(Revenue Memorandum Circular No. 23-2022, March 9, 2022)

This Tax Alert is issued to inform all concerned on the possible suspension of income tax incentives granted to Registered Business Enterprises (RBEs) in the IT-BPM sector for violating Work-From-Home (WFH) threshold requirements and conditions prescribed by the Fiscal Incentives Review Board (FIRB) in FIRB Resolution Nos. 19-21 and 23-21.

Under FIRB Resolution Nos. 19-2021 and 23-21, RBEs in the IT-BPM sector can continue with the WFH arrangement until March 31, 2022, subject to the conditions provided in the said resolutions.

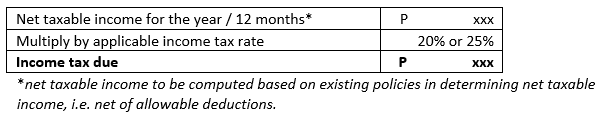

The non-compliance with all the conditions prescribed under FIRB Resolution Nos. 19-21 and 23-21 shall result in the suspension of the income tax incentive on the revenue corresponding to the months of non-compliance. As such, non-compliant RBEs shall pay the RCIT of either 25% or 20% based on the taxable net income corresponding to the months the RBE has violation.

RBEs with no existing transactions subject to RCIT shall use BIR Form 1702-MX for its voluntary payment of the income tax due on the months with reported violation. However, RBEs which have existing transactions subject to RCIT, the voluntary payment shall be made through BIR Form 0605 with the bank-validated copy of which be attached in the Annual Income Tax Return to be filed.

The computation of the income tax due for a month of non-compliance shall be as follows:

If no payment of income tax due was made or the payment is not sufficient/correct, the RBE will be recommended for issuance of Letter of Authority for the conduct of audit covering all internal revenue taxes.

To monitor the violations, FIRB shall endorse monthly reports submitted by Investment Promotions Agencies (IPAs) regarding violations committed by concerned RBEs to the BIR.

.