Tax Alert

06 Feb 2024Clarifications on the accounting and tax treatment of leases

(RMC NO. 11-2024 issued on January 22, 2024)

This Tax Alert is issued to inform all concerned on the clarifications on the differences between the accounting treatment of leases under Philippine Financial Reporting Standard (PFRS) 16 and the tax treatment of leases under the Tax Code of 1997, as amended, and related revenue issuances, on the part of the lessee.

SUMMARY OF DIFFERENCES

INITIAL RECOGNITION AND MEASUREMENT OF LEASE

A. PFRS TREATMENT

A contract is a lease if it conveys the right to control the use of an identified asset for a period of time in exchange for consideration.

a. Initial Recognition

At the commencement date of the lease contract, the lessee recognizes ROUA and lease liability.

This applies to all leases except when the lessee elects the exemptions for short-term lease and/or lease of low-value assets under PFRS 16.

b. Initial Measurement

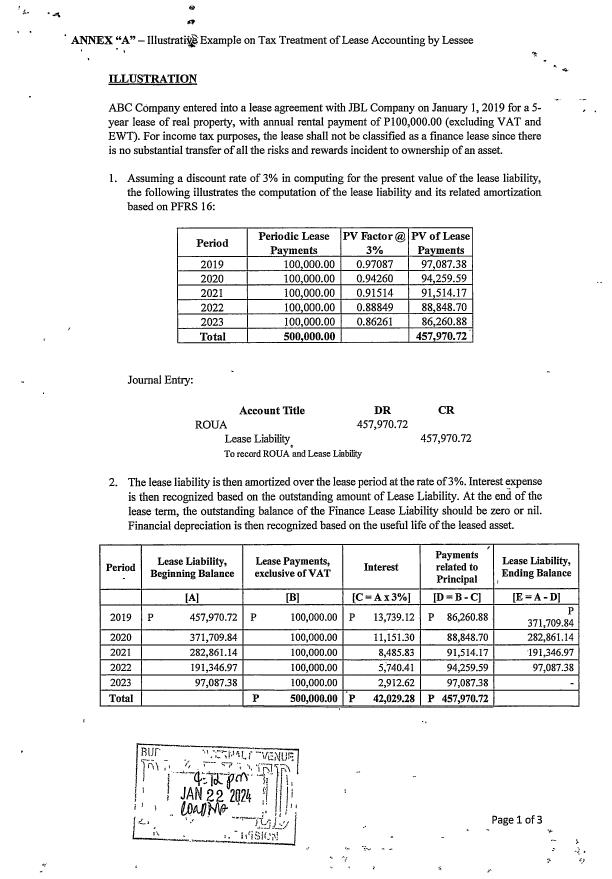

The lesee initially measures at the present value of the future lease payments discounted using the interest rate implicit in the lease, if readily determinable. Otherwise, the lessee shall use its incremental borrowing rate.

The ROUA is recognized initially at the amount of lease liability adjusted for the following:

- Payments made to the lessor at or before the commencement date of the lease, less any lease incentives received;

- Initial direct costs incurred by the lessee; and/or

- An estimate of decommissioning costs.

B. TAX TREATMENT

a. For tax purposes, a lease contract is classified as an operating lease, finance lease or conditional sale.

- Operating Lease - a contract under which the asset is not wholly amortized during the primary period of the lease, and where the lessor does not rely solely on the rentals during the primary period for his profits but looks for the recovery of the balance of his costs and for the rest of his profits from the sale or re-lease of the returned asset of the primary lease period.

- Finance Lease - or a full payout lease is a contract involving payment over an obligatory period (also called primary or basic period) of specified rental amounts for the use of a lessor’s property, sufficient in total to amortize the capital outlay of the lessor and to provide for the lessor’s borrowing costs and profits.” The obligatory period refers to the primary or basic non-cancellable period of the lease, which in no case shall be less than 730 days (or two years).

