(Revenue Memorandum Circular No. 152-2022, issued on December 7, 2022)

This Tax Alert is issued to inform all concerned on further clarifications and guidelines on issues concerning the implementation of certain provisions of Revenue Regulations (RR) No. 21-2021, Revenue Memorandum Circular (RMC) Nos. 24-2022 and 49-2022 regarding the updated VAT rules for Registered Business Enterprises (RBEs) under the CREATE Law.

Transitory provisions

- Registered Export Enterprises (REEs) whose incentives already prescribed are no longer qualified for VAT zero-rating on their local purchases, and therefore are already subject to 12% VAT. However, REEs whose incentive period has already expired from the effectivity of RR No. 21-2021 on December 10, 2021 up to the date before the effectivity of RMC No. 24-2022 on March 08, 2022 shall remain as VAT zero-rated. These include REEs with expired incentives (e.g. Income Tax Holiday) that were erroneously endorsed by their respective Investment Promotion Agencies (IPAs) as still qualified for VAT zero-rating.

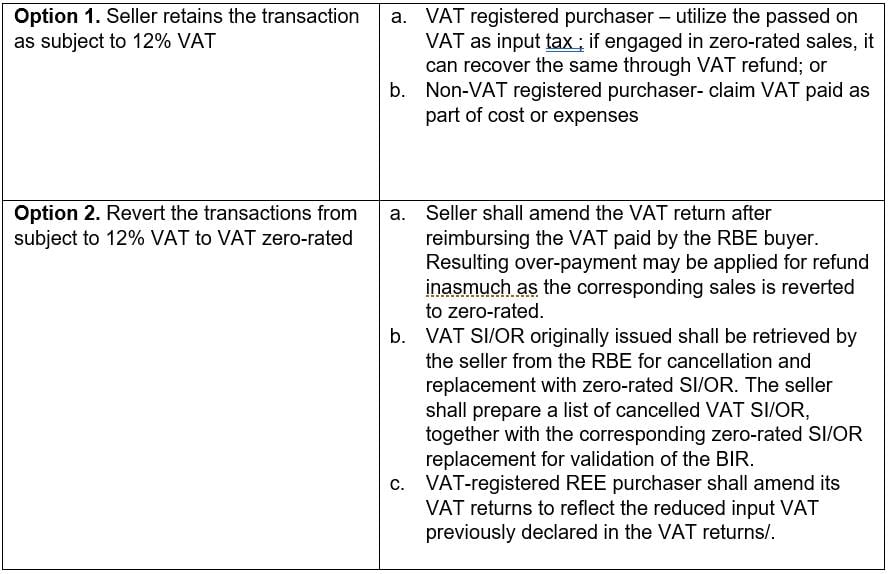

- If the purchase is qualified for VAT zero-rate but was imposed 12% VAT by the seller during the above transitory period, the following procedures may be applied:

![]()

Update of registration of REEs under 5% Gross Income Tax (GIT)/Special Corporate Income Tax (SCIT) from VAT to Non-VAT

- RMC No. 24-2022, as amended by RMC No. 49-2022, prescribes that REEs who have completed their Income Tax Holiday (ITH) and are currently under 5% GIT/SCIT or those already under 5% GIT/SCIT upon effectivity of CREATE Act to change their registration from VAT to non-VAT within two (2) months from the expiration of the ITH or effectivity of RMC No. 49-2022, whichever is applicable.

- REEs who have updated their registration from VAT to non-VAT shall not be subject to Percentage Tax (PT) since the 5% GIT/SCIT scheme is already in lieu of all other internal revenue taxes. REEs are only required to file and pay the corresponding tax due in their respective income tax returns. However, a corresponding assessment and penalties may be imposed if there are projects or activities other than those registered are being carried out by the REEs.

- REEs required to register as a non-VAT taxpayer shall still qualify for VAT zero-rating on its local purchases of goods and services that are directly and exclusively used in their registered activity. Meanwhile, REEs whose registration with an IPA has already expired shall be subject to 12% VAT on its local purchases.