Tax Alerts

29 Jan 2014Clarification on the mode of submission of alphalist

The BIR has issued the following clarifications on the submission of the alphabetical list of employees and list of payees on income payments subject to creditable and final withholding tax (alphalist) in accordance with Revenue Regulations No. 1-2014.

a. Mode of submission of alphalists

All withholding agents, regardless of the number of employees/payees, are now required to submit electronically their alphabetical list of employees and list of payees using either of the following modes:

1) Attachment in the electronic filing and payment system (eFPS)

2) Electronic submission using the BIR’s website (esubmission@bir.gov.ph)

3) Electronic mail (email) at dedicated BIR address using the prescribed CSV data file format.

The proper mode of submission shall depend on the type of registration/enrolment of the taxpayer, as follows:

|

Taxpayer registration |

Mode of Submission of alphalist |

||

|

e-Submission |

e-mail Submission |

Attachment in the eFPS |

|

|

eFPS |

Yes |

No |

Yes, when attachment facility becomes available |

|

BIR Inter-Active Form system (IAFS) |

Yes |

No |

No |

|

Non-eFPS/Non-IAFS |

Yes (BIR-preferred mode) |

Yes |

No |

Taxpayers submitting their alphalist through eSubmission or email shall receive an email message on the status of their submission. The required courses of action for the taxpayer are outlined below:

|

Submission status |

Course of action of taxpayer |

|

Alphalist successfully uploaded |

Print the e-mail message or the computer screen displaying the confirmation which shall serve as proof of filings/submission. The printed copy of the computer screen display shall be attached to the hard or physical copy of the monthly remittance returns, annual information returns, etc. required to be filed by non-eFPS taxpayers |

|

Alphalist failed the prescribed validation process |

Address the issues and re-submit the corrected and completely filled-up alphalist within 5 days from receipt of email-message |

|

|

|

|

No e-mail message |

Coordinate with the RDO to confirm the status. If submission did not reach BIR, re-check correctness of email address and re-send. |

b. Coverage of the modes of submission of alphalist

The prescribed modes of submission under RR 01-2014 covers the Monthly Alphalist of Payees (MAP) and the Summary Alphalist of Withholding Taxes (SAWT). It does not cover the monthly remittance return for compensation (BIR Form 1601C) where the monthly list of recipients of compensation is not required to be attached to the return.

c. Penalty on failure to successfully upload the alphalist

In case a taxpayer unsuccessfully uploaded its alphalist and was considered not received by the BIR, he/it shall be liable to pay P10,000 plus imprisonment of not less than one year but not more than 10 years, or in lieu of imprisonment, pay the compromise penalty based on gross annual sales under RMO 19-2007.

In case the BIR, after conducting the validation process, duly informed the taxpayer for non-compliance of requirements in the submission of alphalist (Q12 of the Circular) and required the re-submission of a correct alphalist, a separate penalty shall be imposed against the taxpayer for each incorrectly accomplished and submitted alphalist.

On the other hand, if the taxpayer failed to file the alphalist, or failed to address the issues and re-submit its complete and corrected alphalists after the validation process, the taxpayer cannot claim the expenses arising from the alphalist for income tax purposes.

Where the taxpayer is able to successfully upload its alphalist in the BIR’s data warehouse but fails to enter some transactions that should have been entered in its previously submitted alphalist, the taxpayer is required not only to re-file/re-submit the missing information but also to re-file/re-submit the complete and corrected alphalist to the BIR.

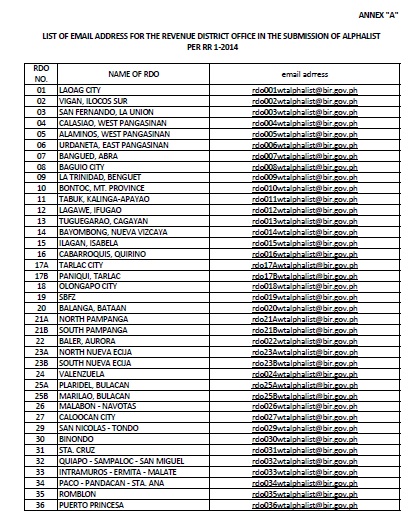

The specific procedures/steps in the submission of alphalists are explained in RMC 5-2014 Likewise, the e-mail addresses of the different BIR offices where the taxpayer may submit their alphalist through email is contained in the Annex “A” of RMC 5-2014.

Both RMC 5-2014 and Annex “A” thereof are attached below.

.

.

RMC 05-14 (Clarification on Alphalist)