- Conditional Sale

When an agreement, which in form of a lease, but in substance a conditional sales contract based upon the intent of the parties as evidenced by the provisions of such agreement at the time the contract was executed, such contract shall be considered as conditional sale.

Revenue Regulation No. 19-86 set the following criteria for conditional sales:

1. Compelling Persuasive Factors: A contract or agreement purported to be a lease shall be treated as conditional sales contract if one or more of the following compelling persuasive factors are present:

-

-

- The lessee is given the option to purchase the asset at any time during the obligatory period of the lease, notwithstanding that the option price is equivalent to or higher than the current fair market value of the asset;

- The lessee acquires automatic ownership of the asset upon payment of the contracted rentals,

- Portions of the periodic rental payments are credited to the purchase price of the asset;

- The receipts of payment indicate that the payments made were partial or full payment of the asset.

-

2. In the absence of the above factors or contrary implication, a purchase and sale rather than a lease or rental agreement may in general be said to exist if one or more of the following conditions are met:

-

-

- Portions of the periodic payments are made specifically applicable to an equity to be acquired by the lessee.

- The property may be acquired under a purchase option at a price which is nominal in relation to the value of the property at the time when the option may be exercised, as determined at the time of commencement of the original agreement, or which is a relatively small amount compared with the total payments required to be made.

-

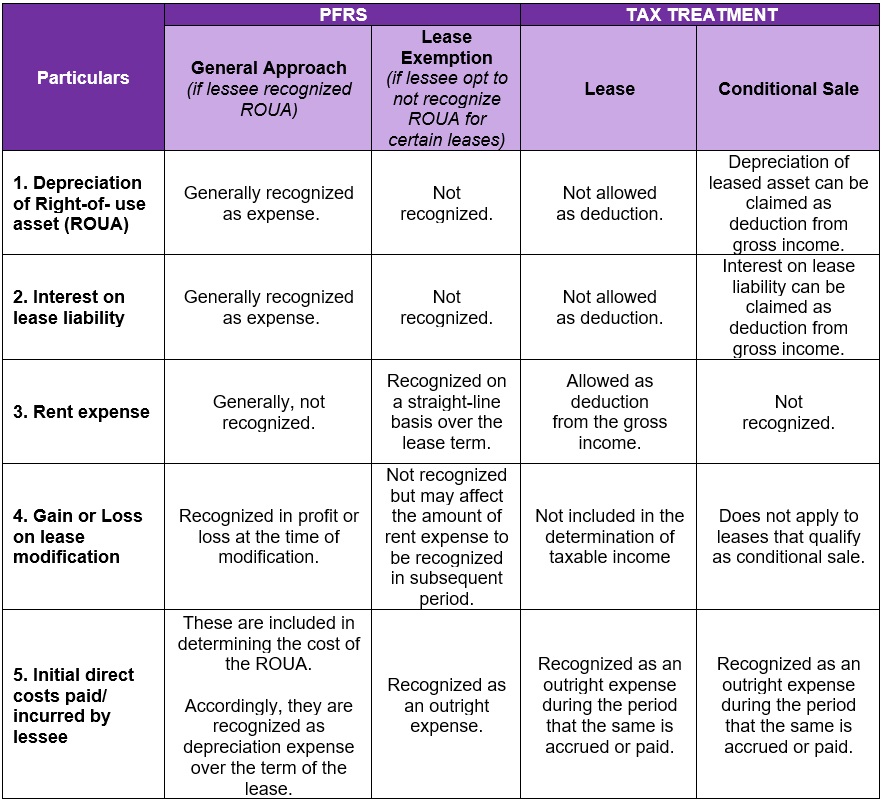

b. For tax purposes, initial direct costs, which are directly related to the negotiation and execution of a lease agreement, which are paid or incurred by the lessee in relation to the lease agreement shall be claimed as outright expenses in the year it was paid or incurred subject to substantiation requirements pursuant to Section 34 of the Tax Code, as amended.

c. Estimated costs to be incurred by the lessee in dismantling and removing the underlying asset, restoring the site on which it is located or restoring the underlying asset to the condition required by the terms and conditions of the lease shall only be considered as deductible expenses during the taxable year that the same has been actually paid or incurred pursuant 34(A)(1)(a) of the Tax Code, as amended.

