This Accounting Alert is issued to circulate Securities and Exchange Commission (SEC/Commission) Memorandum Circulars (MC) No. 8-2021 dated July 8, 2021 on the amendment to SEC MC No. 14-2018, SEC MC No. 3-2019, SEC MC No. 4-2020, and SEC MC No. 34-2021 to clarify transitory provision.

Overview

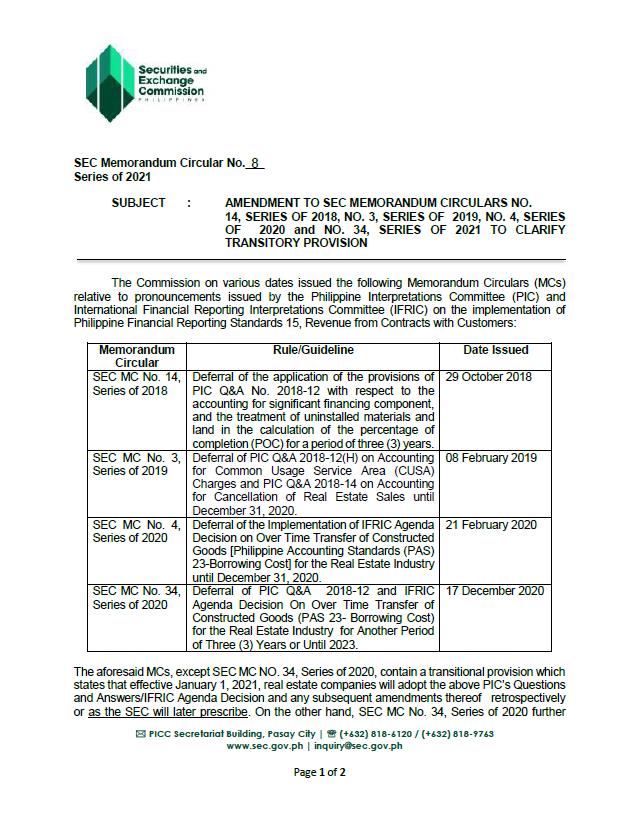

The SEC on various dates issued SEC MC Nos. 14-2018, 3-2019, 4-2020 and 34-2020 relative to pronouncements issued by the Philippine Interpretations Committee (PIC) and International Financial Reporting Interpretations Committee (IFRIC) on the implementation of Philippine Financial Reporting Standards (PFRS) 15, Revenue from Contracts with Customers.

Those MCs, except SEC MC No. 34-2020, contain a transitional provision which states that effective January 1, 2021, real estate companies will adopt the PIC’s Q&A/ IFRIC Agenda Decision and any subsequent amendments thereof retrospectively or as the SEC will later prescribe. On the other hand, SEC MC No. 34-2020 further extended the deferral of application of the provisions of PIC Q&A No. 2018-12 with respect to the accounting for significant financing component and the exclusion of land in the calculation of percentage of completion and IFRIC Agenda Decision on Overtime Transfers of Constructed Goods under PAS 23, Borrowing Cost, for another 3 years or until 2023.

The Amendments

To assist real estate companies to finally adopt the said PIC Q&A and IFRIC pronouncements, and enable them to fully comply with PFRS 15 and revert to full PFRS, the Commission en Banc, in its meeting held on July 8, 2021, approved the amendment to the transitional provisions of the above MCs which would provide real estate companies the accounting policy option of applying either the full retrospective approach or modified retrospective approach when they apply the provisions of the PIC and IFRIC pronouncements.

The Commission en banc, in the same meeting, likewise approved that the policy option be available to entities that cease availing of the above SEC financial reporting reliefs whether in full or in part.

See attached Memorandum Circular for further details.