(Signed on September 22, 2021)

This Tax Alert is issued to inform all concerned on the salient provisions of Republic Act (RA) No. 11590 (An Act Taxing Philippine Offshore Gaming Operations, amending for the Purpose Sections 22, 25, 27, 28, 106, 108, and Adding New Sections 125- A and 288(G) of the National Internal Revenue Code Of 1997, as Amended, and for Other Purposes).

As defined in RA No. 11590, offshore gaming licensee refers to offshore gaming operator, whether organized abroad or in the Philippines, duly licensed and authorized, through a gaming license, by the PAGCOR or any special economic zone authority, tourism zone authority or freeport authority to conduct offshore gaming operations, including the acceptance of bets from offshore customers.

On the other hand, a service provider refers to any juridical person, that is duly created or organized within or outside the Philippines, or natural person, regardless of citizenship or residence, which provides ancillary services to an offshore gaming licensee, or any gaming licensee or operator with licenses from other jurisdictions. The ancillary services may include customer and technical relations and support, information technology, gaming software, data provision, payment solutions and live studio and streaming services.

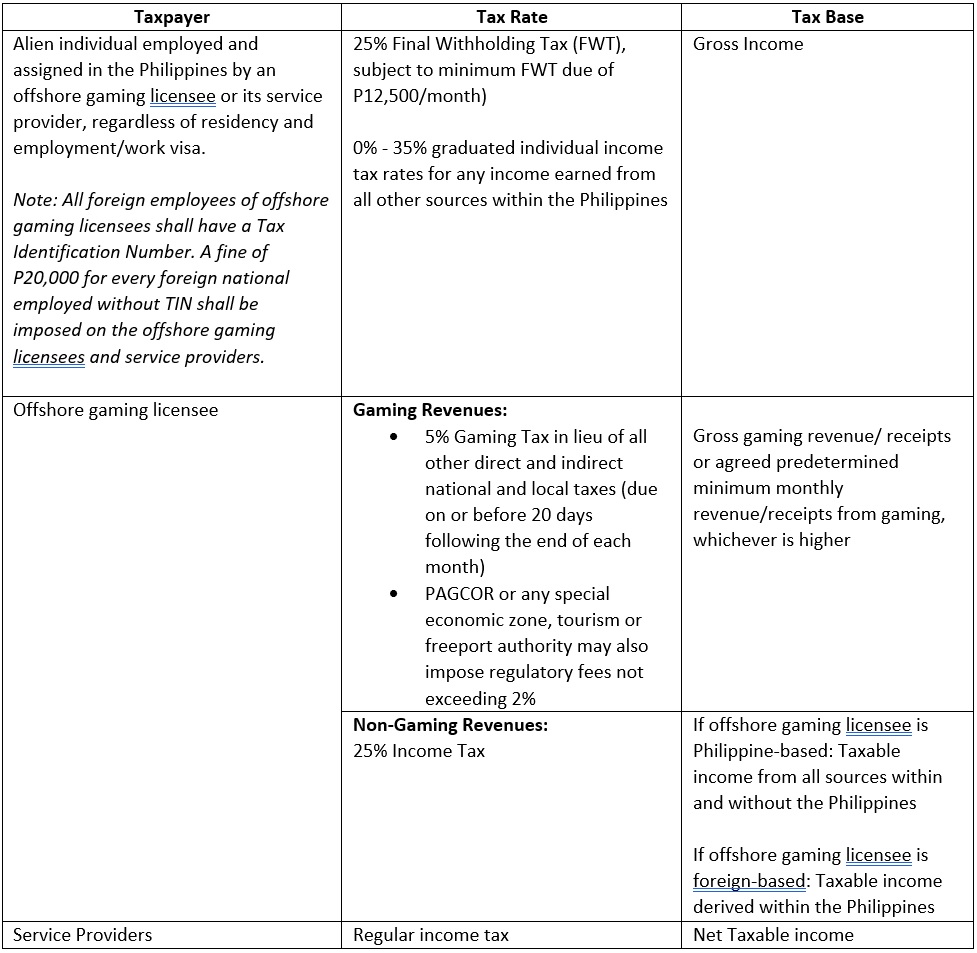

The taxes applicable to offshore gaming licensees, their service providers and alien individuals employed by them are summarized below.

Moreover, the following shall be considered subject to zero percent (0%) VAT:

The PAGCOR or other implementing agency, shall engage the services of a third-party audit platform that would determine the gross gaming revenues/receipts of each offshore gaming licensee for submission to BIR by PAGCOR or other implementing agency.