Tax Alert

30 Apr 2021Clarifications on the submission of BIR Form 1709 and preparation of transfer pricing documentation

(Revenue Memorandum Circular No. 54-2021 issued on April 27, 2021)

This Tax Alert is issued to inform all concerned taxpayers on the following clarifications on the submission of BIR Form 1709 (Information Return on Related Party Transactions) and the preparation of Transfer Pricing Documentation (TPD) pursuant to RR No. 19-2020, as amended by RR No. 34-2020:

A. Taxpayers required to submit BIR Form 1709

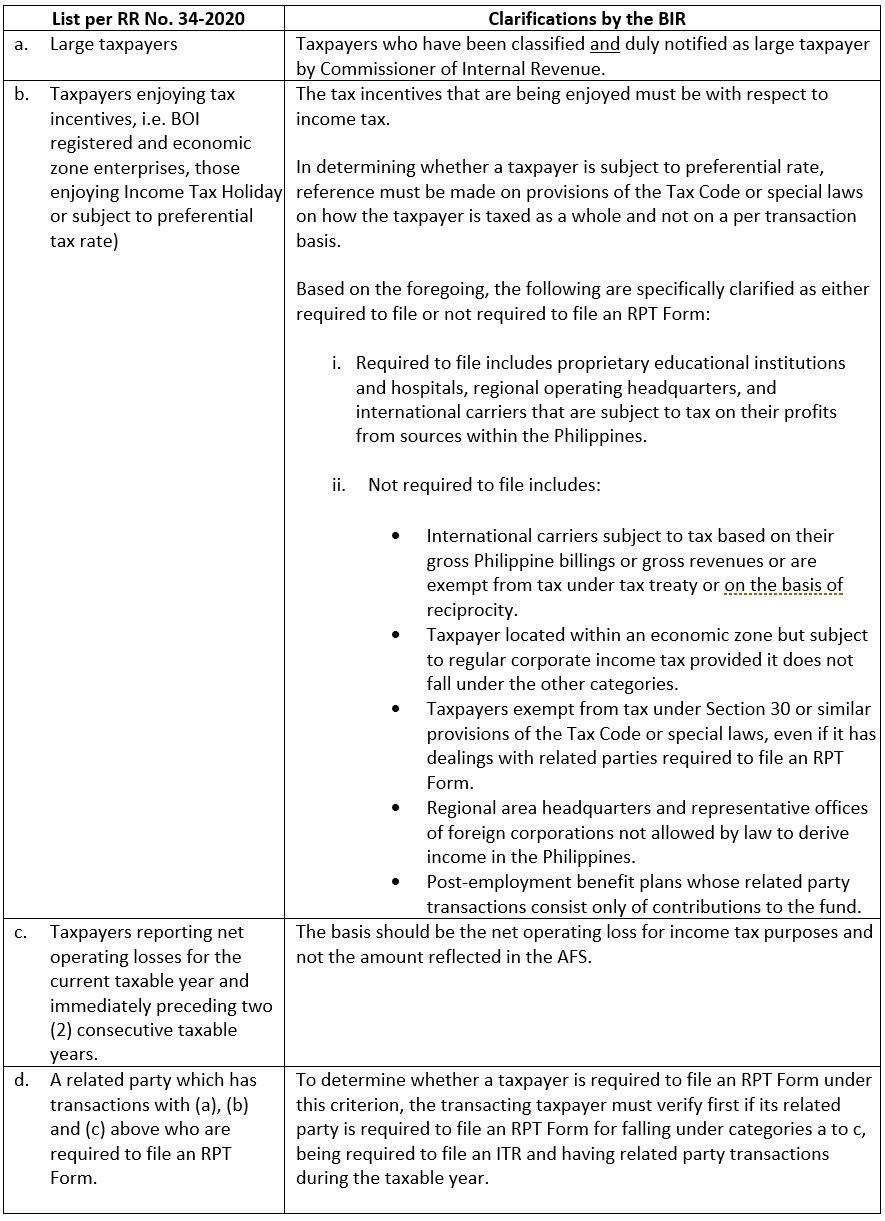

The BIR clarified that taxpayers required to submit BIR Form 1709 are those taxpayers required to file an Annual Income Tax Return (AITR) and has transactions with a domestic or foreign related party during the concerned taxable period. In addition, they should also fall under any of the conditions enumerated and clarified below:

b. Filling out and submission of BIR Form 1709

i. On reporting of related party transactions:

- All related party transactions must be disclosed irrespective of amounts.

- Similar transactions with the same related party must be aggregated if possible.

- The actual amounts (not estimates) of the related party transactions shall be declared in the RPT Form.

