Regulations

January 27, 2016

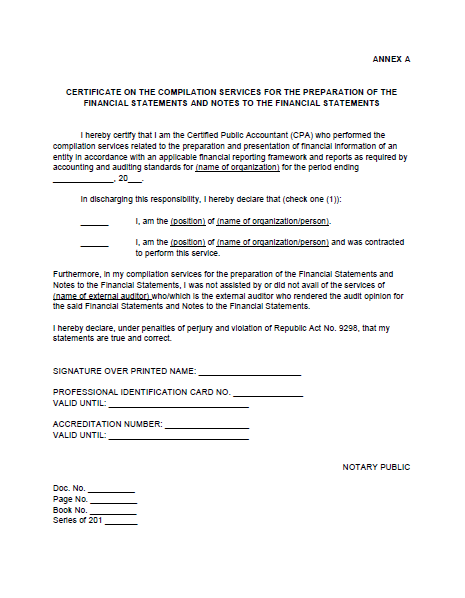

This Alert discusses the requirements of the Philippine Regulatory Board of Accountancy (“BOA”) with respect to the accreditation of Certified Public Accountants (“CPAs”) who will prepare the Certificate of Compilation Services for the Preparation of Financial Statements (“FS”) and Notes thereto (the “Certificate”) as provided by BOA’s Resolution No. 3, Series of 2016, Requiring the Submission of Certificate by the Responsible Certified Public Accountants on the Compilation Services for the Preparation of Financial Statements and Notes thereto, dated January 19, 2016 (the “Resolution”), which mandatorily applies for statutory financial information covering reporting periods ending June 30, 2016 and subsequent thereto filed with the Philippine Securities and Exchange Commission (“SEC”) and the Bureau of Internal Revenue (“BIR”), particularly:

- the general requirements of the Resolution;

- the BOA accreditation requirements for CPAs in the practice of accountancy in commerce and industry; and,

- the penalties and violations in cases of violations of the Resolution.

The suggested editable templates and forms of the required documents to be submitted in relation to the accreditation process of CPAs in commerce and industry are also provided in this Alert.

See BOA’s press release dated January 26, 2016 together with the Q&As clarifying the requirements on the Resolution (refer to the earlier P&A Grant Thornton Accounting Alert issued on January 27, 2016).

See the attached documents for the details of this Alert (including the copies of the editable forms and templates to be used during the accreditation which are attached within the Alert).

Questions about this communication should be referred to Mabel Comedia or Jerald Sanchez.