(Revenue Regulations No. 11-2018)

This Tax Alert is issued to inform all concerned on the changes on the creditable/expanded withholding tax rules on professional fees, talent fees and commissions, effective January 1, 2018.

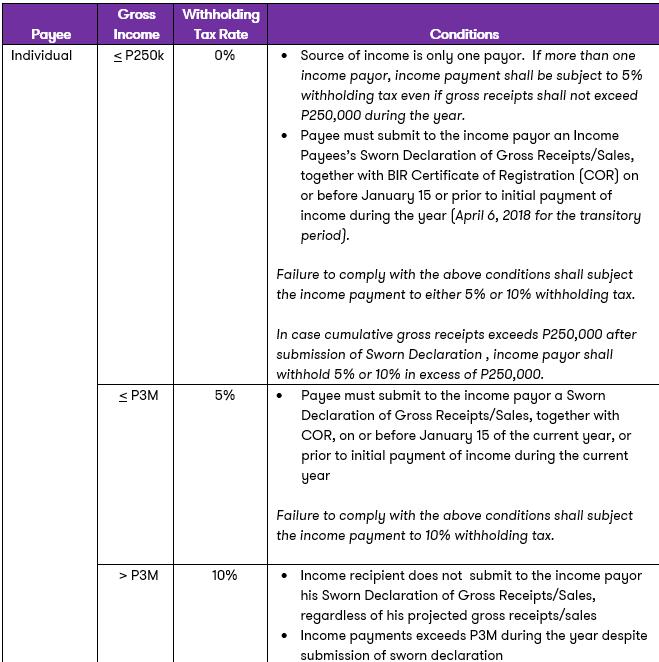

Professional fees, talent fees, and consultancy fees payable to individual payees are now subject to 5%/10% withholding tax (8% under RMC No. 01-2018, and 10%/15% prior to this ). Fees received by an individual from a lone income payor amounting to not exceeding P250,000 may not be subject to withholding tax. If the recipient of such income is an employee of the payor, the payment shall be considered supplemental compensation subject to withholding tax on compensation.

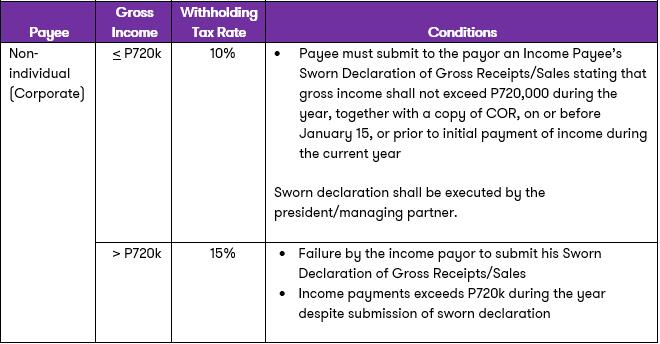

Those payable to non-individual payees remain to be subject to 10%/15% withholding tax.

Commissions payable to brokers, agents, independent/exclusive sales representatives and marketing agents of companies are now subject to the same rates and rules applicable to professional fees. Previously, commissions are subject to 10% withholding tax only.

Below are the guidelines in determining the applicable withholding tax rate on the above income payments.

The sworn declaration of gross receipts/sales by the income payee is no longer required to be received by the BIR. However, the income payor/withholding agent shall submit to the BIR the following documents:

a) Income Payor/Withholding Agent’s Sworn Declaration on individual payees not subjected to withholding tax orsubjected to 5% withholding tax, and non-individual payees subjected to 10% withholding tax; and

b) List of Individual Payees.

The withholding agent shall submit the above documents to the BIR on or before January 31 of each year, or 15 days following the month when a new income payee has submitted sworn declaration of gross receipts/sales.

Transitory provisions

For the transitory period, the above documents shall be submitted to the BIR on or before April 20, 2018.

Any income taxes withheld in excess of what is prescribed in the regulation shall be refunded by the withholding agent to the payee. The amount refunded shall be reflected in the first quarter withholding tax return as adjustment to the remittable withholding tax due. The adjusted amount of tax withheld shall also be reflected in the Alphabetical List of Payees to be attached in the first quarter return. The said list of payees, who are subject to refund, shall likewise be attached in the return which shall be filed on or before April 30, 2018. The corresponding Certificate of Tax Withheld at Source (BIR Form No. 2307) shall be returned and replaced by a new BIR Form 2307 upon refund of the excess withholding tax.