Tax Alert

05 Dec 2017Tax Reform for Acceleration and Inclusion

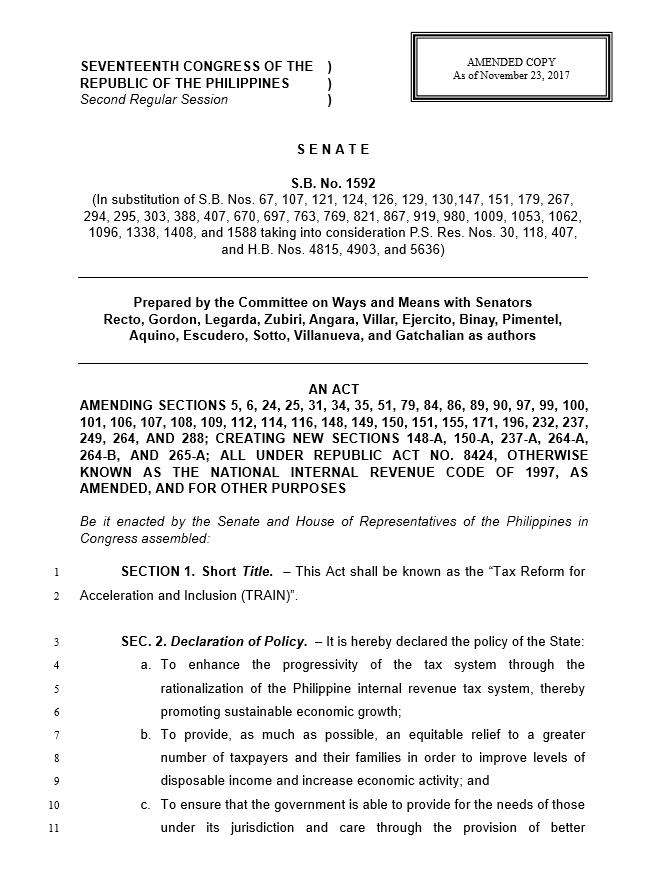

(Senate Bill No. 1592)

This Tax Alert is issued to inform all concerned on Senate’s version of the Tax Reform for Acceleration and Inclusion (TRAIN) under Senate Bill (SB) No. 1592, as approved on 3rd and final reading.

Below are the significant changes being proposed under SB No. 1592 in relation to the House of Representative’s House Bill No. 5636. The two versions are currently being reconciled in the bicameral conference committee.

1. Under SB No. 1592, proposed non-taxable individual income is P250,000 and the maximum rate of 35% is applicable on income over P8M. Personal and additional exemptions are now disallowed. In the House version, 35% rate applies on income of P5M.

2. Tax exemption of 13th month pay and other bonuses retained at P82,000. House version increased the cap to P100,000.

3. Self-Employed and/or Professional shall have the option to be subject to 8% income tax on gross sales or gross receipts, or graduated tax rates of 0% to 35% to be applied on income from business or practice of profession. In the House version, self-employed earning more than the VAT threshold shall be taxed like corporations.

4. Optional Standard Deduction (OSD) of individuals shall be based on gross income (sales less COS) at the rate of 40%. Same proposal in the House version.

5. The 15% preferential tax treatment on employees of RHQ, ROHQ, OBUs and petroleum contractors will be repealed under both House and Senate version. However, in the Senate version, present and future qualified employees of existing RHQ, ROHQ, OBUs and petroleum contractors shall continue to be entitled of the 15% preferential tax rate.

6. Individual income received from PCSO and Lotto winnings exceeding P10,000 shall continue to be subjected to 20% final tax. In the House version, the exemption was completely repealed.

7. Final tax on interest on foreign currency deposits (currently 7.5%) and capital gains from sale of shares of stocks not traded in the stock exchange (currently 5%/10%) shall be increased to 15% final tax. No proposed change in the House version.

8. The fringe benefit tax shall be increased to 35%, aligned with the top marginal rate. In the House version, the FBT will be repealed by 2022.

9. Corporate and individual income tax return shall be limited to 2-pages containing profile and information, gross sales, receipts or income, except income subject to final tax, allowable deductions, taxable income, and tax due and payable. No proposed change in the House version.

10. Due date for individual income tax return will be moved from April 15 to May 15. Second installment of individual income tax shall be due on or before October 15, currently July 15. No proposed change in the House version.

11. Expanded withholding tax rate shall be at a maximum of 10%. No proposed change in the House version.

12. Estate tax shall be subject to a flat rate of 6% with removal of certain deductions, similar to the House version. Senate version proposes increase in standard deduction to P5M, and an increased threshold of family home to P10M. Certain changes on filing and notification requirements are also being proposed. Deductions for expenses, losses, indebtedness, taxes, and medical expenses are now disallowed. Installment payment of estate tax due shall be allowed within two years in case the available cash of the estate is insufficient to pay total estate tax due.

13. Donor’s tax shall be a flat rate of 6% on donations in excess of P250,000. House version exempts only the first P150,000.

14. Removal of certain VAT zero-rated sales subject to enhanced VAT refund system. Mostly same as in the House version.

15. VAT threshold shall be increased to P3M. Same as in the House version.

16. The following are VAT exempt transactions:

a. VAT exemption of residential dwellings will be limited to those located outside Metro Manila with selling price of not more than P2M. Exemption was completely repealed in the House version.

b. Lease of residential unit for P15,000 per month. Exemption was completely repealed in the House version.

c. Sale of prescription drugs and medicines. No proposal in the House version.

d. Association dues, membership fees, and other assessments and charges collected by homeowners’ associations and condominium corporations. No proposal in the House bill.

e. Transfer of property pursuant to Section 40 (c) (2). No proposal in the House bill.

17. Excise tax rates on petroleum products shall be increased at different schedules in both versions.

18. Excise tax rates on automobiles shall be decreased to 10% for NMP/ISP up to P1M and 20% in excess of P1M. Vehicles purely powered by electricity or hybrid vehicles shall not be subject to excise tax. In the House version, the top rate will be increased to 90% and 120% on NMP/ISP over P3M.

19. Excise tax of 10% on cosmetic procedures shall be imposed. None in the House version.

20. Sugar Sweetened Beverage Tax of P4.5/P9 per liter based on the type of sugar content shall be imposed. House version proposes P10/P20 per liter.

21. Excise tax on mineral products shall be increased. No changes in the House version.

22. Documentary stamp tax on most transactions shall be doubled. No changes in the House version.

23. Deficiency interest rate shall be reduced from 20% to twice the legal rate as set by BSP (currently at 6%, hence, interest rate shall be 12%). No proposal in the House bill.

Please find attached, a copy of the Senate Bill as posted in the Senate website.

.