- The amounts that should be disclosed in the RPT Form should be the amounts in foreign currency and its equivalent in the local currency. However, if several currencies were used for the related party transactions, and it seems impractical to indicate all of them in the RPT Form, their equivalent in the local currency should instead be disclosed. In all cases, the exchange rates to be used should be the rate at the transaction date.

- The share in the net income of an associate or joint venture is not required to be reported in the RPT Form.

- Contributions to the post employment benefit plans need not be included in the RPT Form.

ii. The TPD and other supporting documents are not required to be attached to the RPT Form but should be made available during BIR audit.

iii. The filing of RPT Form as attachment for short period returns shall only be required for short period returns to be filed in 2021 and subsequent years.

iv. If the taxpayer fails to provide any material information (e.g. details of the related parties and related party transactions, etc.), the RPT Form will be disregarded, and the penalty for failure to file such information return will be imposed.

v. Advance Pricing Agreement (APA) should be approved and accepted by the BIR for the related party transactions covered by the said APA to be exempt from disclosure in the RPT Form.

C. Taxpayers required to prepare TPD

i. A taxpayer who is required to file the RPT Form shall only prepare its TPD if it meets any of the threshold under Sec. 3 of RR No. 34-2020. If the taxpayer is not required to file the RPT Form, then it is not also mandated to prepare a TPD

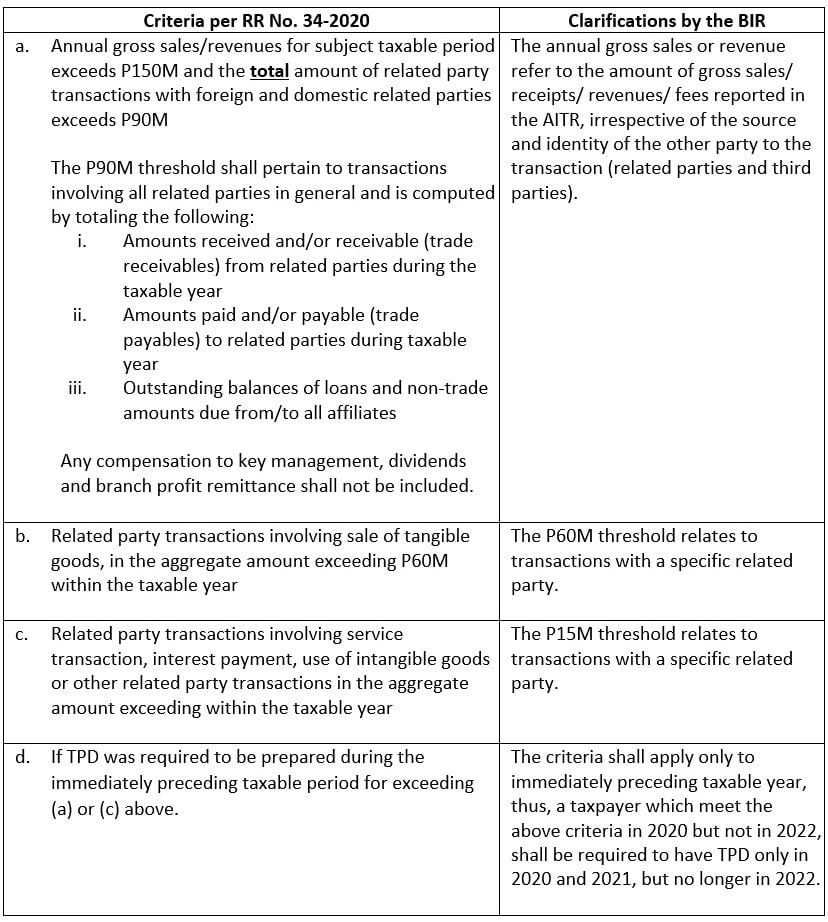

ii. The preparation of TPD shall be mandatory if the taxpayer meets any of the following thresholds, as clarified by the BIR:

iii. Nothing prevents any taxpayer from preparing a TPD and presenting the same during audit to prove that its related party transactions were conducted at arm's length. Taxpayers who are not required to prepare a TPD, still need to reasonably assess and prove whether its dealings with related parties adhere to the arm's length principle.

The BIR still retains the right to conduct transfer pricing audit against taxpayers with related party transactions, irrespective of whether or not they are required to file the RPT Form and prepare a TPD.

D. Transitory provisions

i. The required disclosure in the Audited Financial Statements (AFS) for taxpayers not covered by the requirements and procedures for related party transactions applies to AFS required to be submitted after effectivity of RR No. 34-2020.

ii. The provisions of RR No. 34-2020 shall only apply to RPT Forms required to be submitted after effectivity of the said regulation on December 23, 2020.

.