Overview

On September 18, 2025, Bangko Sentral ng Pilipinas (BSP) issued BSP Circular No. 1218 (Series of 2025), which introduces stricter controls and enhanced due diligence (EDD) requirements for large value cash transactions exceeding ₱500,000.

Its primary goal is to mitigate money laundering (ML), terrorism financing (TF), and proliferation financing (PF) risks arising from cash based transactions. The Circular reinforces safeguards to deter illicit use of cash and promote the integrity of the financial system.

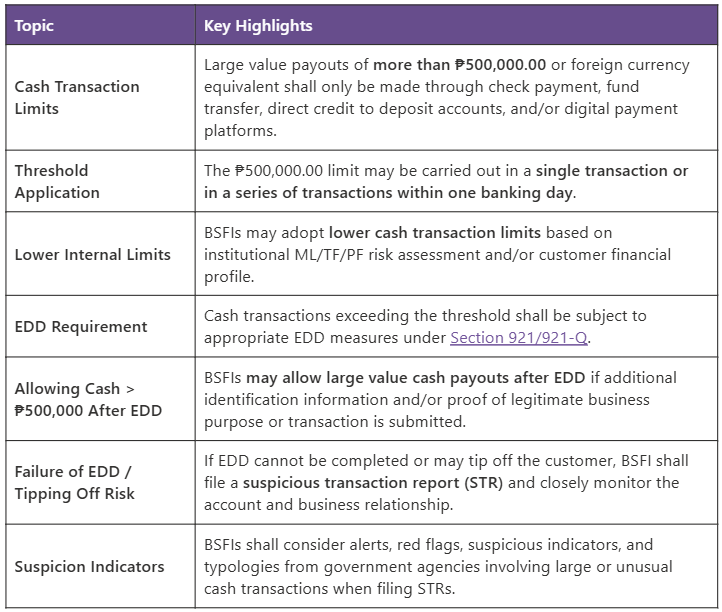

Key Highlights of the Circular

BSP Circular No. 1218 (Series of 2025) Section 1 amends Section 923/923 Q of the Manual of Regulations for Banks (MORB) and the Manual of Regulations for Non Bank Financial Institutions (MORNBFI). Under the amendment, BSP‑Supervised Financial Institutions (BSFIs) shall adopt appropriate anti money laundering/countering terrorism and proliferation financing (AML/CTPF) policies and procedures to strictly implement cash transaction limits and restrictions.

To guide BSFIs in understanding the regulatory expectations under the amended provisions of the MORB/MORNBFI, the table below summarizes the key highlights of BSP Circular No. 1218 (Series of 2025). It provides a clear overview of the new limitations, required controls, and due diligence measures applicable to large value cash transactions.

Clarification on the Implementation

Memorandum No. M‑2026‑005 provides clarifications on the implementation of the enhanced due diligence (EDD) requirements for large‑value cash withdrawals under BSP Circular No. 1218. It reiterates the following clarifications:

- BSFIs shall conduct EDD for cash withdrawals exceed in ₱500,000 on a per customer basis, instead of per transaction basis.

- BSFIs may adopt streamlined EDD based on the customer’s risk profile, nature of business or operations, and transaction patterns.

- Streamlined EDD may be applied to bank‑to‑bank transactions, including inter‑branch cash requirements, inter‑bank cash requirements, and loan disbursements.

- For cash payouts or withdrawals during declared calamities or emergencies, BSFIs may rely on a certification from the head of the concerned agency.

- More rigorous EDD must be applied when transactions deviate from the customer’s expected behavior, or present heightened money laundering, terrorism financing, or proliferation financing risks.

- BSFIs must ensure EDD procedures do not unduly delay legitimate transactions by streamlining internal processes providing branch personnel with targeted training, promoting consistent, efficient, and effective implementation across operations.

Please refer to this Memorandum for further guidance.

For additional guidance, BSFIs and readers are advised to refer directly to the following relevant BSP issuances:

- BSP Circular 1218, Series of 2025 – Regulation on Large Value Cash Transactions

- Memorandum No. M-2025-036 – Frequently Asked Questions (FAQs) on BSP Circular 1218, Series of 2025.