Tax Alert

09 Oct 2019Additional clarifications on the availment of estate tax amnesty

(Revenue Memorandum Circulars No. 102-2019 and 103-2019)

This Tax Alert is issued to inform all concerned on the additional clarifications on the Implementing Rules and Regulations (IRR) of the Estate Tax Amnesty. The estate tax amnesty can be availed by estates of decedents who died on or before December 31, 2017 and can be availed from June 15, 2019 to June 14, 2021.

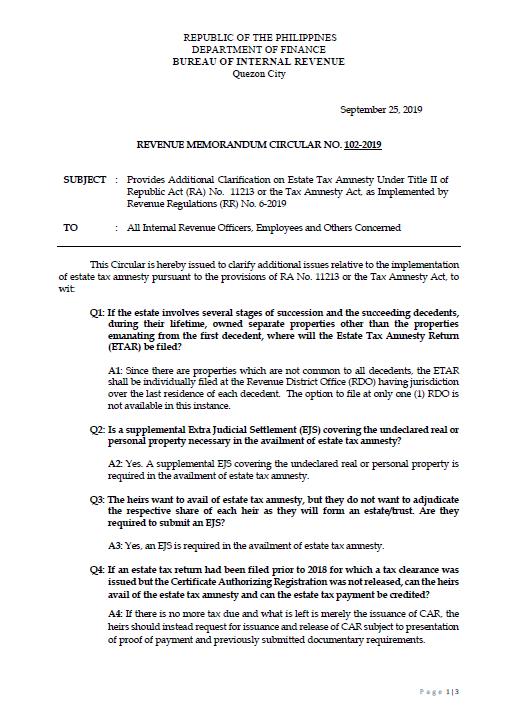

A. Availment of Estate Tax Amnesty and documentary requirements

- If the estate involves multiple stages of succession and the succeeding decedents, during their lifetime, owned separate properties other than the properties emanating from the first decedent, the Estate Tax Amnesty Return (ETAR) shall be individually filed at the Revenue District Office (RDO) having jurisdiction over the last residence of each decedent. The option to file at only one RDO is not available in this instance.

- A supplemental extra-judicial settlement (EJS) covering undeclared real or personal property is required in the availment of estate tax amnesty.

- If an estate tax return has been filed prior to 2018 for which a tax clearance was issued but the Certificate Authorizing Registration (CAR) was not released, the heirs should instead request for issuance and release of CAR subject to presentation of proof of payment and previously submitted documentary requirements, instead of availing the estate tax amnesty.

- If the owner’s copy of the Transfer Certificate of Title (TCT) was lost, estate tax amnesty can be availed provided that the filer submits a certified true copy of the OCT/TCT/CCT of the subject property which is issued by the Register of Deeds (RD)/Land Registration Authority (LRA).

- If the RD’s copy of the OCT/TCT/CCT was lost, the owner’s copy together with the Certificate of Loss issued by the RD shall be submitted for purposes of estate tax amnesty availment.

B. Estate subject to tax investigation

- If the decedent has an on-going investigation in an RDO other than the RDO of his domicile, the on-going investigation shall be consolidated in the RDO where the estate tax return shall be filed.

- eCAR shall be issued only after the submission of report of investigation on the other internal revenue tax liabilities, and after payment of deficiency taxes, if any. However, if the filer insists that the eCAR be issued even without the results of the audit, or even without the payment of deficiency taxes, the eCAR may be issued provided that the filer shall post a bond.

- If an eCAR has been issued for a regular estate tax transaction and deficiency tax was subsequently noted by the Assessment Division, the estate tax amnesty can still be availed. There is no need to issue another eCAR.

C. Allowable deductions from gross estate and other clarifications

- The judicial expenses pertaining to issue of heirship, if there is a pending case filed in court, is not an allowable expense against the estate.

- Family Home, Standard Deduction and Medical Expenses are treated as special item of deduction which should not affect the share of the surviving spouse.

- Starting from July 1, 1939, deductions shall only be allowed if the executor, administrator, or anyone of the heirs, as the case may be, includes in the return required to be filed, the value at the time of his death of that part of the gross estate of the nonresident situated in the Philippines.

- Self-adjudication is allowed if there is only one heir.

- There is no donation in a general waiver or renunciation of rights, interest and participation. There is also no Documentary Stamp Tax due.

The BIR also issued the following:

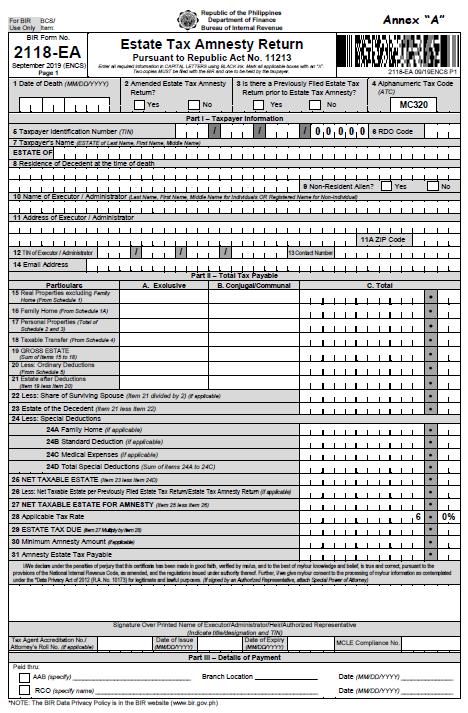

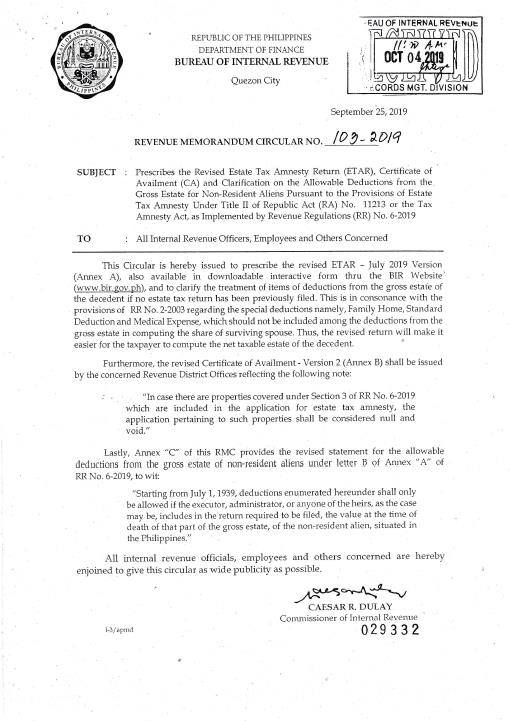

A. Revised Estate Tax Amnesty Return (July 2019 version)

The revised ETAR was issued to clarify the treatment of items of deductions from the gross estate of the decedent, if no estate tax return has been previously filed.

B. Revised Certificate of Availment (Version 2)

The revised Certificate of Availment shall reflect a statement that, “In case there are properties covered under Section 3 of RR No. 6-2019 which are included in the application for estate tax amnesty, the application pertaining to such properties shall be considered null and void”

The revised ETAR is downloadable through the BIR website.