(Revenue Memorandum Circular No. 39-2022 issued on April 06, 2022)

This Tax Alert is issued to inform all concerned on the manner of payment of penalties in relation to the suspension of income tax incentives granted to Registered Business Enterprises (RBEs) in the IT-BPM sector for violating Work-From-Home (WFH) threshold requirements and conditions prescribed by the Fiscal Incentives Review Board (FIRB) in FIRB Resolution Nos. 19-21 and 23-21.

Thus, for the months the RBE violated the WFH conditions, the RBE shall be liable to pay the regular income tax of 25% or 20%.

The following revised guidelines were prescribed by the BIR:

- RBEs shall continue to file their Annual Income Tax Return (AITR) using BIR Form No. 1702-EX for those with Income Tax Holiday (ITH) incentive and BIR Form No. 1702-MX for those enjoying Gross Income Tax (GIT) incentive or those with mixed transactions, as if they are still entitled for incentives during the months of non-compliance. Also, they are mandatorily required to complete the required information pertaining to allowable deductions pursuant to existing tax laws and regulations.

- Payment of the computed penalty shall be made using BIR Form No. 0605 by choosing the radio button pertaining to 'Others', under 'Voluntary Payment' and by indicating in the field provided the phrase "Penalty pursuant to FIRB Res. No. 19-2021". The tax type code shall still be "IT" and the ATC to be indicated is "MC 200".

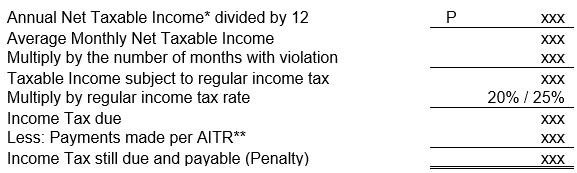

- The RBE shall compute the penalty (income still payable) in the following manner:

![imagee3de.png]()

*Annual Taxable Income must be computed based on existing tax laws and policies.

**For those under 5% GIT, payments made per AITR is computed as total gross income tax due per AITR divided by 12 months multiplied by the number of months with violation.

- The payment of penalty must be made within 30 days after the due date prescribed for the payment of income tax. Payment made beyond such period will be imposed with administrative penalties.