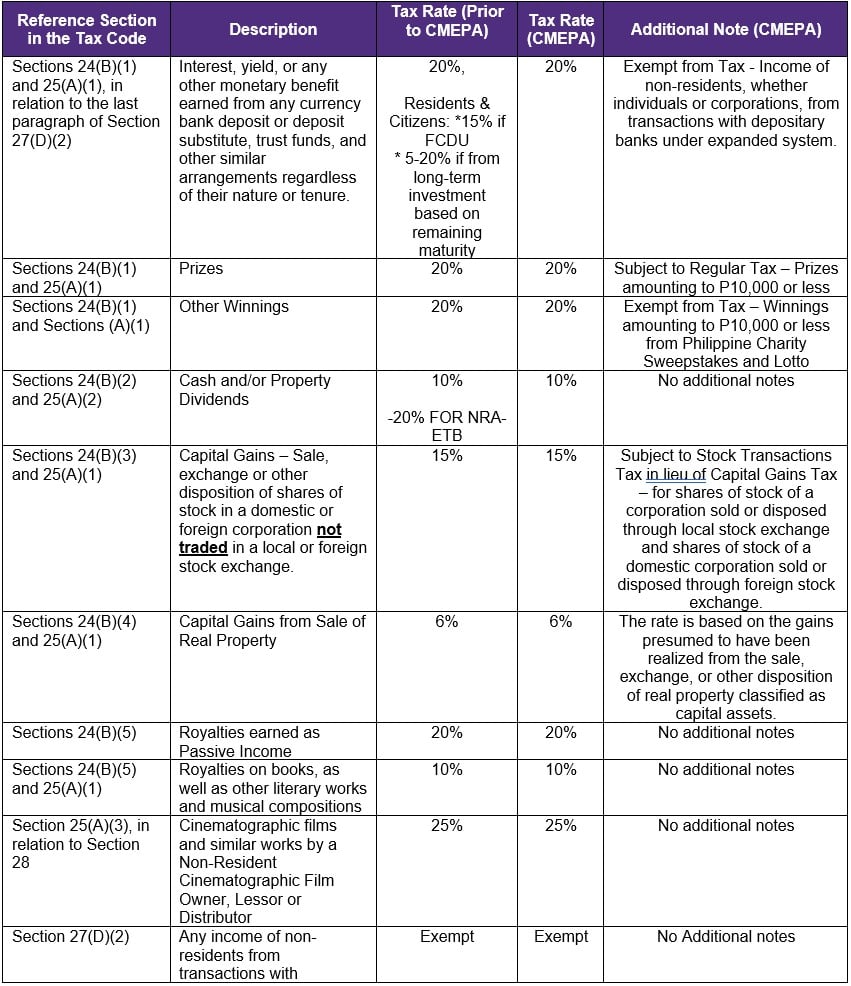

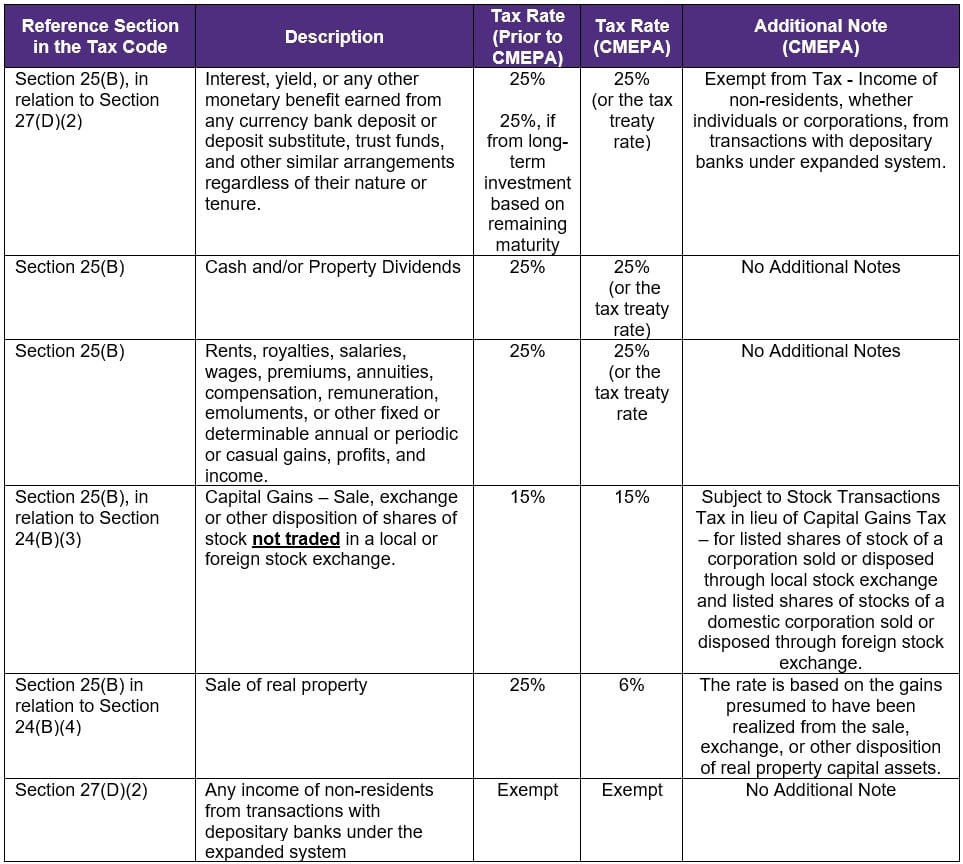

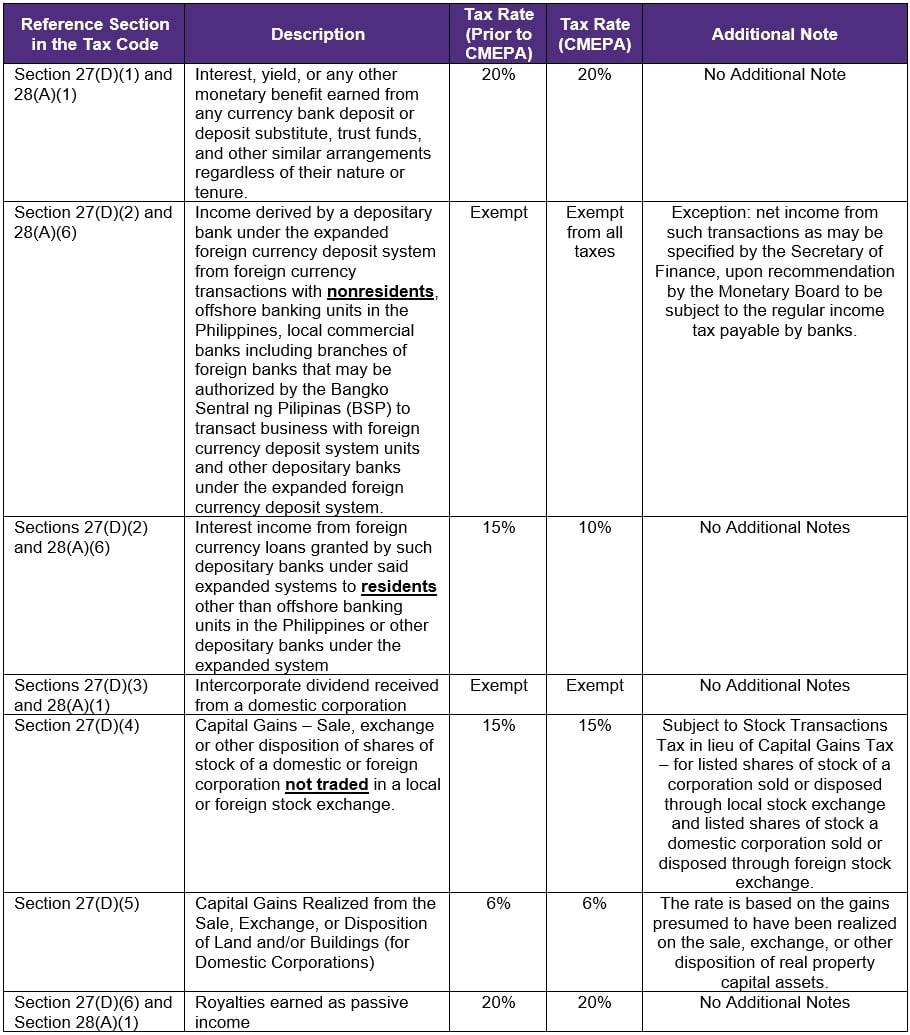

Pursuant to the amendments on certain income tax rates on passive income, passive income shall be taxed as follows:

For Individuals:

