(Revenue Memorandum Order No. 32-2018)

This Tax Alert is issued to inform all concerned on the audit to be conducted on individual and non–individual taxpayers belonging to the “small” category.

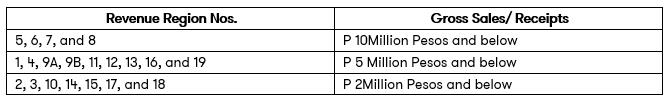

Pursuant to Revenue Memorandum Order No. 32-2018, electronic Letters of Authority (eLAs) shall be issued to taxpayers with the following amount of gross sales/receipts declared in the tax returns for taxable year 2017:

![]()

Below are the relevant audit policies and guidelines for the audit:

- One eLA shall be issued for each taxable year. The eLA shall include examination of all internal revenue tax liabilities of the taxpayer, except when a specific tax type had been previously examined (e.g. VAT audit).

- The eLA, together with the Notice for the Presentation/Submission of Documents/Records with checklist of requirements shall be personally delivered by a BIR employee to the taxpayer, or delivered through a courier company.

- The taxpayer shall have 10 days to submit the required documents/records. Failure to submit within the 10-day period shall result to issuance of a reminder letter giving an additional 5 days to comply. Failure to submit within the 5-day period shall result to issuance of Subpoena Duces Tecum. No further extension to submit documents shall be allowed.

- The audit shall be conducted without field investigation. The report of investigation shall be submitted by the Revenue Officers (RO) to the Review and Evaluation Section in the Assessment Division within 90 days from the issuance of the eLA.

Thus, submission of the supporting documents/records and reconciliations must be completed prior to the end of the 90-day period.