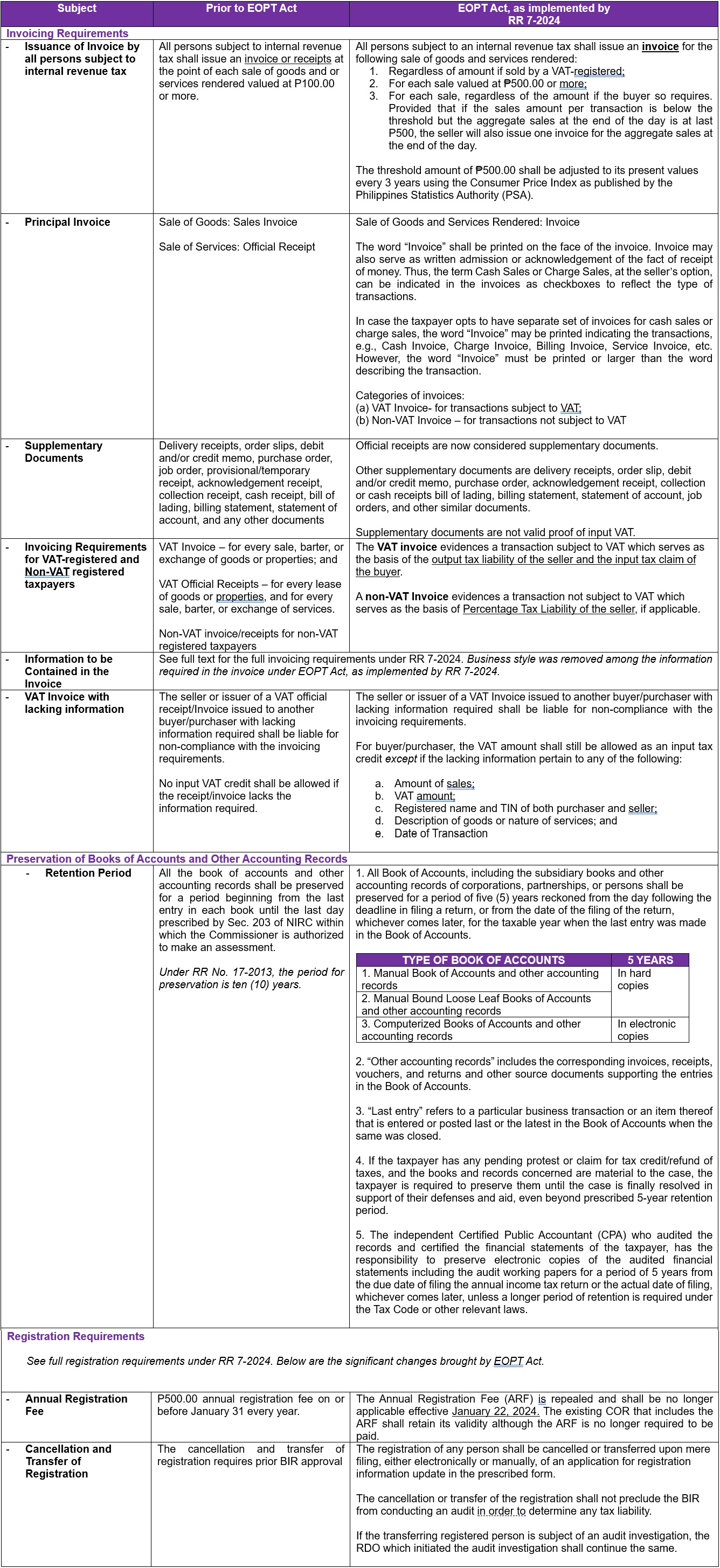

(Revenue Regulations No. 07-2024, April 11, 2024)

This Tax Alert is issued to inform all concerned on the rules and regulations to implement the amendments on invoicing requirements and registration procedures, pursuant to Republic Act No. 11976, also known as Ease of Paying Taxes (EOPT) Act.

