(Revenue Memorandum Circular No. 3-2023, issued on January 10, 2023)

This Tax Alert is issued to inform all concerned on the policies and guidelines on the new requirement to register all books of accounts online using the BIR Online Registration and Update System (ORUS) facility.

The following guidelines shall be observed in the online registration of books of accounts:

1. All books of accounts shall now be registered online with the BIR ORUS facility (https://orus.bir.gov.ph).

2. A Quick Response (QR) Stamp shall be generated upon successful registration of the books of accounts. Taxpayers shall paste the QR Stamp on the first page of their manual books of accounts and permanently bound loose leaf books of accounts. In the case of computerized books of accounts, the QR Stamp shall be attached to the transmittal letter showing detailed content of the USB flash drive where the books of accounts and other accounting records are stored upon submission to the BIR.

The QR Stamp shall have the following taxpayer information printed:

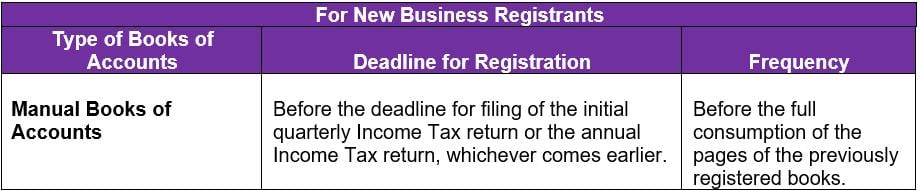

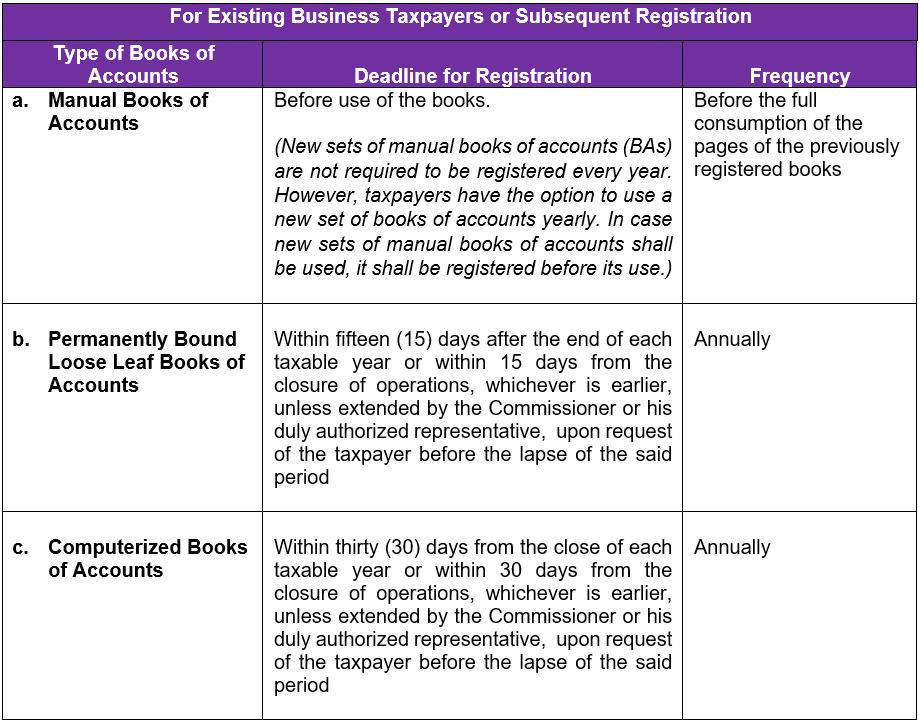

3.The manners of registering and maintaining the books of accounts are summarized below:

4. Upon initial implementation of the online registration of books of accounts through ORUS, taxpayers shall still be allowed to register and stamp their manual books of accounts at the Revenue District Office/Large Taxpayer Division/Office where the Head Office or Branch is registered.

5. The Revenue District Office/Large Taxpayer Division/Office shall announce and inform taxpayers under its Jurisdiction that the registration of books of accounts can be done manually or online.

Attached are the sample QR Stamps and the BIR ORUS Taxpayer Guide published by the BIR.

.

.

.