Tax Alers

10 Apr 2012New guidelines in filing of ITRs of eFPS filers

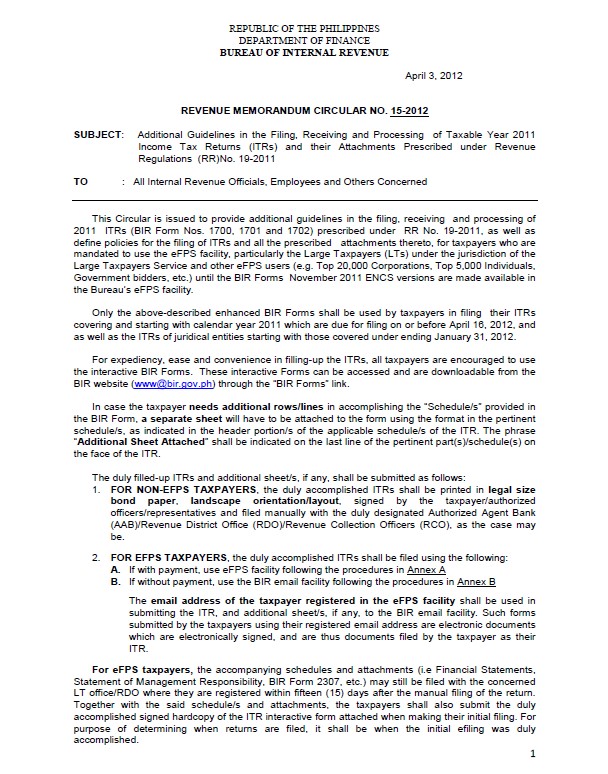

Earlier, the BIR announced that eFPS filers should manually file their annual income tax returns (ITR) due this April 16, 2012. Under RMC 15-2012, new procedures using the eFPS facility have been prescribed, as follows:

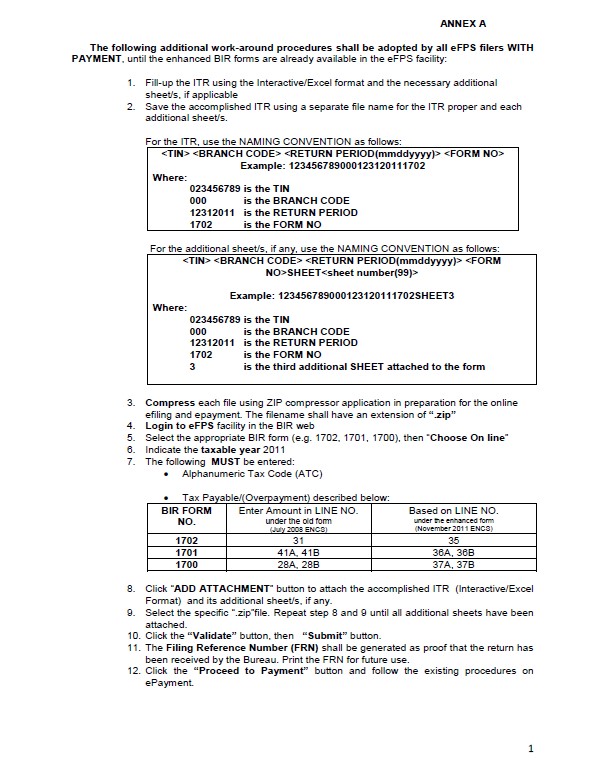

a. If the return is with payment, the eFPS taxpayer should fill up ITR using the interactive BIR Form and file accomplished return using the eFPS facility. e-Payment shall also be done through the eFPS facility. (Please follow detailed procedures in Annex A which can be accessed in the link below).

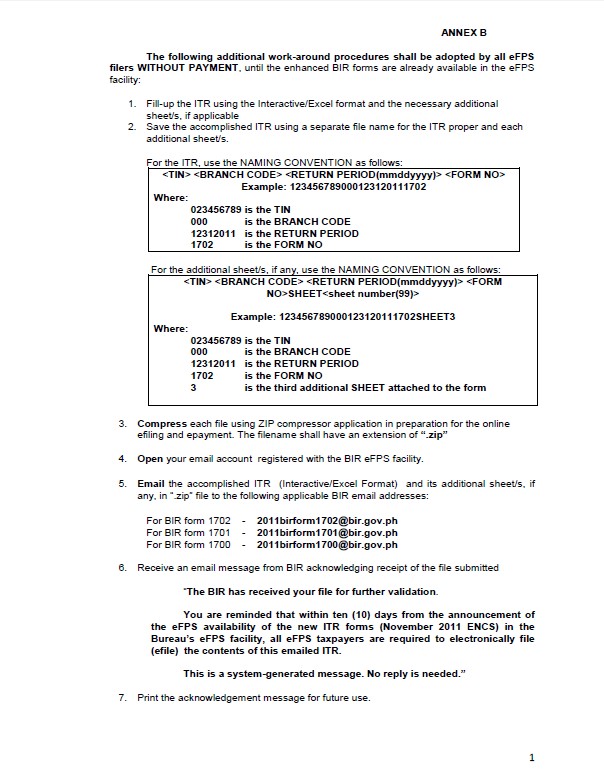

b. In case the return is without payment, eFPS taxpayer should fill up ITR using the interactive BIR Form and email the accomplished return using BIR email facility (Please follow detailed procedures in Annex B which can be accessed in the link below).

eFPS taxpayers are given 15 days after the manual filing of the return to submit the accompanying schedules and attachments (i.e., financial statements, statement of management responsibility, BIR Form 2307, etc.) of their ITRs. Together with the schedules and attachments, eFPS taxpayers shall also submit the duly accomplished signed hardcopy of the ITR interactive form attached when making their initial filing. For purposes of determining when returns are filed, it shall be when the initial efiling was duly accomplished.

The RMC also issued the following reminders:

1. Use of BIR Forms - Only the enhanced BIR Form Nos. 1700, 1701 and 1702 prescribed under Revenue Regulations (RR) No. 19-2011 shall be used by taxpayers in filing their ITRs covering and starting calendar year 2011 which is due for filing on or before April 16, 2012 and for ITRs of juridical entities starting taxable period ending January 31, 2012.

2. Attachment of additional sheets - In case additional rows/lines are needed in accomplishing schedules in the new BIR Forms, a separate sheet should be attached to the form using the format in the pertinent schedule. The words "additional sheet attached" should be indicated on the last line of the pertinent schedule on the face of the ITR.

3. Submission of ITRs by Non-eFPS taxpayers - The duly accomplished ITRs shall be printed in legal size bond paper, landscape orientation/layout, signed by the authorized officers/representatives, and filed manually with appropriate Authorized Agent Bank (AAB), Revenue District Office (RDO) or Revenue Collection Officer (RCO), as the case maybe

4. efiling of contents of manually filed ITRs - Upon availability of the enhanced forms in the eFPS facility, eFPS taxpayers should encode the contents of their manually filed ITRs within 10 days from the date of announcement of the eFPS availability in the BIR website, or before April 16, whichever comes earlier.

For further details, please see attached copy of RMC 15-2012 and Annexes.