On Citizens, Resident Aliens, and Non-Resident Aliens Engaged in Trade or Business (NRA-ETB)

On Non-Resident Alien Not Engaged in Trade or Business (NRA-NETB)

For Corporations:

On Domestic and Resident Foreign Corporations:

On Non-Resident Foreign Corporations:

For purposes of situs of interest income, those that are arising from debt instruments, bank deposits, deposit, deposit substitutes, trust funds, and other similar arrangements, such as bonds, notes, or other interest-bearing obligations of residents, corporate, or otherwise, regardless of the place of execution of said instruments are sourced within the Philippines. This also includes debt instruments or debt securities issued by the government or any of its agencies or instrumentalities

Further, if the income stated in the tables above is of an active pursuit of the primary purposes of the corporation, it is not considered as passive income. Hence, if the same is in the ordinary course of trade or business, including incidental thereto, it shall be subjected to VAT.

With this, the BIR also emphasizes that the following rendition of service is considered as being in the ordinary course of trade and business and thus subject to VAT:

- Those rendered in the Philippines by non-resident foreign persons; and

- Digital services that are being rendered by non-resident digital service providers that is consumed in the Philippines.

C. Inclusions on Gross Income

CMEPA Law now includes equity based compensation which includes the following:

- Stock Options;

- Restricted Stock Units;

- Stock Appreciation Rights; and

- Other Similar Items.

With further clarification that this should be included in the gross income at the time of the exercise.

Additionally, the law also repealed the exemption of gains realized from the sale or exchange or retirement of bonds, debentures or other certificate of indebtedness with maturity of more than five (5) years. With this effect, it will now be considered as an inclusion on gross income.

D. Exclusions on Gross Income

Prior to CMEPA Law, only gains from redemption of shares in the mutual fund are excluded from gross income. Currently, through this RR, the exclusion on gross income now includes gains from redemption of units of participation and is not only limited to the mutual fund, but now explicitly states that it also includes unit investment trust fund.

Interest income and gains from sale, transfer, or disposition of project-specific bonds are also added as an exclusion. Per definition, project-specific bonds are issued by the Republic of the Philippines or any of its instrumentalities in order to finance capital expenditures (CAPEX) or programs covered by the Philippine Development Plan or its equivalent and other high-level priority programs of the national government, as determined by the secretary of finance.

E. Allowable Deductions

Securities shall be considered as an ordinary asset if it is held by a dealer in securities, a licensed entity (through an appropriate government regulatory agency) to buy and sell securities which is either for the entity’s own account or for the account of others. This also includes banks and other financial intermediaries. With this, if such will be ascertained to be worthless, the same security shall be considered as an ordinary loss allowable as a deduction.

Such entities stated above may also claim deductions losses from wash sales of stocks or securities with the requisite that these should be in the ordinary course of business.

Further, an additional fifty percent (50%) of the employer’s actual contribution to the Personal Equity and Retirement Account (PERA) shall be deducted from the gross income of the taxpayer subject to certain conditions.

F. Capital Losses to Dealer in Securities or Other Financial Intermediary

Limitations of capital losses do not apply to dealers in securities or other licensed financial intermediaries (through an appropriate government regulatory agency) to trade in securities that sell any bond, debenture, note, or certificate or other evidence of indebtedness issued by any corporation (including one issued by a government or political subdivision), with interest coupons or in registered form.

G. Transitory Provision

With the effectivity of the new law, the question arises whether to apply the new or old rates pertaining to long term financial instruments. The RR introduced that any tax exemption and preferential rate on financial instruments that were issued or transacted prior to July 1, 2025, shall be subjected to the tax rate at the time of its issuance for the remaining maturity of the relevant agreement.

The RR also imposed conditions whether the prevailing rate or tax exemption prior to July 1, 2025 shall apply for the remaining maturity. Note that all the conditions must be present:

1. The financial instrument was issued or transacted prior to July 1, 2025 – evidenced by the instrument itself or any other relevant agreement whether in written or electronic form.

2. The instrument or any other relevant agreement states that maturity period of the financial instrument is beyond July 1, 2025.

3. The instrument or any other relevant agreement must have no changes in the maturity date or remaining period of coverage nor renewal or issuance of new instrument to replace the old ones, starting July 1, 2025.

H. Effectivity

This regulation takes effect on July 1, 2025, following its publication to the Official Gazette or the BIR’s official website, whichever comes first.