Tax Alert

02 Feb 2024Clarifications on the accounting and tax treatment of foreign currency transactions

(RMC NO. 12-2024, January 22, 2024)

This Tax Alert is issued to inform all concerned on the clarifications on the differences between the treatment of foreign exchange (forex) gains/losses recognized in the financial statements prepared under the Philippine Financial Reporting Standards (PFRS) /Philippine Accounting Standards (PAS) and the forex gains/losses recognized as income or allowable deductions for income tax purposes pursuant to Tax Code of 1997, as amended, and related revenue issuances.

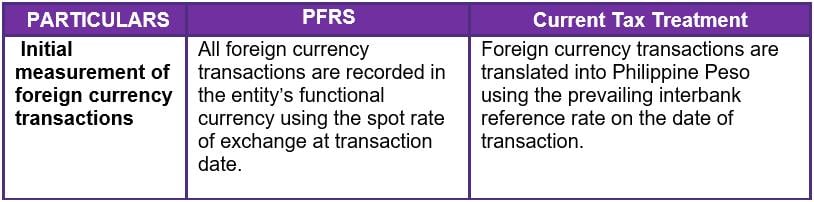

MEASUREMENT OF FOREIGN CURRENCY TRANSACTIONS

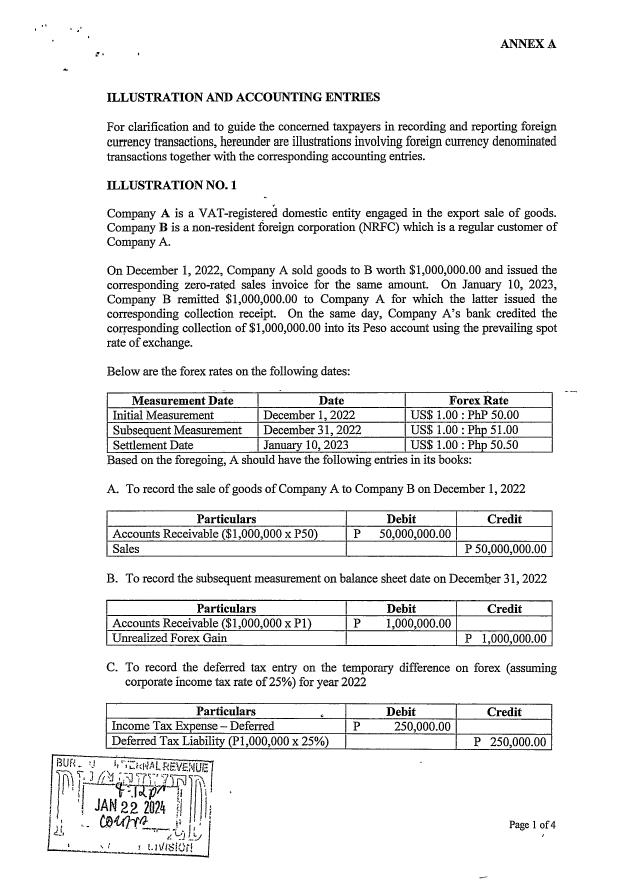

A. SUMMARY

Foreign currency transactions shall be recognized and measured as follows:

B. PFRS TREATMENT

For financial reporting purposes, a foreign currency transaction is recorded as follows:

a. Initial measurement

A foreign currency transaction is recorded initially using the rate of exchange on the date of the transaction. The use of average rate is permitted as long as they are a reasonable approximation of the actual

b. Subsequent measurement

At each reporting date, foreign currency monetary amounts are reported using the closing rate. Non-monetary items carried at historical costs are measured using the historical exchange rate at the date of the transaction. On the other hand, non-monetary items that are carried at fair value are translated using the exchange rates at the date the fair value is measured.

C. TAX TREATMENT

1. For tax reporting purposes, foreign currency transactions shall be converted into functional currency using the exchange rate at the time an asset, liability, income and expense are recognized and measured/remeasured.

2. The spot rate at the date of transaction shall be used. The taxpayer has the option to adopt which spot rate to be used (e.g., open, close, high, low, weighted average, etc.) in the beginning of the taxable year, as long as the spot rates adopted is used consistently both in recording for financial accounting purposes and tax purposes.

The use of monthly average exchange rates in converting foreign currency transactions is not permitted.

3. If there are no available published forex rates available on the date of transaction (e.g. weekends, holidays, etc.), the latest closing spot rate available on the business date immediately preceding the date of transaction shall be used.

4. The spot rate of exchange shall be based on the Banker’s Association of the Philippines (BAP) published rates. If the BAP rate is impractical or not feasible, the spot rate on the day of transaction based on other available exchange rates (BSP, Bloomberg, Reuters exchange rates, etc.) shall be used subject to the following conditions:

a. The taxpayer should submit to the RDO, LTDO, or LTS whichever has jurisdiction over the taxpayer, within 30 days prior to the start of the taxable year, a notarized sworn statement stating the source of the forex rates to be used, the reason for using such forex other than BAP published rates and a statement allowing the BIR during BIR audit to have an access on the day-to-day forex rates.

b. The source of forex rates used (e.g., URL/source where the forex rates are published) or a summary of the day-to-day exchange rates used for the taxable year, must be available for presentation and submission, together with supporting documents, during BIR audit.