SUBSEQUENT MEASUREMENT AND EXPENSE RECOGNITION

A. PFRS TREATMENT

After the commencement date, a lessee measures the lease liability by increasing the carrying amount to reflect interest on the lease liability and reducing the carrying amount to reflect the lease payments made (PFRS 16.37). A lessee recognizes in profit or loss any interest incurred on lease liability. (PFRS 16.38).

ROUA is generally measured in the statement of financial position at cost less accumulated depreciation and accumulated impairment losses. The depreciation of the right-of-use asset is also recognized in profit or loss, unless depreciation is permitted to be capitalized (e.g. to inventory) under other PFRS.

B. TAX TREATMENT

- For both operating lease and finance lease, the lessee can deduct the amount of rent paid or accrued and all expenses the lessee is required to pay to or for the account of the lessor.

However, the depreciation expense pertaining to the ROUA and the interest expense that is recognized for financial accounting purposes shall not be treated as deductible expenses. Only the actual amount of rent paid or incurred, including any other payments to lessors, based on the lease agreements, shall be allowed as deductions in arriving at the net taxable income.

- For finance lease, the lessor may be allowed a depreciation during the primary lease period, but such period shall not be less than 60% of the depreciable life of the property. The interest expense computed based on the amortization are not accounted for separately from the principal payments.

- Amounts paid by the lessee for certain expenses, which are properly for the account of the lessor as indicated in the contractual agreement between the parties, shall be allowed as deductions during the year the same has been paid or accrued, provided, however, that the lessor shall issue invoices/receipts in the name of the lessee.

- Security deposits are advance payments for the faithful performance of certain obligations of the lessee, shall only be recorded as an asset in the year the advance payment is received.

However, if the advance payment is a security deposit and the conditions which make the security deposit the property of the lessor occur, then the lessee shall be entitled to a deduction based on the amount of security deposit applied to the lease.

LEASE MODIFICATIONS AND LEASE EXEMPTIONS

A. PFRS TREATMENT

Lease Modification

- A lease modification is a change in the scope of a lease, or the consideration for a lease, that was not part of the original terms and conditions of the lease (PFRS 16, Appendix A). Examples of lease modifications are adding or terminating the right to use one or more underlying assets or extending or shortening the contractual lease term.

- A lease modification that does not decrease the scope of a lease will normally require recalculation of lease liability with a corresponding adjustment to the ROUA. This type of modification will not normally result in any gain or loss in the statement of income. In contrast, a lease modification that decreases the scope of a lease will require a partial de-recognition of the ROUA and lease liability. The difference between the amounts of reduction in the right-of-use asset and lease liability is recognized immediately in profit or loss.

Lease Exemptions (Short-term Lease and Lease of Low-Value Items)

- PFRS 16 provides a recognition exemption for short-term leases and leases of low-value items. A short-term lease is a lease with a lease term of 12 months or less, but takes into consideration lease renewal options. A lease of low value items, on the other hand, is a lease for which the underlying asset is of low value (per the standard, with a value of US$5,000.00 or the equivalent for new similar asset).

- Lessees who avail of these exemptions do not have to recognize ROUA and the related lease liability in the statements of financial position. Instead, lease payments are recognized as expense, on a straight-line basis, or another systematic basis, if that basis is more representative of the pattern of the lessee's benefit.

B. TAX TREATMENT

Lease Modification

- For tax purposes, gains or losses from lease modifications shall not be included in the determination of taxable income as defined under Section 31 of the Tax Code, as amended.

