Tax Alert

10 Dec 2020Proposed Corporate Recovery and Tax Incentives for Enterprises Act (CREATE)

(Senate Bill No. 1357)

This Tax Alert is issued to inform all concerned on the proposed amendments to the National Internal Revenue Code of 1997, as amended, under Senate Bill No. 1357, otherwise known as “Corporate Recovery and Tax Incentives for Enterprises Act” or CREATE Bill. The CREATE Bill was approved on third and final reading by the Senate on 26 November 2020.

Below are the highlights and relevant provisions of the CREATE Bill:

A. Corporate Income Tax (CIT)

- Starting July 01, 2020, CIT rate for corporations will be reduced as follows:

i. Reduced CIT rate of 20% shall be applicable to domestic corporations with net taxable income not exceeding P5,000,000 and with total assets not exceeding P100 Million (excluding land on which the business entity’s office, plant and equipment are situated)

ii. Reduced CIT rate of 25% shall be applicable to all other domestic and foreign corporations.

- For the period beginning July 01, 2020 until June 30, 2023, minimum corporate income tax rate shall be 1%, instead of 2%.

- Improperly accumulated earnings tax is repealed.

B. Preferential tax rates for certain corporations

- For the period beginning July 01, 2020 until June 30, 2023, non-profit proprietary educational institutions and hospitals shall be taxed at 1%, instead of 10%.

- Preferential tax rates/exemption for offshore banking units is repealed.

- Starting December 31, 2021, regional operating headquarters (ROHQ) will be subject to regular CIT.

C. Final tax rates in certain passive income

- Aside, from lotto winnings, winnings from PCSO games amounting to P10,000 or less received by a nonresident alien individual shall be exempt from income tax.

- Foreign-sourced dividends received by domestic corporations may be exempt from income tax if the following conditions are met:

-

- The dividends are reinvested in the business operations of the domestic corporation in the Philippines within the next taxable year from date of receipt; and

- The dividends shall be used to funding the working capital requirements, capital expenditures, dividend payments, investment in domestic subsidiaries and infrastructure project; and

- The domestic corporation holds directly at least 20% of the outstanding shares of the foreign corporation for a minimum of 2 years at the time of dividends distribution.

- Interest income earned by a resident foreign corporation (RFC) under the expanded foreign currency deposit system shall be subject to final tax of 15% (currently 7.5%).

- Capital gains from sale of shares of stocks not traded in the stock exchange earned by RFC and nonresident foreign corporation (NRFC) shall be subject to final tax of 15% (currently 5%/10%).

D. Deductions from gross income

- An additional deduction equal to 50% of the value of labor training expenses incurred for skills development of enterprise-based trainees enrolled in public senior high schools, public higher education institutions, or public technical and vocational institutions duly covered by an apprenticeship agreement and for which a proper certification must be secured from DepEd, TESDA or CHED shall be allowed, provided that such deduction shall not exceed 10% of direct labor wage.

- Due to the proposed reduction in CIT rate, interest arbitrage shall be reduced to 20% of interest income subjected to final tax.

E. Tax Free Exchanges

1. Specific types of reorganizations involving corporations will be covered by tax-free property for shares exchanges, including:

i. Merger or consolidation

ii. Acquisition by a corporation of stock of another corporation in exchange for shares, if, immediately after the acquisition, the acquiring corporation has control of the acquired corporation

iii. Acquisition by a corporation in exchange for shares, of substantially all of the properties of another corporation

iv. Recapitalization

v. Reincorporation

2. BIR confirmation or ruling shall not be required for purposes of availing the tax exemption on tax free exchanges.

3. Clarified the definition of “control” for purposes of tax-free exchange which provides that the collective and not the individual ownership of all classes of stocks entitled to vote of the transferor or transferors shall be used in determining the presence of control.

F. VAT Exempt Transactions

1. Adjustment of threshold for VAT exempt sale of residential real property:

i. Residential lot – P2,500,000 (currently P1,500,000)

ii. House and lot and other residential dwellings – P4,200,000 (currently P2,500,000 and P2,000,000 effective Jan. 1, 2021)

2. Additional VAT exempt transactions:

i. Sale, importation of any books/newspaper, or any educational reading material covered by the UNESCO agreement on the importation of educational, scientific and cultural materials, including the digital or electronic format thereof (requirement to appear at regular intervals shall be removed)

ii. Sale or importation of the following goods from January 1, 2021 to December 31, 2023:

- capital equipment, its spare parts and raw materials, necessary to produce personal protective equipment component;

- all drugs, vaccines and medical devices specifically prescribed and directly used for the treatment of COVID-19

- drugs, including raw materials, for the treatment of COVID-19 approved by the FDA for use in clinical trials

3. VAT exemption of sale or importation of prescription drugs and medicines for cancer, mental illness, tuberculosis, and kidney diseases will start on January 1, 2021 instead of January 1, 2023.

