(Revenue Memorandum Circular No. 5-2023, issued on January 13, 2023)

This Tax Alert is issued to inform all concerned on the transitory provisions for the implementation of the quarterly filing of Value-Added Tax (VAT) returns beginning January 1, 2023, pursuant to the Tax Reform for Acceleration or Inclusion Law (TRAIN Law).

VAT-registered taxpayers are no longer required to file monthly VAT returns (BIR Form No. 2550-M) for transactions beginning January 1, 2023. They shall be required to file only the corresponding quarterly VAT returns (BIR Form No. 2550-Q) within twenty-five (25) days following the close of each taxable quarter when the transactions occurred.

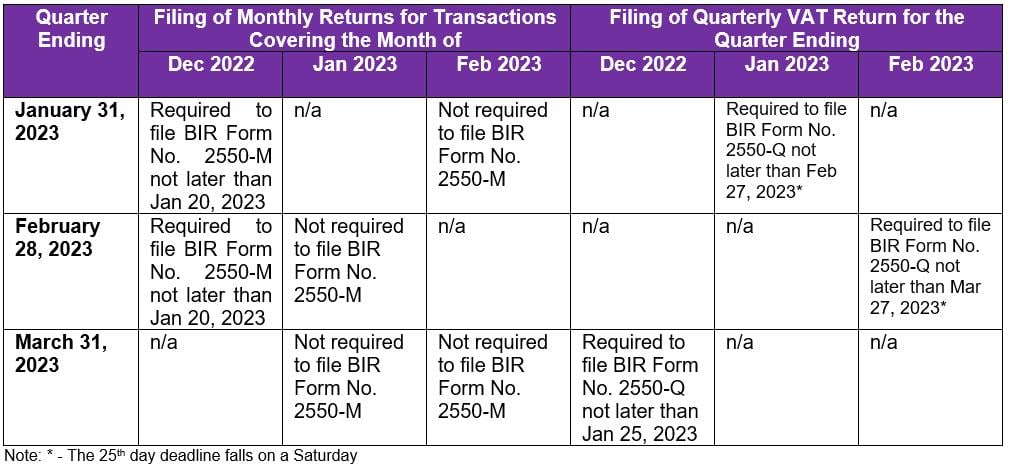

The following transitory provisions are prescribed to avoid confusion during the initial implementation thereof, particularly for taxpayers implementing fiscal period of accounting:

.