Tax Alert

30 Aug 2023Clarifications on VAT zero-rating of Registered Export Enterprises (REEs) and Other Entities Granted with VAT Zero-Rate Incentives under Special Laws and International Agreements

(Revenue Memorandum Circular No. 80-2023, August 9, 2023)

This Tax Alert is issued to inform all concerned on the clarifications on the provisions of Revenue Regulations (RR) No. 3-2023 and certain issues and concerns pertaining to transactions with other entities granted with VAT zero-rate incentives on local purchases under special laws and international agreements.

A. Registered Export Enterprises (REEs)

Upon the effectivity of RR No. 3-2023 last April 28, 2023, local supplier of goods and/or services of REEs shall no longer be required to apply for approval of VAT zero-rate with the BIR. Instead, the VAT Zero-Rate Certification issued by the concerned Investment Promotion Agency (IPA) shall be the basis for the VAT zero-rating. The goods and/or services directly and exclusively attributable to the registered project or activity of the REE should be enumerated in Section III, Annex "A" of the prescribed Template for VAT Zero-Rate Certification per RMC No. 36-2022. The said goods and/or services must likewise be declared in the REE's sworn undertaking.

The following documents must be provided by the REE-buyers to its local suppliers for the latter's documentation in case of post-audit by the BIR:

- VAT Zero-Rate Certification issued by the IPA in accordance with the template prescribed in RMC 36-2022;

- COR issued by the BIR having jurisdiction over the head office/branch/freeport/ecozone location where the goods and/or services are to be delivered;

- COR issued by the concerned IPA stating all registered ecozone location; and

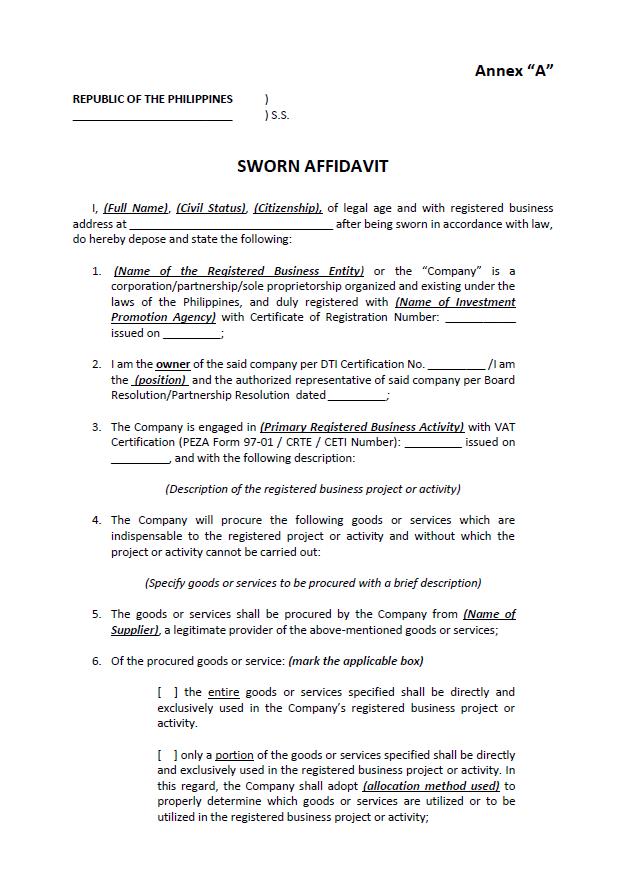

- A sworn affidavit executed by the REE-buyer, stating that the goods and/or services are directly and exclusively used for the production of goods and/or completion of services to be exported or for utilities and other similar costs, the percentage of allocation be directly and exclusively used for the production of goods and/or completion of services to be exported. See Annex "A" of RMC No. 84-2022 for the prescribed format.

For applications for VAT zero-rating which are pending approval as of the effectivity date of RR No. 3-2023, the transactions covered by the application shall be accorded VAT zero-rating treatment from the date of filing of such application subject to the conduct of post audit by the BIR that the services are indeed directly and exclusively used by the REE in its registered project or activity.

If the transaction was entitled to VAT zero-rating, i.e., the goods and/or services sold were directly and exclusively used in the registered project or activity, and the REE is duly endorsed by the concerned IPA, but the seller failed to secure an approved Application or failed to file an application for VAT Zero-Rate prior to the effectivity of RMC 3-2023, such sale shall be subject to twelve percent (12%) VAT. Likewise, if there was already a prior determination by the BIR that the transaction is not qualified for VAT zero-rate, it will also be subject to 12% VAT.

The VAT-registered REE enjoying 5% Gross Income Tax (GIT) or Special Corporate Income Tax (SCIT) may claim the corresponding input VAT from the said purchase, as either deduction against future output VAT liability after the incentive period or may be claimed as VAT refund under Section 112 (B) of the National Internal Revenue Code of 1997, as amended (Tax Code).

In case of post audit by the BIR, the following must be considered in the evaluation of transaction subject for VAT zero-rate:

- The REE's place of business where the registered project or activity is being processed/rendered must be duly registered with the appropriate BIR office;

- The REE must be duly registered with the IPA administering tax incentives;

- A VAT Zero-Rate Certificate has been issued by the IPA to the REE;

- The transaction occurred within the period the REE is entitled to VAT zero-rate incentives and is corroborated with a valid documentation, such as but not limited to duly certified copies of purchase order, job order or service agreement, sales invoice and/or official receipt, delivery receipt, or similar documents to prove existence and legitimacy of the transaction;

- The purchased goods and/or services must be delivered within the REE's registered head office/branch/freeport/ecozone/location granted with VAT zero-rate incentives; and

- The transaction is indeed qualified for VAT zero-rating in accordance with the provisions of the Tax Code, and its implementing rules and regulations, revenue issuances.

B. Enterprises granted VAT Zero-rate incentives under Special Laws or International Agreements

Local suppliers of goods and/or services of other entities granted with VAT zero-rate incentives under special laws and international agreements shall also no longer apply for approval of VAT zero-rate with the BIR. Rather, it will need to secure the following documentary requirements from the buyer:

A. For the Supplier of RE Developer

- Certificate of Registration issued by the BIR which has jurisdiction over the location of the RE Project;

- Certificate of Registration issued by the BOI; and

- Certificate of Registration issued by the DOE.

B. For the Supplier of Other Entities under Special Law and International Agreements

- A certified copy of VAT Exemption Certificate/Ruling or equivalent document, issued by the appropriate office of the BIR and other documentary requirements as may be required under the special law and international agreement including its implementing rules and regulations.

In case of post audit by the BIR, the following must be considered in the evaluation of transaction subject for VAT zero-rate:

- The location of the registered project of the entity granted with VAT zero-rate incentives under special law must be duly registered with the appropriate BIR office;

- The entity granted with VAT zero-rate incentives under special law must be duly registered with other government agency (OGA) administering tax incentives;

- The entity granted with VAT zero-rate incentives under special law or international agreement must have been issued by its concerned OGA administering tax incentives a VAT Exemption Certificate/BIR Ruling/equivalent certificate; and

- The transaction is indeed qualified for VAT zero-rating in accordance with the provisions of the Tax Code, and its implementing rules and regulations, revenue issuances, special laws or international agreements; and is likewise corroborated with a valid documentation, such as but not limited to duly certified copies of purchase order, job order or service agreement, sales invoice and/or official receipt, delivery receipt, or similar documents to prove existence and legitimacy of the transaction.