Tax Alerts

03 Feb 2017Format for approval/denial of applications for compromise settlement and abatement of penalties

Format for approval/denial of applications for compromise settlement and abatement of penalties

(Revenue Memorandum Order No. 03- 2017)

This Tax Alert is issued to inform all concerned on the format of the Certificate of Availment and Notice of Denial

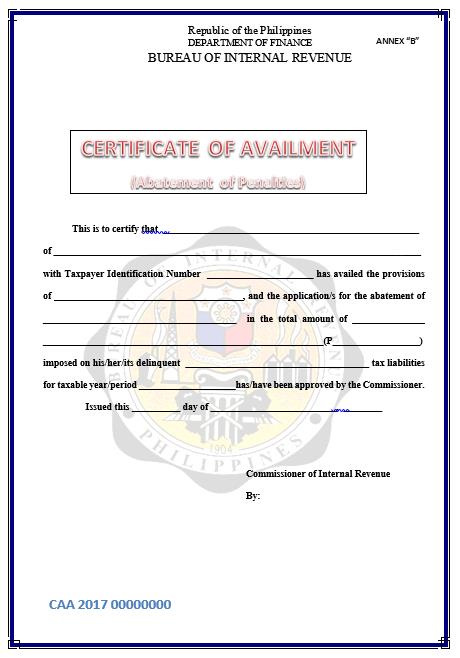

Approval of applications for compromise settlement of deficiency taxes and abatement of penalties shall be issued a Certificate of Availment in the prescribed format which indicates the name and TIN of the taxpayer, the amoung approved, taxes and taxable year covered.

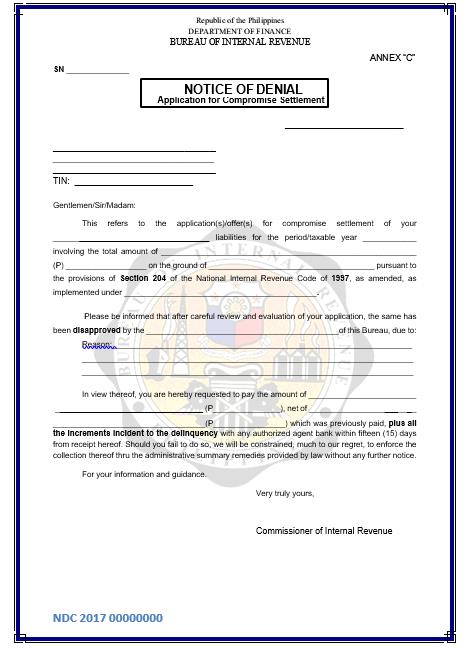

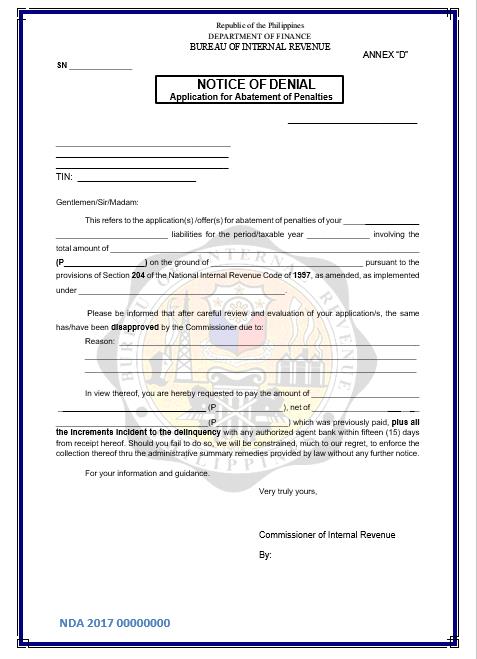

Denied applications shall be issued a Notice of Denial with a note on the reason for the denial and the amount of taxes/penalties that the taxpayer still needs to pay within the 15 days from receipt of Notice. There is also a warning that, in case of non-payment, collection may be enforced through the summary administrative remedies under the law.

.