(Revenue Memorandum Circular No. 59-2023, issued on May 19, 2023)

This Tax Alert is issued to inform all concerned on the availability of the manual revised BIR Form No. 2550-Q [Quarterly Value-Added Tax (VAT) Return] January 2023 (ENCS).

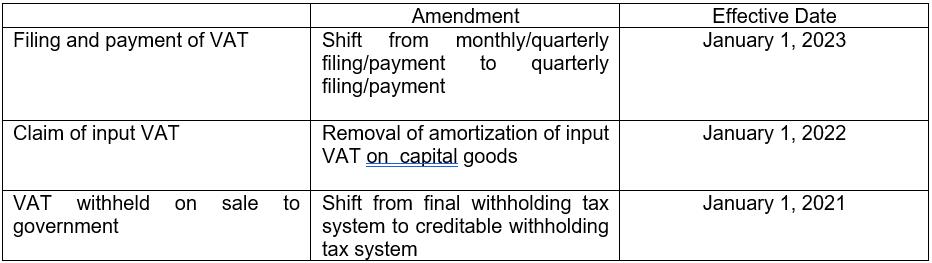

The Bureau of Internal Revenue (BIR) released the revised BIR Form 2550Q in line with the following amendments on the filing, payment and reporting of value added tax (VAT) under Republic Act No. 19963 (TRAIN Law)

Attached is the copy of the revised BIR Form 2550-Q (January 2023 ENCS) (“Annex A”).

eFPS-filers and eBIR Forms-filers shall continue to use the old version of the Quarterly VAT Return in the eFPS and eBIRForms Package v.7.9.4 since the revised form is still not yet available in the eFPS and eBIR Forms. A separate revenue issuance will be issued upon availability of the revised return in the eFPS and eBIR Forms.

Manual filers shall download and print the PDF copy of the revised return and fill out all the applicable fields, otherwise, penalties under Section 250 of the Tax Code, as amended, shall be imposed. Payment of the tax due thereon, if any, shall be made through any of the following:

a.) Online Payment

b.) Manual Payment

.

.

.