(Revenue Memorandum Circular No. 123-2022, issued on August 31, 2022)

This Tax Alert is issued to inform all concerned of the clarifications on the removal of the 5-year validity period on all manual and system generated principal and supplementary invoices and receipts pursuant to Revenue Regulations No. 6-2022, in line with the “Ease of Doing business and Efficient Government Service Delivery Act of 2018”.

Covered taxpayers

Taxpayers who are/ will be using principal and supplementary receipts/ invoices or those who will apply for any of the following are covered by the removal of the 5-year validity period:

a. Authority to Print (ATP);

b. Registration of Computerized Accounting System (CAS)/ Computerized Books of Accounts (CBA) and/or its components; and

c. Permit to Use (PTU) Cash Register Machines (CRM)/ Point-if-sale (POS) Machines and Other Sales Receipting Software

Effectivity date

Removal of the 5-year validity period was effective on July 16, 2022.

Validity phrases

The phrase “THIS INVOICE/RECEIPT SHALL BE VALID FOR FIVE (5) YEARS FROM THE DATE OF THE PERMIT TO USE” and “Valid Until (mm/dd/yyyy) of the PTU shall no longer be required to be reflected on the footer of generated receipts/invoices. Likewise, the phrase “THIS INVOICE/RECEIPT SHALL BE VALID FOR FIVE (5) YEARS FROM THE DATE OF THE ACKNOWLEDGEMENT CERTFICATE” is no longer required for the registration of CAS and/or its components.

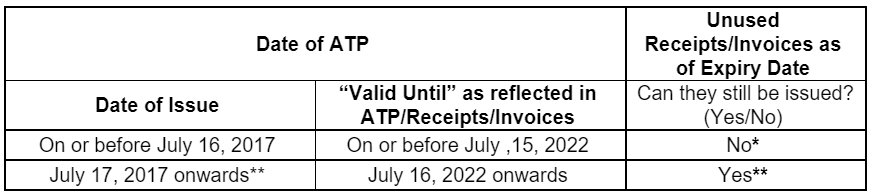

Unused receipts/ invoices

Below guidelines shall be followed on the use of unused receipts/invoices:

*All unused and expired receipts/ invoices which expired on or before July 15, 2022, shall be surrendered for destruction, together with an inventory listing to the RDO where the Head Office or Branch is registered on or before the 10th day after the validity period of the expired receipts/ invoices. Usage of expired receipts/ invoices shall be subject to penalty of P20,000 for the 1st offense and P50,000 for the 2nd offense.

Taxpayers with expired ATP on or before July 15, 2022, but failed to apply for subsequent ATP not later than sixty (60)-mandatory period prior to expiration shall not be liable to pay penalty for late application of ATP.

**Taxpayers with receipts/Invoices with existing ATP expiring on or after July 16, 2022 shall continue to issue such receipts/invoices until fully exhausted and the phrase “THIS INVOICE/RECIEPT SHALL BE VALID FOR FIVE (5) YEARS FROM THE DATE OF THE ATP” and the “Validity period” shall be disregarded.

Transitory procedures

Taxpayers with registered PTU CRM/POS machines/CAS shall reconfigure its software to reflect the removal of the validity phrase and date. The configuration shall be done until December 31, 2022.

A written notification on the modification in the system due to the removal of validity phrase and date is no longer required to be submitted to the concerned RDO.

.