-

Annual and short period audit

We perform audit engagements in accordance with the Philippine Standards on Auditing (PSA), as required by required by national legislation or other regulations of agencies such as the Bureau of Internal Revenue (BIR), Securities and Exchange Commission (SEC), Bangko Sentral ng Pilipinas (BSP), Insurance Commission (IC), Cooperative Development Authority (CDA), etc.

-

Review engagement

We provide a limited or moderate level of assurance that financial statements are free from material misstatements, in accordance with the Philippine Standard on Review Engagements (PSRE).

-

Financial statements compilation

We help in the preparation of financial statements of clients in accordance with Philippine Standard on Related Services (PSRS) 4410.

-

Security offerings services

We provide assurance services for our clients’ debt and equity security offerings. These include audits or reviews of financial statements, examination of prospectuses, and issuance of comfort letters as required.

-

Agreed-upon procedures

We perform agreed-upon procedures in accordance with applicable professional standards, delivering factual findings reports tailored to the specific needs of our clients and relevant third parties. Our services include asset and inventory count observations, financial statement translations, and assistance with regulatory applications such as capital stock increases and debt-to-equity conversions.

-

Other related services

We help our clients stay ahead of the evolving complexities in the accounting landscape. Our offerings include training programs, transition and implementation planning, and impact assessments related to newly adopted accounting standards, such as Philippine Financial Reporting Standards (PFRS Accounting Standards) and other relevant frameworks.

-

Tax advisory

With our knowledge of tax laws and regulations, we help safeguard the substantive and procedural rights of taxpayers and prevent unwarranted assessments.

-

Tax compliance

We aim to minimise the impact of taxation, enabling you to maximise your potential savings and to expand your business.

-

Transfer pricing

We provide comprehensive Transfer Pricing (TP) solutions suited to the needs of the client.

-

Corporate services

For clients who want to do business in the Philippines, we help set up the business and assist in determining the appropriate and tax-efficient operating business or investment vehicle.

-

Tax education and advocacy

We offer seminars and trainings on tax-related developments and special issues of interest to taxpayers.

-

Business risk services

Our business risk services cover a wide range of solutions that assist you in identifying, addressing and monitoring risks in your business. Such solutions include external quality assessments of your Internal Audit activities' conformance with standards as well as evaluating its readiness for such an external assessment.

-

Business consulting services

Our business consulting services are aimed at addressing concerns in your operations, processes and systems. Using our extensive knowledge of various industries, we can take a close look at your business processes as we create solutions that can help you mitigate risks to meet your objectives, promote efficiency, and beef up controls.

-

Transaction services

Transaction advisory includes all of our services specifically directed at assisting in investment, mergers and acquisitions, and financing transactions between and among businesses, lenders and governments. Such services include, among others, due diligence reviews, project feasibility studies, financial modelling, model audits and valuation.

-

Forensic advisory

Our forensic advisory services include assessing your vulnerability to fraud and identifying fraud risk factors, and recommending practical solutions to eliminate the gaps. We also provide investigative services to detect and quantify fraud and corruption and to trace assets and data that may have been lost in a fraud event.

-

Cyber advisory

Our focus is to help you identify and manage the cyber risks you might be facing within your organization. Our team can provide detailed, actionable insight that incorporates industry best practices and standards to strengthen your cybersecurity position and help you make informed decisions.

-

ProActive Hotline

Providing support in preventing and detecting fraud by creating a safe and secure whistleblowing system to promote integrity and honesty in the organisation.

-

Sustainability

At P&A Grant Thornton sustainability is at the core of our mission. We are committed to fostering a healthier planet through innovative practices that reduce our environmental footprint, promote social responsibility, and ensure economic viability for future generations.

-

Accounting Services

At P&A Grant Thornton, we handle accounting services for several companies from a wide range of industries. Our approach is highly flexible. You may opt to outsource all your accounting functions, or pass on to us choice activities.

-

Payroll Services

We streamline payroll operations with secure, technology-driven solutions that enhance accuracy, ensure compliance, and free organisations to focus on strategic priorities.

-

Human Capital Outsourcing Services

We deliver highly trainable and experienced accounting professionals matched to client requirements, covering center and attrition management, and special projects.

-

Our values

Grant Thornton prides itself on being a values-driven organisation and we have more than 38,500 people in over 130 countries who are passionately committed to these values.

-

Global culture

Our people tell us that our global culture is one of the biggest attractions of a career with Grant Thornton.

