(Revenue Memorandum Circular No. 66-2021 issued on May 24, 2021)

This Tax Alert is issued to inform all concerned taxpayers on the availability of the new Quarterly Income Tax Return (QITR) (BIR Form 1702Q - January 2018 ENCS) in eFPS and modified version of the QITR (BIR Form 1702Qv2008c) in the eBIRForms package in relation to the reduction of corporate income tax rates under Republic Act No. 11534, also known as Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act.

1. eFPS-filers

- The new BIR Form 1702Q January 2018 version is now available in the EFPS.

- eFPS-filers shall select the Alphanumeric Tax Code (ATC) with the corresponding tax rate to be used (20% or 25%).

2. eBIRForm-filers

- The new BIR Form 1702Q is not yet available in the offline eBIRForms package.

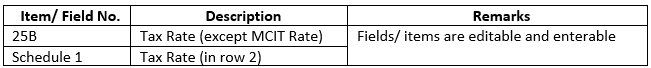

- eBIRForm-filers shall use the modified 2008 version of the QITR (BIR Form 1702Qv2008c) which has been modified in the offline eBIRForms package v7.9.1 as follows:

![imageypz3.png]()

- The Offline eBIRForms Package v7.9.1 is already available and downloadable from bir.gov.ph and www.knowyourtaxes.ph.

- Taxes due can be paid via manual payment with AAB or RCOs, or via available online modes of payment.