(Revenue Memorandum Circular No. 52-2020, June 06, 2020)

This Tax Alert is issued to inform all concerned taxpayers throughout the country on the updated modes of submission of withdrawal of protest to qualify for the tax amnesty.

Under RMC 11-2020, it was clarified that a taxpayer may be allowed to withdraw his protest on Final Assessment Notice (FAN)/ Formal Letter of Demand (FLD) or appeal on Final Decision on Disputed Assessment (FDDA) before the concerned Regional office or the National office to qualify for the tax amnesty. In view of the implementation of various levels of quarantine, electronic filing or online withdrawal of the protests is now temporarily allowed as an alternative to physical filing.

To submit via e-mail, the following guidelines shall be observed:

a. Subject of the email

Withdrawal of the Protest of FAN/FLD or Appeal on FDDA of (Name of Taxpayer) filed before (Name of BIR Office)

b. Body of the email

Name of the Taxpayer:

Name of the Filing Party:

Position of the Filer:

Date of Protest/ Appeal was Filed:

Taxable Year:

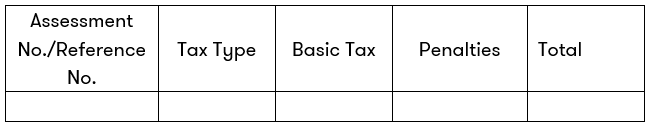

Summary of FAN/FLD/FDDA

(Please refer to the RMC for the list of e-mail addresses to be used for each BIR Office.)

The option for online filing of withdrawal of any protest or appeal shall no longer be allowed as soon as the ECQ or the GCQ is lifted.

.