-

Learning & development

At Grant Thornton we believe learning and development opportunities allow you to perform at your best every day. And when you are at your best, we are the best at serving our clients

-

Global talent mobility

One of the biggest attractions of a career with Grant Thornton is the opportunity to work on cross-border projects all over the world.

-

Diversity

Diversity helps us meet the demands of a changing world. We value the fact that our people come from all walks of life and that this diversity of experience and perspective makes our organisation stronger as a result.

-

In the community

Many Grant Thornton member firms provide a range of inspirational and generous services to the communities they serve.

-

Behind the Numbers: People of P&A Grant Thornton

Discover the inspiring stories of the individuals who make up our vibrant community. From seasoned veterans to fresh faces, the Purple Tribe is a diverse team united by a shared passion.

-

Fresh Graduates

Fresh Graduates

-

Students

Whether you are starting your career as a graduate or school leaver, P&A Grant Thornton can give you a flying start. We are ambitious. Take the fact that we’re the world’s fastest-growing global accountancy organisation. For our people, that means access to a global organisation and the chance to collaborate with more than 40,000 colleagues around the world. And potentially work in different countries and experience other cultures.

-

Experienced hires

P&A Grant Thornton offers something you can't find anywhere else. This is the opportunity to develop your ideas and thinking while having your efforts recognised from day one. We value the skills and knowledge you bring to Grant Thornton as an experienced professional and look forward to supporting you as you grow you career with our organisation.

Background

PFRS 15 ‘Revenue from Contracts with Customers' (the Standard) provides a comprehensive and standardized framework for revenue recognition. It establishes principles that ensure revenue is reported in a manner that faithfully represents the transfer of goods or services to customers in exchange for consideration.

Revenue recognition is a fundamental aspect of financial reporting across all industries. The Standard does not seek to redefine the concept of revenue, but rather to establish a uniform approach that ensures revenue is consistently recognized at the appropriate time and at the most reliable amount. The Standard aims to enhance the relevance and comparability of financial statements and improves the quality of financial information provided to users.