The election of forex rates is irrevocable and must be used consistently both in recording for financial accounting purposes and tax purposes for at least one (1) taxable year. In case of a subsequent change in forex rates used, a new notice shall be submitted to the concerned BIR office, which shall be applied from the start of the succeeding taxable year.

If the taxpayer failed to notify the BIR on the use of forex rates other than BAP rates, it will still be required to prove the reliability of exchange rate used during a BIR audit. In the absence of any proof, foreign currency transactions denominated in USD shall be converted by the BIR using BAP rates while those transactions denominated in foreign currency other than USD shall be converted using BSP rates.

Moreover, corresponding administrative penalties under Section 255 of the Tax Code, as amended, would be imposed for first and second offenses. Subsequent offenses shall be considered as willful failure, and thus not subject to compromise.

5. Taxpayers shall use the actual forex rates published or listed, including the number of decimal places used. In case the taxpayer’s accounting system is not capable of adopting the exact number of decimal places for the forex rates as published, the taxpayer may use the maximum number of decimal places in its system subject to written notification to the BIR.

6. Considering that BAP published rates has only USD conversion, taxpayers with foreign currency denominated transaction other than USD are allowed to directly convert the foreign currency, other than USD, to PHP using the forex rates other than BAP published rates subject to the conditions on use of forex rates other than BAP forex rates, as mentioned above.

7. If a taxpayer initially elected to use BAP published rates but incurred a foreign currency transaction other than in USD in the middle of the taxable year, it shall be allowed to use BSP spot rates for forex transactions other than USD, provided that the taxpayer shall summarize its foreign currency transactions other than USD with the required information (date, amount, nature of transaction, forex rate used, and PhP converted amount) and the summary and supporting documents must be available for presentation and submission during BIR audit.

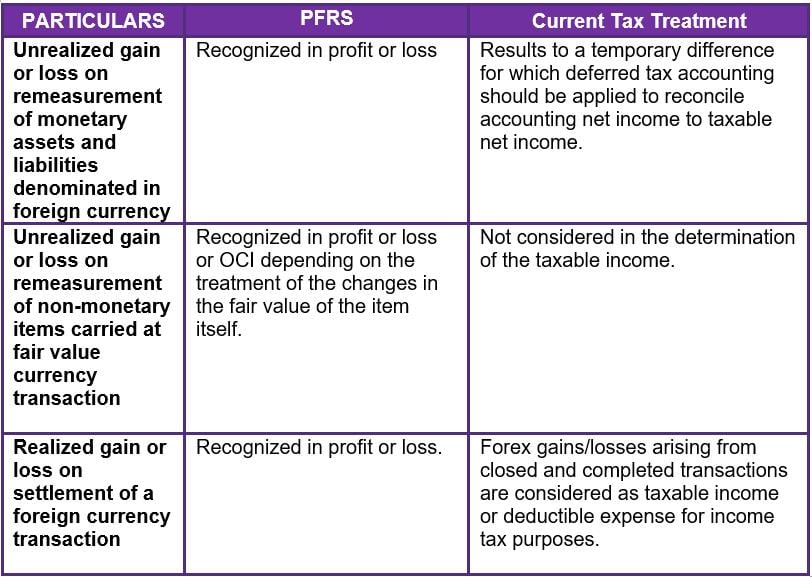

TREATMENT OF FOREX GAINS/LOSSES

A. SUMMARY

1. A forex difference (i.e., gains/losses) results when there is a change in the exchange rate between the transaction date, balance sheet date and the date of settlement of any monetary items arising from a foreign currency transaction.

2. Below is a summary of the difference between accounting and tax treatment of forex gains/losses:

B. PFRS TREATMENT

1. At each reporting date, any unrealized gain or loss arising from the translation of monetary assets and liabilities at the end of the reporting period is generally recognized in profit or loss.

2. Non-monetary items carried at historical costs are not remeasured at the reporting date. For non-monetary items carried at fair value, any unrealized gain or loss arising from the translation is recognized in the same way the change in fair value is recognized in the financial statements. For example, when the change in the fair value of a non-monetary item is recognized in OCI, then unrealized gain or loss arising from the translation shall also be recognized in OCI.

3. When monetary items are settled, the difference between the carrying amount of the monetary asset or liability and the consideration received/paid is recognized immediately in profit/loss.

C. TAX TREATMENT

1. For taxation purposes, only the realized gain or loss from foreign exchange transaction will be subject to income tax. Unrealized gains or losses on forex fluctuations recognized in connection with the periodic remeasurement of assets and liabilities denominated in foreign currency to functional currency are not considered as income/loss for purposes of computing taxable income.

2. Realized forex gains/losses shall be substantiated with sufficient evidence that the same arose from a closed and completed transaction (e.g., schedule of foreign currency transactions resulting to forex gains/losses with reference to the bank statements on actual collection of receivables and payment of payables, etc.).

Moreover, automatic reversal of unrealized forex differences to realized forex gains/losses in the succeeding year not arising from closed and completed transactions are strictly prohibited for income tax purposes.

3. Taxpayers should separately record and report unrealized forex gains/losses from the realized forex gains/losses arising from foreign currency transactions. The practice of netting or offsetting of forex gains and losses is strictly prohibited for tax purposes.

In terms of presentation in the income tax returns, forex gains shall be presented as part of "Other Taxable Income" and be included in the computation of "Total Taxable Income" or "Gross Taxable Income" in the income tax return. On the other hand, forex losses shall be presented as part of the "Ordinary Allowable Itemized Deductions" in the income tax return.

.