(Revenue Regulations No. 06-2024 and Revenue Regulations No. 08-2024, April 11, 2024)

This Tax Alert is issued to inform all concerned on the implementing rules and regulations to implement the amendments on the classification of taxpayers and the reduced administrative penalties on certain taxpayers, pursuant to Republic Act No. 11976, also known as Ease of Paying Taxes (EOPT) Act.

A. Classification of Taxpayers

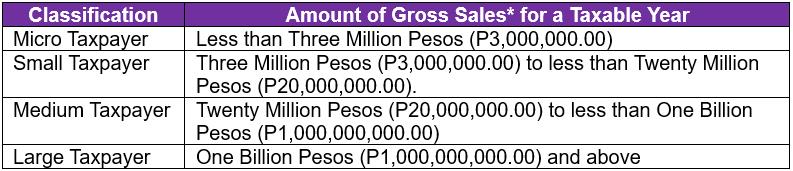

Taxpayers shall be classified as follows:

*Gross sales shall refer to total sales revenue, net of VAT, if applicable, during the taxable year, without any other deductions. It only covers business income which includes income from the conduct of trade or business or the exercise of a profession. It does not include the following:

a. Compensation income earned under employee-employer relationship;

b. Passive income under Section 23, 25, 27, and 28 under Tax Code, as amended; and

c. Income excluded under Section 32(B), under Tax Code, as amended.

Taxpayers shall be duly notified by the BIR of their classification or reclassification, as may be applicable, in a manner or procedure to be prescribed in a revenue issuance to be issued separately.

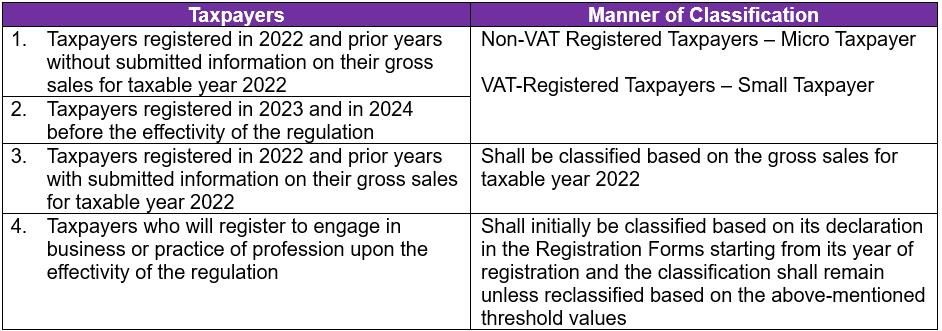

Initial Classification

B. Reduced Administrative Penalties for Micro and Small Taxpayers

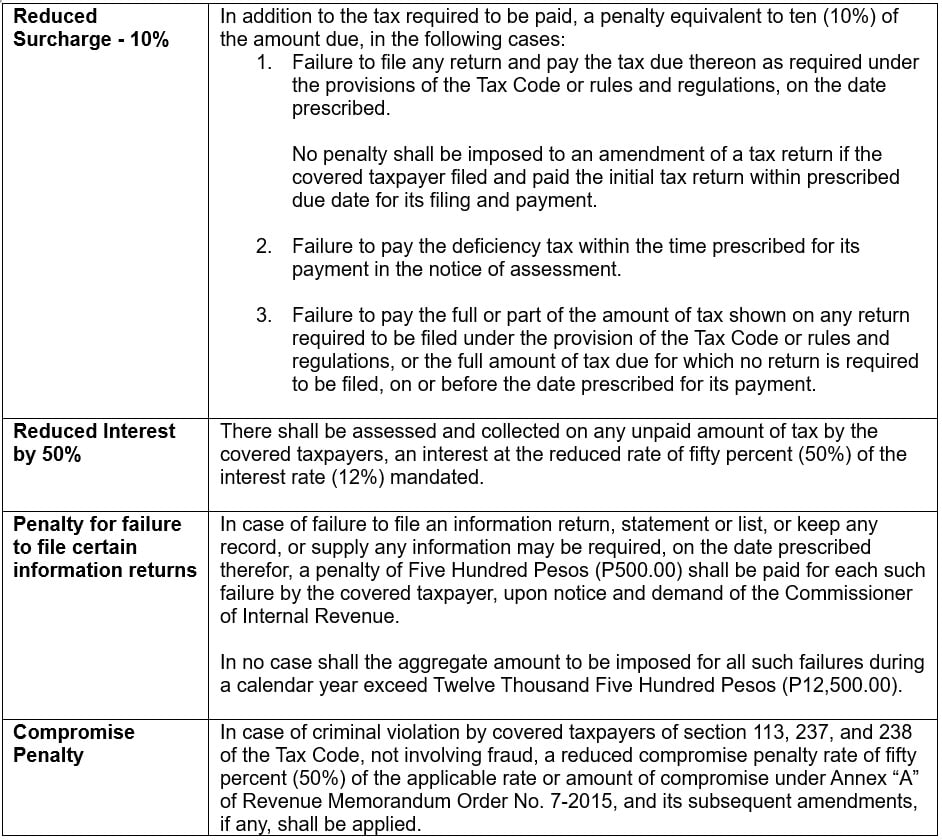

For taxpayers classified as micro and small taxpayers, the following reduced civil penalties shall be applied in case of the respective non-compliance:

The surcharge for willful neglect to file a return, or for false or fraudulent return remains to be 50%.

Applicability

These Regulations shall apply prospectively in accordance with Section 51 of RA No. 11976.

Effectivity

These Regulations take effect fifteen (15) days following its publication in the Official Gazette or the BIR official website, whichever is applicable. These Regulations were posted on the BIR website on April 12, 2024.