Background

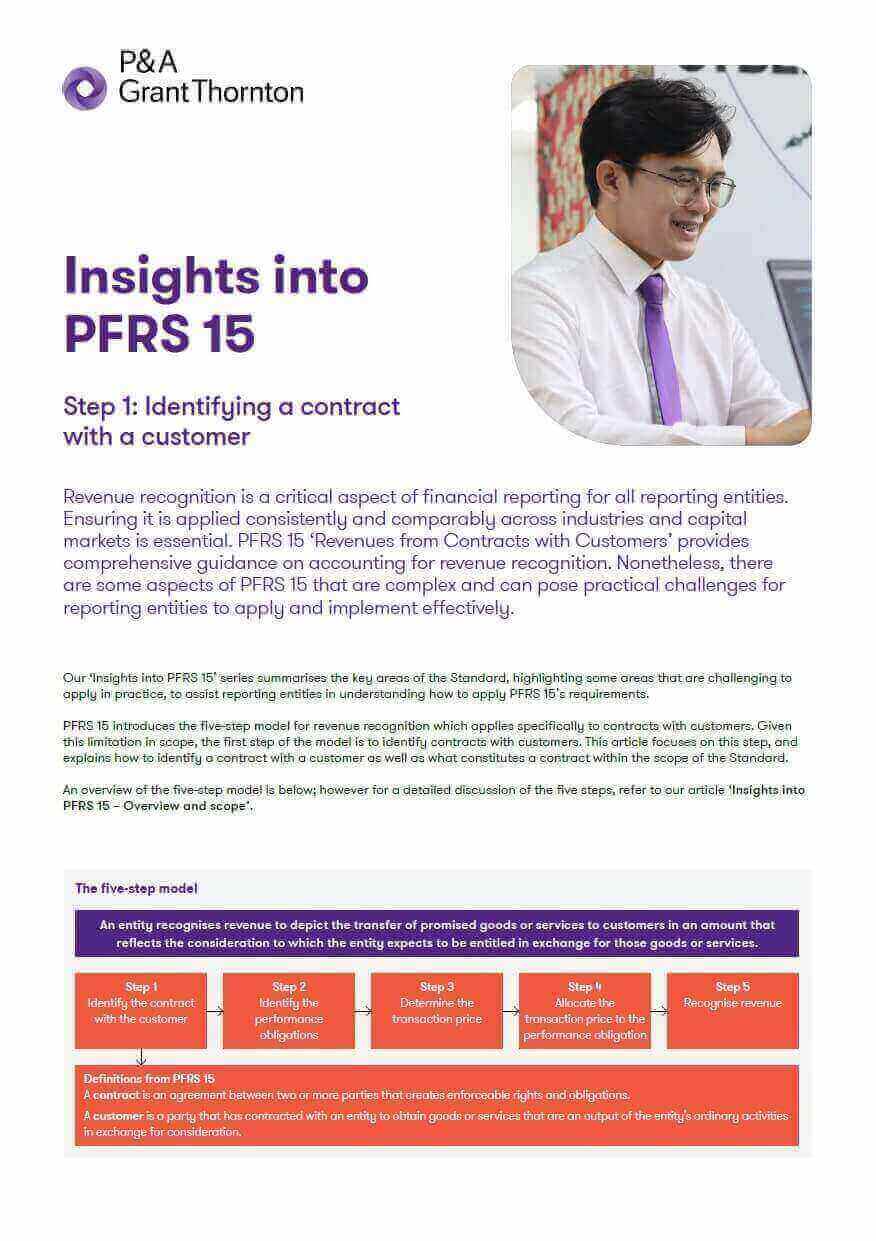

PFRS 15 ‘Revenue from Contracts with Customers' (the Standard) introduces the five-step model for revenue recognition which applies specifically to contracts with customers. Given this limitation in scope, the first step of the model is to identify contracts with customers. This article focuses on this step and explains how to identify a contract with a customer as well as what constitutes a contract within the scope of the Standard.

Five criteria for recognizing a contract

Step 1 acts as a gate before applying the later steps of the model. If the criteria are not met at inception, the remaining steps should not be applied until it determines that the Step 1 criteria are subsequently met. Significant judgment may be needed to determine if a contract exists. Once a contract meets the five criteria and passes

Step 1, reassessment is only required if there is a significant change in facts or circumstances.

An accounting contract for the purpose of PFRS 15 exist only when an arrangement meets all of the following criteria:

Criteria 1 - The parties have approved the contract and are committed to perform them

Under PAS 18, revenue recognition focused on transfer of risks and rewards, with no specific guidance on contracts. PFRS 15 introduces a control-based approach, requiring an approved contract as the foundation for the five-step model.

To satisfy the first criterion, the contract must be approved—whether in writing, orally, or implied—consistent with the entity’s customary business practices. Evidence may include signed agreements, purchase orders, or online authorizations, provided they are final and include all relevant terms. Both parties must demonstrate substantial commitment to perform their obligations, even if certain rights or conditions are not enforced.

Criteria 2 - The entity can identify each party’s rights

An entity must clearly identify the rights of all parties to assess the transfer of goods or services. If rights cannot be clearly identified, a contract does not exist.

When using a Master Service Agreement (MSA), enforceability depends on whether it alone creates rights and obligations. If purchase orders are required for specifics, enforceability arises only upon their approval, making each purchase order a separate contract. Minimum purchase clauses may establish enforceable rights unless past practices render them legally unenforceable.

Criteria 3 - The entity can identify the payment terms for the goods or services

An entity must also be able to identify the payment terms for the promised goods or services within the contract. The entity cannot determine how much it will receive in exchange for the promised goods or services (the ‘transaction price’ in Step 3 of the model for revenue recognition) if it cannot identify the contractual payment terms. The payment terms do not need to be fixed, but the contract must contain enough information to allow an entity to reasonably estimate the consideration that it expects to be entitled to.

Criteria 4 - The contract has commercial substance

A contract has commercial substance if it changes the risk, timing, or amount of an entity’s cash flows, meaning it has economic consequences. This prevents entities from inflating revenue through transactions with little or no consideration. The criterion applies to both monetary and non-monetary transactions.

Criteria 5 - It is probable the entity will collect substantially all of the consideration

To pass Step 1, an entity must determine it is probable to collect substantially all consideration under the contract. This ‘collectability assessment’ considers the customer’s ability and intent to pay. Under PFRS 15, probable means the event is more likely than not to occur.

An entity should assess whether contractual terms or business practices allow it to mitigate credit risk, such as requiring upfront payments or stopping service for non-payment. Collectability guidance under PFRS 15 is consistent with PAS 18: revenue is recognized only when it is probable that economic benefits will flow to the entity. However, when uncertainty arises, any amount later deemed uncollectible is recognized as an expense, rather than as an adjustment of the amount of revenue originally recognized.

Contracts that do not "pass" Step 1

If a contract fails Step 1 but the entity receives non-refundable consideration, revenue cannot be recognized until Step 1 is met or specified events occur. Until then, the amount received is recorded as a liability.

Portfolio practical expedient

PFRS 15 applies to individual contracts but permits a portfolio approach for contracts or performance obligations with similar characteristics, provided results do not differ materially from individual application. Entities must exercise judgment in grouping contracts for this practical expedient.