This Accounting Alert is issued to circulate Securities and Exchange Commission (SEC/Commission) Memorandum Circular (MC) No. 34-2020 dated December 15, 2020 on the deferral of certain unresolved provisions of Philippine Interpretations Committee Question & Answer (PIC Q&A) No. 2018-12 and IFRS Interpretations Committee (IFRIC) Agenda Decision on Over Time Transfer of Constructed Goods for Real Estate Industry.

Overview

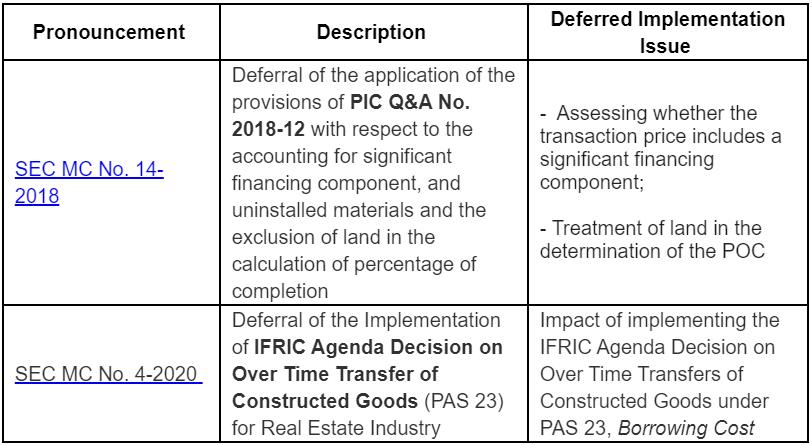

The Commission en banc, on its meeting held on December 15, 2020, decided to provide relief to the real estate industry by further deferring the application of the following unresolved implementation issues of PIC Q&A No. 2018-12 and IFRIC Agenda Decision on Over Time Transfer of Constructed Goods, for another period of three years or until 2023:

![]()

The deferral is in response to the request of the real estate industry for an additional period of deferral to afford the industry reasonable time to further evaluate the impact of several remaining items in the implementation of the above pronouncements.

Option Not to Avail

A real estate company may opt not to avail of any of the relief provided above and, therefore, will comply in full with the requirements of PIC Q&A 2018-12 and IFRIC Agenda Decision in respect of the relief not availed of.

Disclosure Requirements in the Financial Statements

The above regulatory relief, once adopted and recorded for financial reporting purposes, is not considered in accordance with Philippine Financial Reporting Standards (PFRS). Thus, real estate companies which opt to avail of the deferral shall specify in the Basis of Preparation of the Financial Statements section of the financial statements the following:

- the relief availed of; and,

- the indication that the financial statements are prepared in accordance with PFRS, as modified by the application of the availed financial reporting reliefs.

For consistency of presentation, real estate companies should comply with the following prescribed wordings:

“The accompanying financial statements have been prepared in accordance with Philippine Financial Reporting Standards, as modified by the application of the following financial reporting reliefs issued and approved by the Securities and Exchange Commission in response to the COVID-19 pandemic: (enumerate reliefs availed of).”

Real estate companies, which opted for the deferral, shall also be required to disclose in the notes to the financial statements:

- the accounting policies applied;

- a discussion of the deferral of the subject implementation issues in the PIC Q&A; and,

- a qualitative discussion of the impact in the financial statements had the concerned application guidelines been adopted.

Should any of the deferral options result in an accounting policy change, such accounting change will have to be accounted for under PAS 8, Accounting Policies, Changes in Accounting Estimates and Errors, i.e., retrospectively, together with the corresponding required quantitative disclosures.

Effects on the Independent Auditor's Opinion

The external auditor shall reflect in the opinion paragraph that the financial statements are prepared in accordance with PFRS, as modified by the application of the above financial reporting reliefs issued and approved by the SEC. In addition, the external auditor shall include an Emphasis of Matter paragraph in the auditor’s report to draw attention to the basis of accounting that has been used in the preparation of the financial statements.

See attached Accounting Alert for further details.