(Revenue Memorandum Circular No. 38-2024, March 15, 2024)

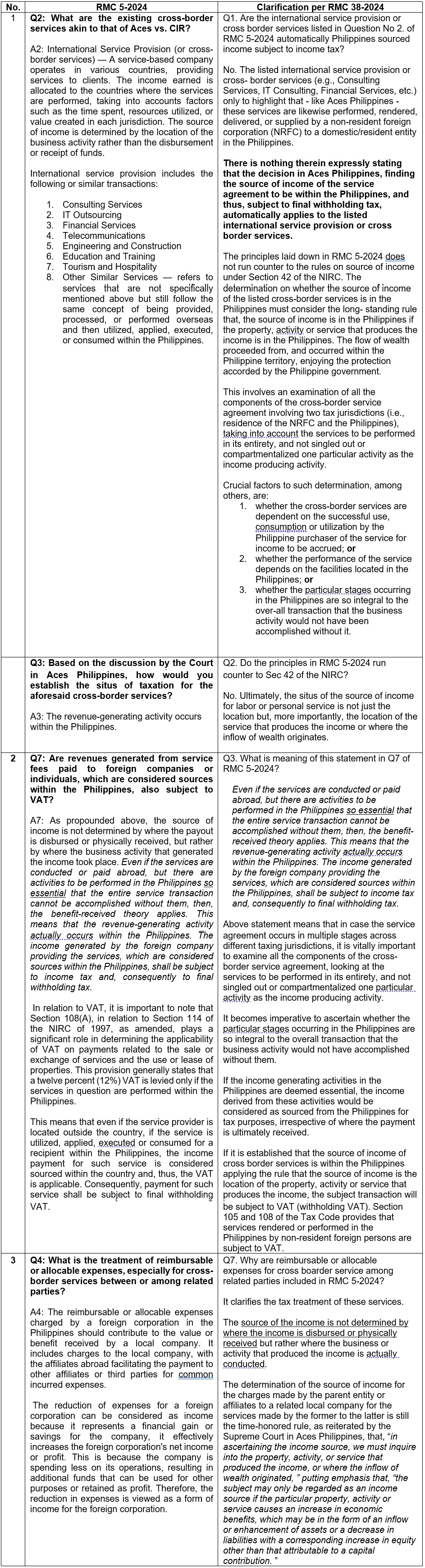

This Tax Alert is issued to inform all concerned on the clarifications on issues raised on the proper tax treatment of cross border services as provided in Revenue Memorandum Circular (RMC) No. 5-2024, in light of the Supreme Court en Banc Decision in Aces Philippines Cellular Satellite Corp. v. CIR, GR No. 226680, dated August 30, 2022.

The RMC also clarifies that the rules enunciated in RMC No. 5-2024 is not inconsistent with the provisions of tax treaties. As such RMC No. 5-2024 merely set forth the guidelines to establish the source of taxation for cross-border services listed in Question No. 2 (Consulting Service, IT Outsourcing, Financial Services, etc), which is, that the source of taxation is the property, activity, or service that produces the income or where the inflow of wealth originates.

Once the source of income is established to be within the Philippines using the aforesaid guidelines, then, the affected taxpayer can invoke the application of a particular tax treaty to assert that the income derived or sourced within the Philippines (e.g., business profits, dividends, royalties or interests) is exempt from income tax for lack of permanent establishment or subject to preferential rate, as the case may be. In short, the application of the benefits of the tax treaty, such as tax exemption of business profits for lack of permanent establishment, presupposes that the situs of the source of income is in the Philippines.