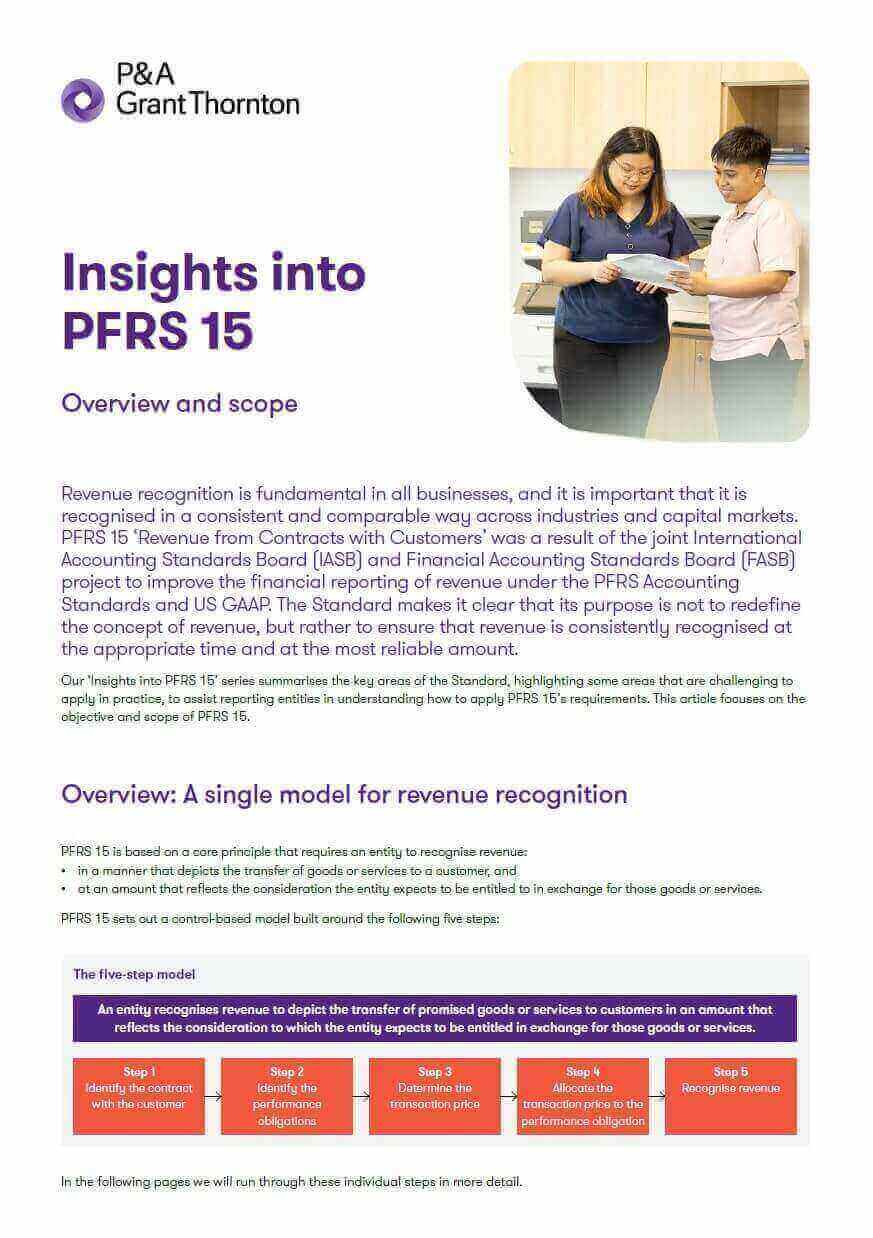

Overview: Single Model for Revenue Recognition

Step 1 - Identify the contract with a customer

A contract is defined as an agreement between two or more parties that creates enforceable rights and obligations.

A contract must meet all the following criteria within the scope of PFRS 15:

- the parties have approved the contract and are committed to performing their respective obligations

- the entity can identify each party’s rights

- the entity can identify the payment terms

- the contract has commercial substance, and

- it is probable that the entity will collect the consideration to which it will be entitled.

PFRS 15 also requires that entities consider the impact of multiple contracts entered into, at or near the same time with the same customer.

Step 2 - Identify the performance obligations in the contract

Part 1 - Identify the promises in the contract

Under PFRS 15, a performance obligation is a promise in a contract with a customer to transfer either:

- a good or service, or a bundle of goods or services, that is ‘distinct’, or

- a series of distinct goods or services that are substantially the same and have the same pattern on transfer to the customer.

Part 2 - Determine if the promises are separate performance obligations

An entity accounts for a promise as a separate performance obligation if the promise meets the criteria to be distinct or if it represents a series of distinct goods or services. A promised good or service is ‘distinct’ if both:

- the customer benefits from the item on its own or together with other readily available resources, and

- it is separately identifiable from other promises (e.g. the supplier does not provide a significant service integrating, modifying or customizing the promised goods or services).

Step 3 - Determine the transaction price

The transaction price is the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties

(e.g. sales taxes). The consideration promised in a contract with a customer may include fixed amounts, variable amounts, or both.

For the purpose of determining the transaction price, an entity should assume that the goods or services will be transferred to the customer as promised in accordance with the existing contract and that the contract will not be cancelled, renewed or modified. Determining the transaction price can be complex and careful considerations should be made by the entity in order to correctly account for the revenues in accordance with PFRS 15.

Step 4 - Allocate the transaction price to the performance obligations in the contract

An entity should allocate the transaction price to each performance obligation (or distinct good or service) in a manner that best represents the amount of consideration which the entity expects to receive in exchange for transferring the promised goods or services.

This implies that Step 4 is only applicable if the entity has identified more than one performance obligation or if the entity has identified a series of distinct goods or services as a single performance obligation (application of ‘series guidance’). The best way to achieve this objective is typically to allocate the transaction price to each identified performance obligation based on relative stand-alone selling price.

Step 5 - Recognize revenue as and when the entity satisfies a performance obligation

Revenue is recognized when the customer obtains control of the promised good or service. Control refers to the ability to direct the use of and obtain substantially all the remaining benefits from the asset.

Revenue is recognized over time if any of the following criteria are met:

- the customer receives and consumes the benefits as the entity performs

- the customer controls the asset as it is created or enhanced, or

- the asset has no alternative use to the seller and has an enforceable right to payment for its performance to date.

Revenue is recognized at a point in time if none of the conditions above are satisfied.

Scope

PFRS 15 applies to contracts with customers to provide goods or services that are an output of the entity’s ordinary activities in exchange for consideration. It does not apply to certain contracts within the scope of other PFRS Accounting Standards such as lease contracts, insurance contracts, financial instruments, guarantees other than product warranties and non-monetary exchanges between entities in the same line of business to facilitate sales to customers or potential customers.