Tax Alerts

10 Feb 2014New BIR Forms

The BIR has released new BIR forms which should be used for filing the income tax return (ITR) starting for taxable year ended December 31, 2013.

a. BIR Form No.1700 version June 2013 - Annual income tax return for individuals earning purely compensation income

b. BIR Form No.1701 version June 2013 - Annual income tax return for self-employed individuals, estate and trusts

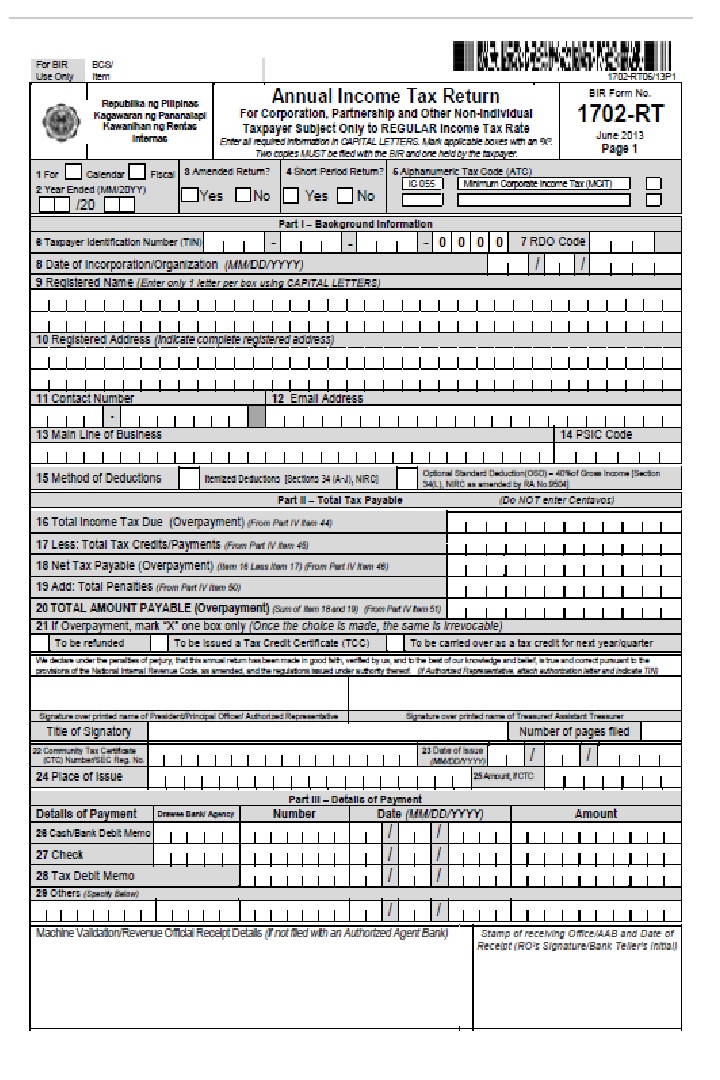

c. BIR Form No. 1702-RT version June 2013 - Annual income tax return for corporations, partnerships and other non-individual taxpayers subject only to the regular income tax