Lease Exemptions (Short-term Lease and Lease of Low-Value Items)

- Short-term lease and lease for low-value assets shall be treated as operating lease. Hence, only actual rentals paid or accrued during the taxable year, in relation to the lease contracts, shall be recognized by the lessee as deductible expense.

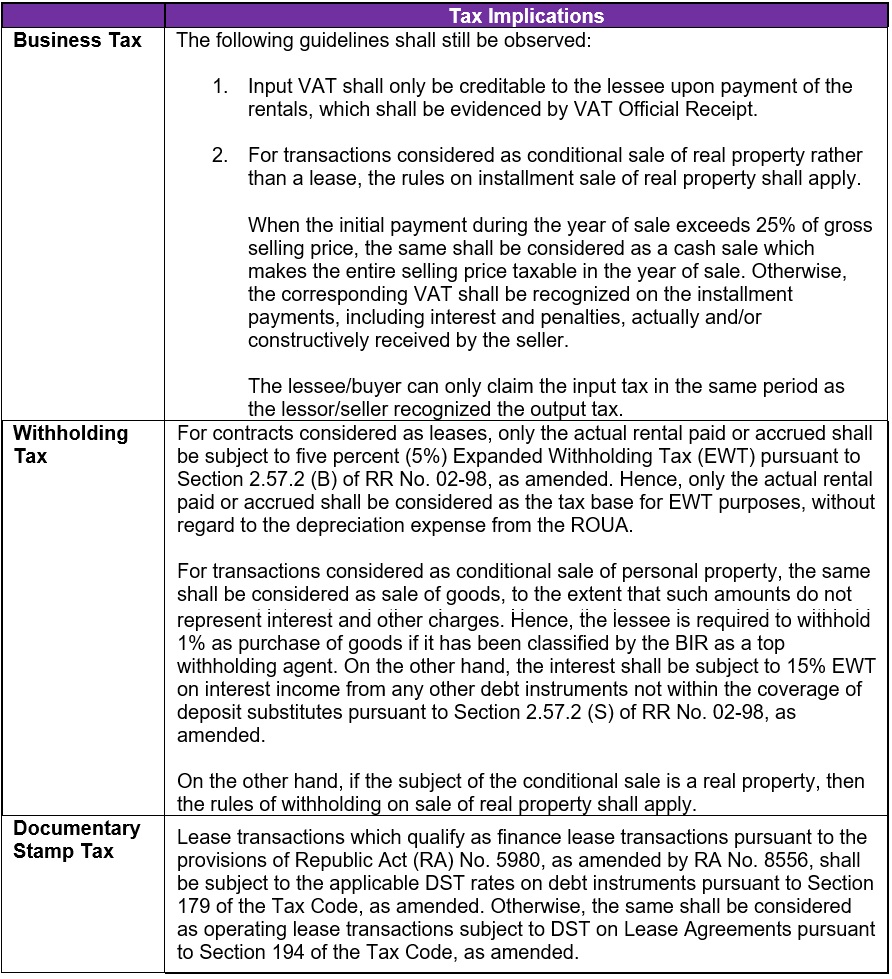

OTHER TAX IMPLICATIONS OF THE LEASE

DISCLOSURE TO FINANCIAL STATEMENTS

For reporting purposes on leases, the taxpayers may disclose the following information in the Notes to Financial Statements:

- Depreciation charge for right-of-use assets by class of underlying assets;

- Interest expense on lease liabilities;

- The expense relating to short-term leases. This expense need not include the expense relating to leases with a lease term of one month or less;

- The expense relating to leases of low-value assets. This expense shall not include the expense relating to short-term leases of low-value assets.

- The expense relating to variable lease payments not included in the measurement of lease liabilities;

- Income from subleasing right-of-use assets;

- Total cash outflow for leases;

- Additions to right-of-use assets;

- Gains or losses arising from sale and leaseback transactions; and

- The carrying amount of right-of-use assets at the end of the reporting period by class of underlying assets.

.