Tax Alerts

14 Jan 2016Jan 20 deadline for list of employees by all Makati business establishments

The Business Permits Office of the City of Makati announced that it is aiming for the strict implementation of the provisions of the Makati Revenue Code (City Ordinance No. 2004-A-02) concerning employees and business establishments located in the City of Makati.

The requirement: All business establishments within the City of Makati are required to submit a certified list of their employees, whether casual, contractual, temporary, probationary or permanent. The list should be signed by a company officer and duly notarized, and should include the following information.

- Names of Employees

- Position

Due date: The list should be submitted twice every year:

- on or before January 20

- on or before July 20

Penalties: Failure to comply shall be subject to a fine not exceeding Php 5,000.

The announcement and the pertinent provisions of the Ordinance are annexed for your reference.

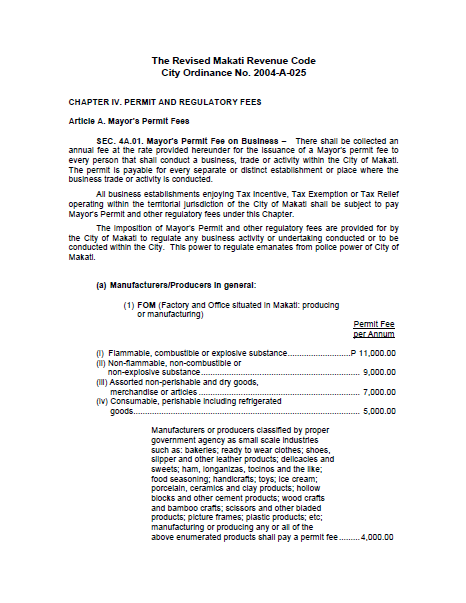

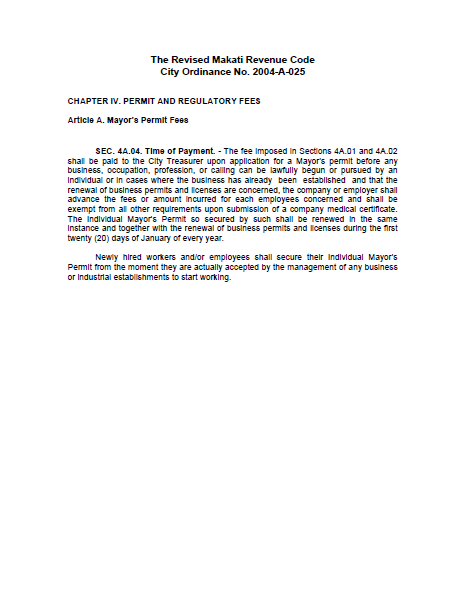

See attached copies of the Makati City Ordinance No 2004-A-02, Mayor's Permit Fee on Business, Mayor's Permit Fee on the Exercise of Profession, Occupation or Calling, and Mayor's Permit Time of Payment below.

.

.

.

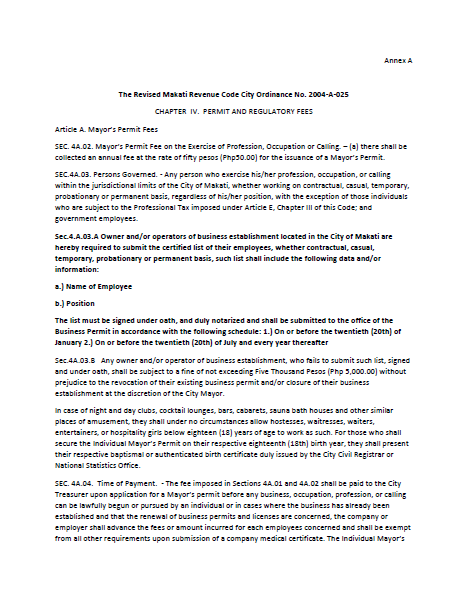

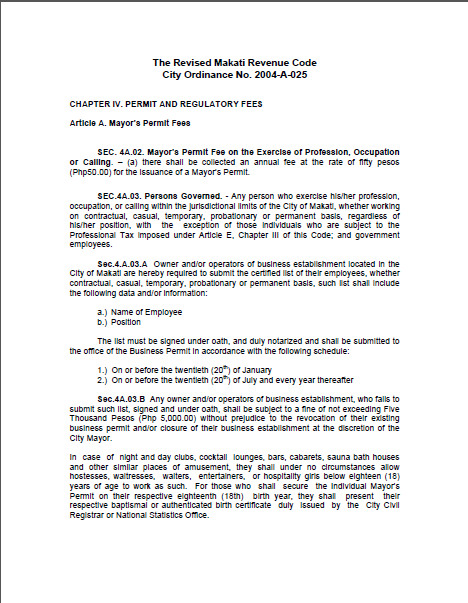

Mayor's Permit Fee on the Exercise of Profession, Occupation or Calling

.