(Revenue Regulations No. 27-2020 published on October 08, 2020)

This Tax Alert is issued to inform all concerned on the further extension of due dates for filing of VAT refund claims pursuant to Bayanihan to Recover as One Act (Republic Act No. 11494) or the Bayanihan II.

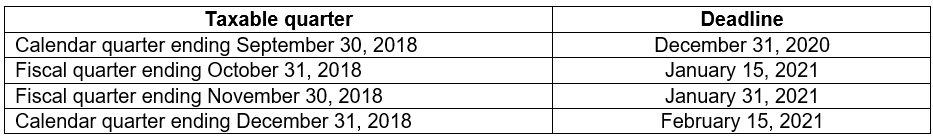

Application for VAT refund claims covering the following taxable quarters shall be due on the following dates:

The 90-day processing of VAT refund claims is likewise suspended during the effectivity of Bayanihan II or until the next adjournment of the 18th Congress on December 19, 2020.

In areas where the Enhanced Community Quarantine (ECQ) or the Modified Enhanced Community Quarantine (MECQ) is in force after December 19, 2020, the following shall be observed until lifting of the state of national emergency:

.