G. Percentage Tax

- For the period from July 01, 2020 to June 30, 2023, the rate of percentage tax shall be 1% (currently 3%).

H. Fiscal Incentives Rationalization

- The Fiscal Incentives Review Board (FIRB) or the Investment Promotion Agencies (IPAs) under a delegated authority from the FIRB, shall grant incentives pursuant to the Tax Code only to the extent of their approved registered project or activity under a Strategic Investment Priority Plan (SIPP).

- Qualifications of a registered business enterprise:

i. Should be engaged in an activity included in the SIPP

ii. Should meet the target performance metrics after agreed time period

iii. Should install adequate accounting systems that can identify the investments, revenue, costs and profits for each activity or establish a separate corporation for each registered project or activity

iv. Should comply with e-receipting and e-sales requirement

v. Should submit annual reports of beneficial ownership of the organization and related parties

3. Income tax incentives that can be availed are as follows:

i. Income tax holiday followed by Special Corporate Income Tax (SCIT) of 5% based on gross income earned, in lieu of all taxes; OR

ii. Regular CIT with enhanced deductions, at the option of the export enterprise or domestic market enterprise engaged in activities classified as strategic industries

Enhanced Deductions includes additional deductions for depreciation, labor, training, R&D, domestic input expense, power expense, investment allowance and claiming of NOLCO for next 5 years.

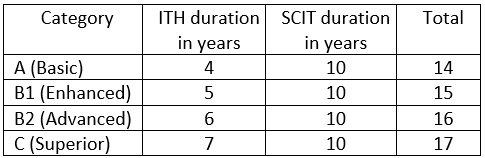

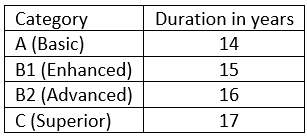

- Duration of income tax incentives differed for each category which is based on location and industry priorities:

i. ITH followed by SCIT

ii. Regular CIT with enhanced deductions

- Other fiscal incentives:i.

i. Exemption from customs duties on importation of capital equipment, raw materials, spare parts or accessories directly and exclusively used in the registered project or activity and which are not produced or manufactured domestically in sufficient quantity at reasonable prices

ii. VAT exemption on importation and VAT zero-rating on local purchases of goods and services directly and exclusively used in the registered project or activity by a registered enterprise located inside an ecozone or freeport

- Qualified expansion or entirely new project or activity may qualify to avail of a new set of incentives

- Existing registered projects or activities prior to effectivity of CREATE Bill may qualify to register under the CREATE Bill provisions

- Reportorial requirements for registered enterprises

i. Registered enterprises should use the electronic system for filing and payment with the BIR

ii. Registered business enterprises shall file with their respective IPA and with the FIRB a complete annual tax incentives report and an annual benefits report within 30 calendar days from the statutory deadline for filing of returns and payment of taxes

iii. Non-compliance with reportorial requirements and failure to use the electronic system for filing and payment of taxes to the BIR shall be imposed with penalties (1st offense – P100,000; 2nd offense – P500,000) then, cancelation of fiscal incentives.

9. Approval of registered projects or activities of P1 billion pesos and below shall be delegated by FIRB to IPA

10. Application for tax incentives shall be deemed approved if not acted upon within 20 days

11. Powers of the President to grant tax incentives

i. The President may modify the mix, period or manner of availment of incentives for a highly desirable project subject to certain conditions and recommendation of the FIRB. The grant of ITH shall not exceed 8 years and thereafter, 5% SCIT may be granted, provided that the total period of availment shall not exceed 40 years.

12. For existing registered projects/activities prior to effectivity of the CREATE:

i. If granted ITH only, existing registered enterprise may still avail of ITH for the remaining ITH period

ii. If granted ITH and 5% (Gross Income Tax) GIT after the ITH or if granted 5% GIT only, existing registered enterprise may avail of 5% GIT for 10 years