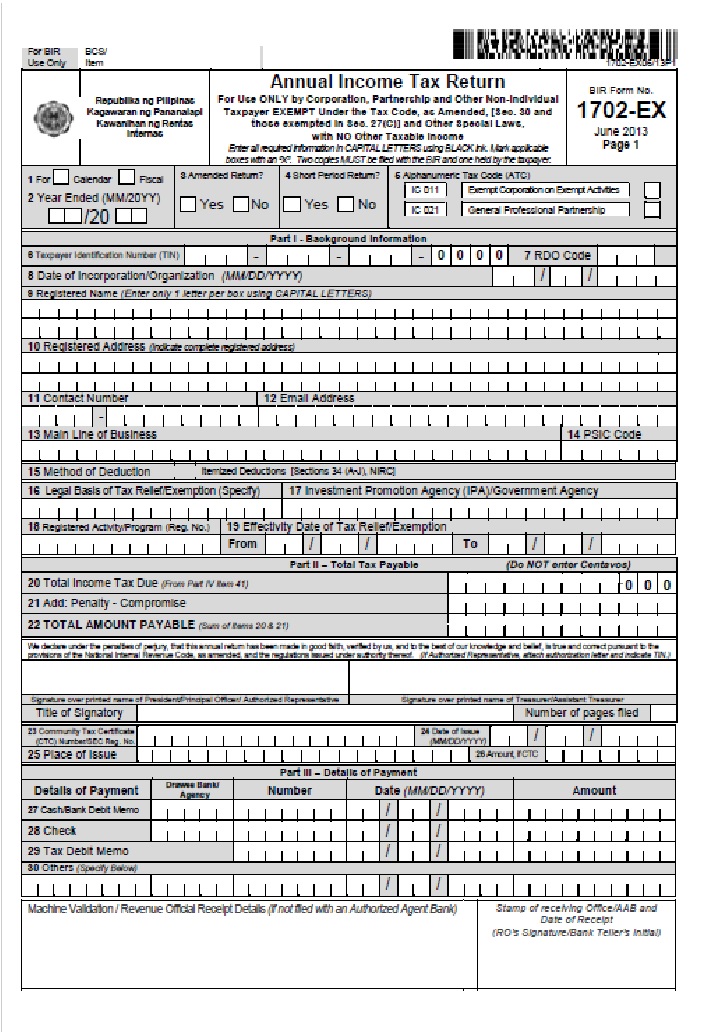

d. BIR Form No. 1702-EX version June 2013 - Annual income tax return for use only by corporations, partnerships and other non-individual taxpayers EXEMPT under the Tax Code, as amended and other special laws

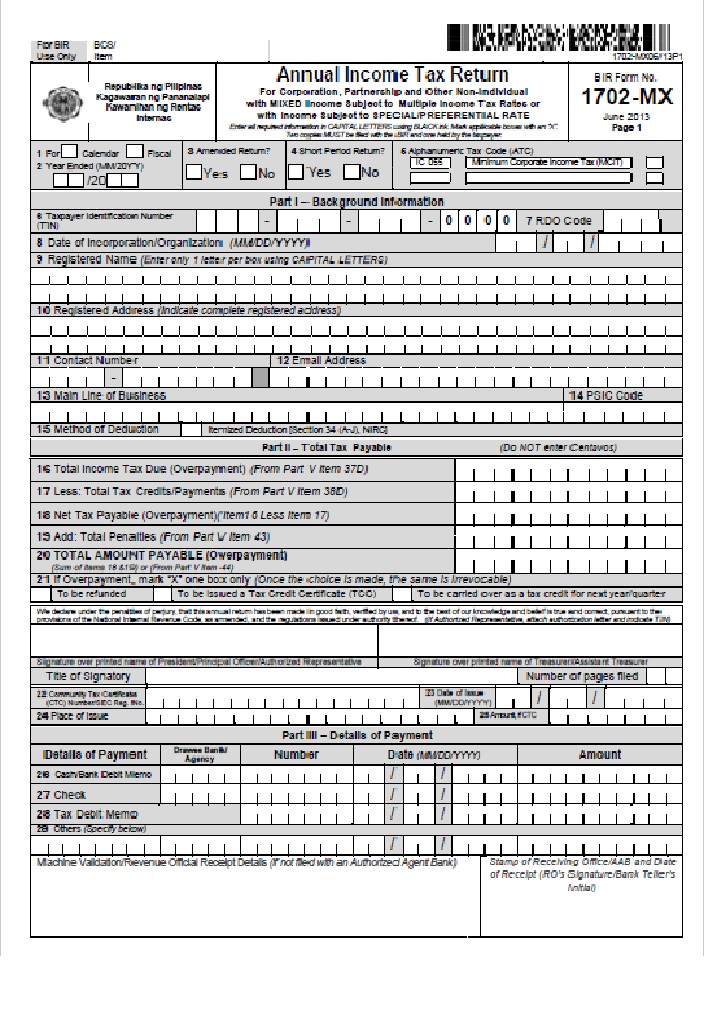

e. BIR Form No. 1702-MX version June 2013 - Annual income tax return for corporations, partnerships, and other non-individuals with mixed income subject to multiple income tax rates or with income subject to special/preferential tax rate.

Taxpayers who have filed the old BIR Forms for their ITR for year ending December 31, 2013 (manual or electronic) must re-file their tax returns using the new BIR Forms.

Rule on rounding-off ITR figures

The amounts reported in the income tax return should be rounded off to the nearest peso. The requirement for entering centavos in the ITR has been eliminated.

Mandatory use of itemized deductions

The following corporations, partnerships and other non-individuals may not avail of the optional standard deductions and are mandated to use the itemized deductions

a. Those exempt under the Tax Code and other special laws, with no other taxable income.

b. Those with income subject to special/preferential tax rates

c. Those with income subject to regular income tax rate and to special /preferential tax rates.

Please access the link below for PDF copy of the new BIR Form 1702.