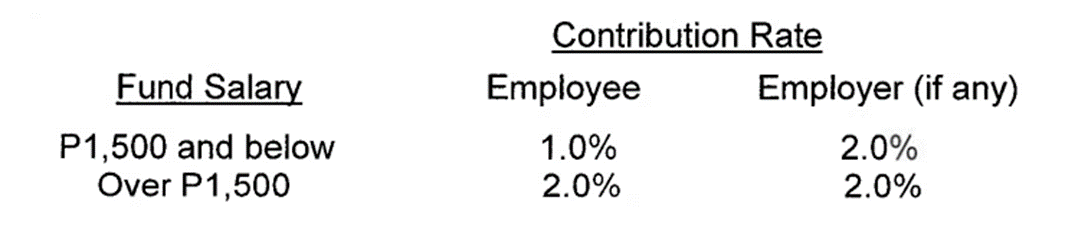

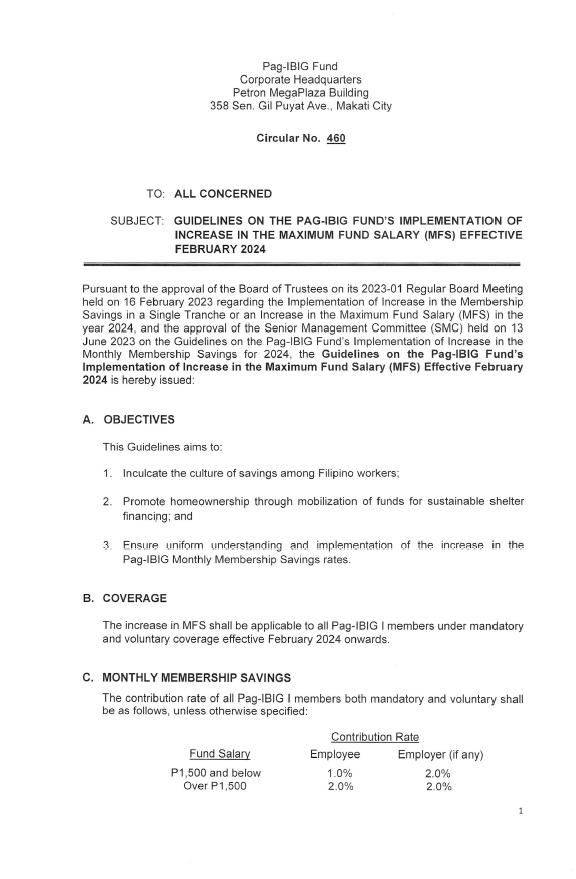

Relative to this Circular, the new mandate is having the increase from one (1) to two (2) percent contribution both for employer and employee.

![]()

Aside from that, the fund salary is now comprised of the gross income of the employee for the month.

It is also clearly stipulated in the circular that employers shall remit two (2) percent of the monthly fund salary of the contributing member as counterpart contribution and the employer is not entitled to deduct from the wages or remuneration of or, otherwise, to recover from the employee the employer’s contribution.

Furthermore, employees with two (2) or more employers shall contribute monthly to the fund a percentage of their Fund Salary per employer, which shall be matched by the letter in accordance with the rates specified in the Item C Section 1 of the Circular.

"Fund Salary" shall refer to the basic salary and other allowances, where basic salary includes, but is not limited to, fees, salaries, wages, and similar items received in a month. It shall mean the renumeration or earnings, however designated, capable of being expresses in terms of money, whether fixed or ascertained on a time, task, or piece or comission basis, or other method of calculating the same, which is payable by an employer to an employee or by one person to another under a written or unwritten contract of employment for work done or to be done, or for services rendered or to be rendered.

The maximum fund salary to be used in computing the employee and employer savings has been increased from Five Thousand Pesos (P5,000) to Ten Thousand Pesos (P10,000) taking into consideration financial calculations and rates of benefits in accordance with Section 7 of Republic Act No. 9679.