(Revenue Memorandum Circular No. 36-2021 issued on March 05, 2021)

This Tax Alert is issued to inform all concerned on the guidelines for the shift from final to creditable system of VAT withheld on sales to government, or any of its political subdivisions, instrumentalities or agencies, including government-owned or -controlled corporations (GOCCs).

Pursuant to the TRAIN Law, beginning January 1, 2021, VAT withheld on sales to government shifted from final to creditable system.

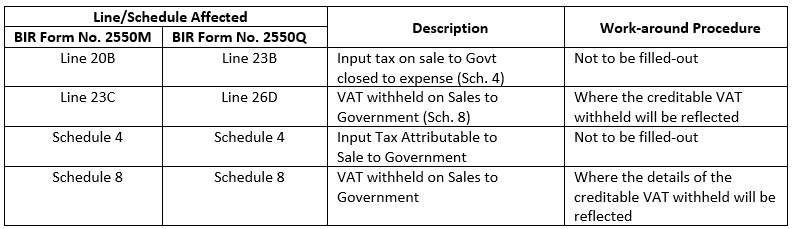

Since new version of the forms is not yet available, the following guidelines shall be followed in accomplishing BIR Form Nos. 2550M and 2550Q in relation to VAT withholding:

The government or any of its political subdivisions, instrumentalities, or agencies, including GOCCs who are required to withhold creditable VAT shall use BIR Form No. 1600-VT for filing and remittance of the amount withheld, except eFPS filers who shall still use BIR Form No 1600 due to unavailability of BIR Form No. 1600-VT.

VAT credits claimed in the VAT returns shall be supported by Certificate of Creditable Tax Withheld at Source (BIR Form No. 2307) issued by the government or any of its political subdivisions, instrumentalities, or agencies, including GOCCs with Alphanumeric Tax Code (ATC) No. WV010 for purchase of goods or WV020 for purchase of services. Erroneous use of the VAT credits (i.e. reflected as tax credit in the quarterly and annual income tax returns instead of VAT returns) shall result in disallowance of the withheld amount and forfeiture of the same in favor of the government.

.