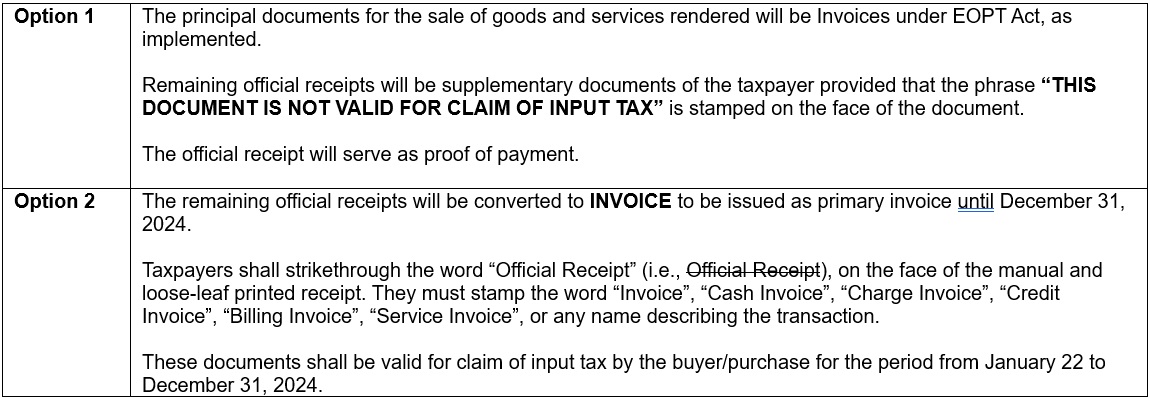

Transitory Provision for Unused Official Receipts

A. Manual and Loose-leaf Invoicing

1. Below are the options of the taxpayers with manual invoicing with regards to unused official receipts:

2. All unused manual and loose leaf ORs to be converted as Invoice shall be reported by submitting an inventory of unused ORs, indicating the number of booklets and corresponding serial numbers, in duplicate original copies, within 30 days upon effectivity of these regulations to the RDO/LT Office/LT Division where the Head Office or Branch Office is registered. The receiving branch RDO shall transmit the original copy to the Head Office RDO and retain the duplicate copy.

3. Taxpayers shall obtain newly printed invoices with an ATP before fully consuming the converted ORs or before Decembre 31, 2024, whichever comes first.

B. Electronic Invoicing

1. Documents issued by CRM/POS/e-receipting or electronic invoicing software containing the word “Official Receipt” beginning at the effectivity of these Regulations shall not be considered as valid for claim of input tax by the buyer/purchaser.

2. Taxpayers using CRM/POS/E-receipting/E-invoicing may change the word “Official Receipt (OR)” to “Invoice,” “Cash Invoice” “Charge Invoice,” etc., whichever may be applicable, without the need to notify the RDOs having jurisdiction over the place of business of such sales machines.

This reconfiguration shall be considered a minor system enhancement which shall not require reaccreditation of the system nor the reissuance of the PTU. The serial number of the renamed Invoice shall start by continuing the last series of the previously approved OR and submit notice, indicating the starting serial number of the converted invoice, to the RDO/LT Office/LT Division where the machines are registered, in duplicate original copies.

3. Taxpayers using duly registered CAS or CBA with Accounting Records, having a direct effect on the financial aspect, shall require a major system enhancement, to comply with the provisions of the EOPT Act. This requires the taxpayer to update their system registration by filing a new application. The previously issued AC or PTU shall be surrendered to the RDO where the concerned taxpayer is registered, and a new AC shall be issued to the Head Office/Branch(es).

The reconfiguration of machines and systems shall be undertaken on or before June 30, 2024. Any extension due to enhancement of systems shall seek approval from the concerned Regional Director or Assistance Commissioner of the LTS which shall not be longer than 6 months from the effectivity of these Regulations.

Effectivity

These Regulations shall take effect fifteen (15) days following its publication in the Official Gazette or the BIR official website, whichever is applicable. These Regulations were posted on the BIR website on April 12, 2024.

.