(Revenue Memorandum Circular No. 46-2019)

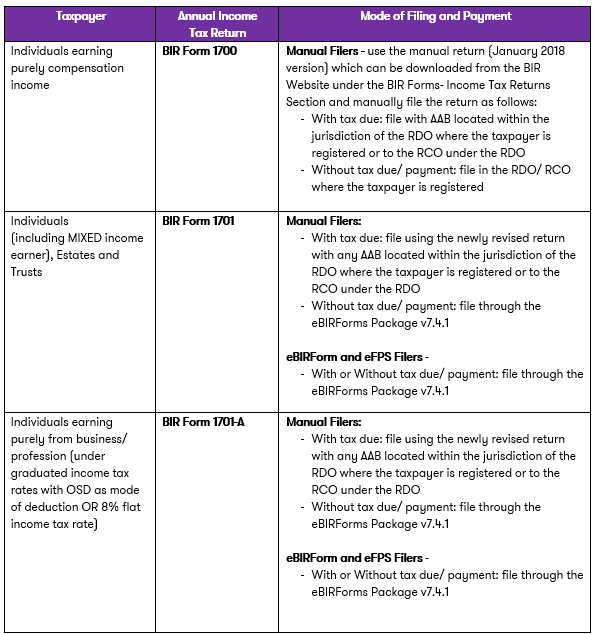

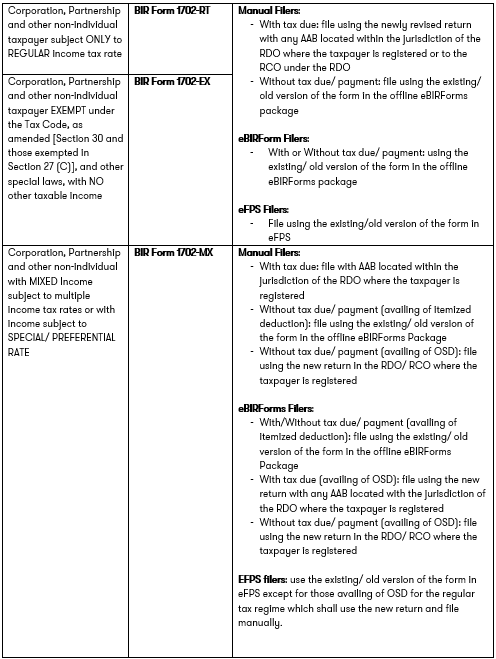

This Tax Alert is issued to inform all concerned taxpayers on the following guidelines on the filing and payment of annual income tax returns (ITRs) for taxable year 2018.

Manual and eBIRForms- mandated filers can pay their taxes due as follows:

1. Manual Payment-

2. Online Payment- (if the applicable BIR form is not available in the offline eBIRForms package, taxpayers who have paid tax due online are required to file the corresponding annual income tax return, with proof of payment with the RDO where the taxpayer is registered or to the RCO under the RDO not later than the following working day after the payment)