Tax Alert

22 Nov 2022Tax treatment of equity-based compensation and reportorial requirements

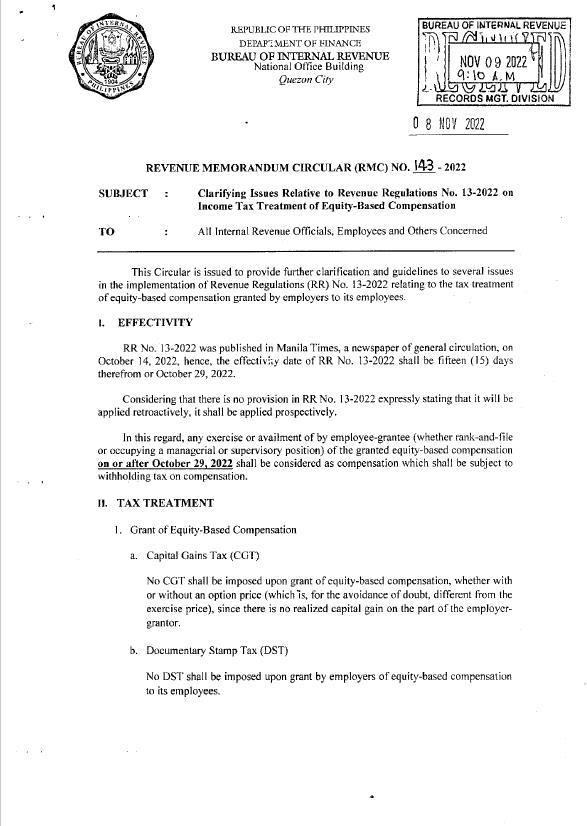

(Revenue Memorandum Circular No. 143-2022, issued on November 9, 2022)

This Tax Alert is issued to inform all concerned on clarifications of issues relating to the income tax treatment of equity-based compensation pursuant to Revenue Regulations (RR) No. 13-2022.

Effectivity of RR No. 13-2022

RR No. 13-2022, which prescribes the taxability of equity-based compensation, was published last October 14, 2022 and was effective on October 29, 2022. The new tax treatment prescribed by the said issuance shall be applied prospectively. Hence, any exercise of or availment by employees (whether rank-and-file or occupying managerial positions) of the granted equity-based compensation on or after October 29, 2022 shall be considered compensation subject to withholding tax on compensation.

Tax Treatment of Equity-Based Compensation

1. Upon Grant of Equity-Based Compensation

No Capital Gains Tax (CGT) is imposed since there is no realized capital gain on the part of the employer-grantor.

No Documentary Stamp Tax (DST) shall be imposed.

2. Upon Sale or Transfer of Equity-Based Compensation

Sale, barter of exchange by employee-grantee of the equity-based compensation is treated as sale of stocks not listed on the stock exchange.

a. Sale or transfer with consideration

CGT shall be imposed on the difference between the sales price and the option price. If the same was granted without a price, the cost base for purposes of CGT computation shall be zero.

b. Transfer without consideration

Donor’s Tax shall be imposed on the fair market value (FMV) of the option at the time of transfer/donation.

3. Upon Exercise of Equity-Based Compensation

The difference between the book Value or FMV of shares (whichever is higher at exercise date) and price fixed at grant date shall be considered as additional compensation subject to income tax and consequently, to withholding tax on compensation.

The above rule shall be applicable to both rank-and-file and managerial or supervisory employees.

DST shall be imposed only upon actual issuance of shares to the employee-grantee.

In the event that the granted equity-based compensation is transferable to the employee’s heirs in case of death of the employee, and such successor or heir exercised the same, the difference between the Book Value or FMV of shares (whichever is higher at exercise date) and price fixed at grant date shall be considered as donation subject to donor’s tax.

Filing of Tax Returns

Employer-grantors shall file the following BIR Forms starting November 2022 for equity-based compensation exercised beginning October 29, 2022:

1. BIR Form No. 1601-C (Monthly Remittance of Income Taxes Withheld);

2. BIR Form No. 1604-C (Annual Information Return for Income Taxes Withheld on Compensation); and

3. BIR Form No. 2316 (Certificate of Compensation Payment/Tax Withheld)

Employer-grantors are still required to file the following BIR Forms for equity-based compensation exercised by managerial or supervisory employees prior to the effectivity date of RR No. 13-2022:

1. BIR Form No. 1603Q (Quarterly Remittance Return of Final Income Taxes Withheld on Fringe Benefits Paid to Employees Other Than Rank and File)

a. Equity-based compensation exercised during the 3rd Quarter of 2022 (included in the 3rd Quarter BIR Form No. 1603Q filed on or before October 31, 2022)

b. Equity-based compensation exercised from October 1, 2022 to October 28, 2022 (included in the 4th Quarter BIR Form No. 1603Q to be filed on or before January 31, 2023)

2. BIR Form No. 1604-F (Annual Information Return for Income Payments Subjected to Final Withholding Tax); and

3. BIR Form No. 2306 (Certificate of Final Tax Withheld at Source)

Reportorial Requirements

1. Upon Grant of Equity-Based Compensation

Within 30 days from the grant of the equity-based compensation, the employer-grantor, shall submit to the Revenue District Office (RDO) where it is registered a statement under oath indicating the following:

a. Terms and Conditions of the stock option;

b. Names, TINs and positions of the grantees;

c. Book value, fair market value, par value of the shares subject of the option at the grant date;

d. Exercise price, exercise date and/or period;

e. Taxes paid on the grant, if any; and

f. Amount paid for the grant, if any.

2. Upon Exercise of Equity-Based Compensation

The employer-grantor shall file a report on or before the 10th day of the month following the month of exercise stating therein the following:

a. Exercise Date;

b. Names, TINs, positions of those who exercised the option;

c. Book value, fair market value, par value of the shares subject of the option at the exercise date/s;

d. Mode of settlement (i.e., cash, equity); and

e. Taxes withheld on the exercise, if any.

.