(Revenue Regulation 03-2024, April 11, 2024)

This Tax Alert is issued to inform all concerned on the implementing rules and regulations to implement the amendments on VAT and percentage tax pursuant to Republic Act No. 11976, also known as Ease of Paying Taxes (EOPT) Act.

General Amendments

The following words, phrases or actions shall be uniformly applied to provisions affected under RR No. 16-05 and its subsequent amendments:

A. Gross Sales – The EOPT Act adopts the accrual basis of recognizing sales for both sales of goods and services. Hence, all references to “gross selling price”, “gross value in money”, and “gross receipts” shall now be referred to as the “GROSS SALES”, regardless of whether the sale is for goods or for services.

B. Invoice – The EOPT Act mandates a single document for both sales of goods and services. Hence, all references to Sales/Commercial Invoices or Official Receipts shall now be referred to as “INVOICE”.

C. Billings for sale of service on account – all references to receipts or payments which was previously the basis for the recognition of sales or services under Title IV (Value-Added Tax) and Title V (Percentage Tax) of the Tax Code, shall now be referred to as “BILLING” or “BILLED”, whichever is applicable.

D. VAT-exempt threshold – all provisions mentioning the VAT-exempt threshold of three million pesos (P3,000,000.00) shall be read as “the amount of VAT threshold herein stated shall now be adjusted to its present value every three (3) years using the Consumer Price Index (CPI), as published by the Philippine Statistics Authority (PSA)”.

E. Filing and Payment – the filing of tax return shall be done electronically in any of the available electronic platforms. However, in case of unavailability of the electronic platforms, manual filing of tax returns shall be allowed. For tax payment with corresponding due dates, the same shall be made electronically in any of the available electronic platforms or manually to any AABs and RCOs.

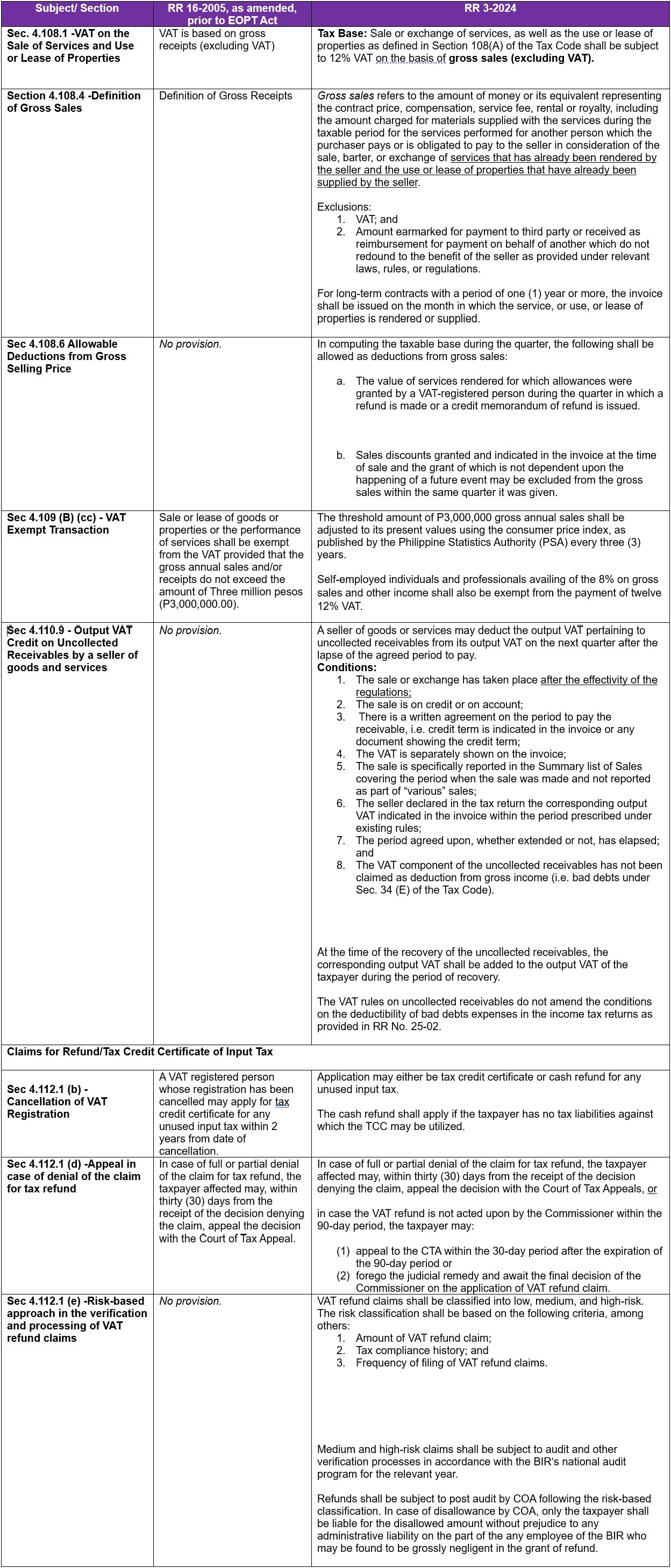

Specific Amendments to RR 16-2005

Transitory Provisions

A. Billed but uncollected sale of services

RR No. 3-2024 shall apply to sale of services that transpired upon its effectivity.

For outstanding receivables on services rendered prior to the effectivity of these Regulations, the corresponding output VAT shall only be declared in the quarterly VAT return when the collection was made. The collection shall be supported with an Invoice following the transitory provisions contained in the RR for invoicing requirements to implement the EOPT Act (RR 7-2024) or the new BIR-approved set of Invoices, whichever is applicable.

B. Uncollected receivables from sale of goods as of the effectivity of these Regulations

In accordance with the provision on output VAT credit on uncollected receivables (Sec. 4.110-9 of RR 3-2024), claim of output VAT credit shall only be applicable to transactions that occurred upon the effectivity of RR 3-2024. No output tax credit shall be allowed for outstanding receivables from sale of goods on account prior to the effectivity of the same Regulations.

Effectivity

These Regulations shall take effect fifteen (15) days following its publication in the Official Gazette or the BIR official website, whichever is applicable. These Regulations were posted on the BIR website on April 12, 2024.