(Revenue Memorandum Circular No. 36-2024, March 11, 2024)

This Tax Alert is issued to inform all concerned on the applicable MCIT rate for the accounting periods ending from July 31, 2023 to June 30, 2024, pursuant to Republic Act No. 11534, otherwise known as the “Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act”.

Under the CREATE Act, the prescribed MCIT for the period July 1,2020 until June 30, 2023 is one percent (1%). Effective July 1, 2023, the MCIT rate reverted to its previous rate of two percent (2%) based on the gross income of the corporation.

In computing the MCIT for the said accounting periods, the gross income shall be divided by 12 months to get the average monthly gross income to be applied the applicable MCIT rate for the period. For taxable year ending December 31, 2023, apply the rate of 1% for the period January 1, 2023 to June 30, 2023 and 2% for the period July 1, 2023 to December 31, 2023.

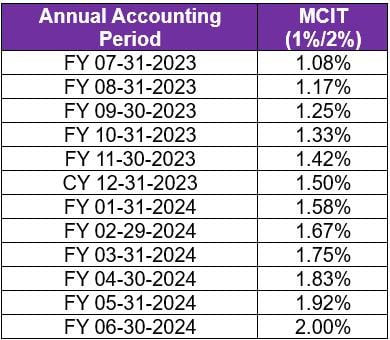

For ease of computation, the following are MCIT rate corresponding to the taxable period of the taxpayer may be used: