Tax Alerts

16 Apr 20152015

Supplemental procedures for manual filing of quarterly ITRs

(RMC No. 20-2015)

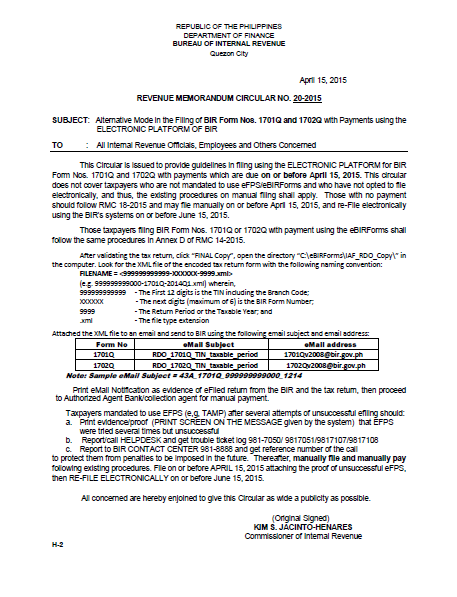

This RMC was posted in the BIR website late afternoon on April 15. The RMC covers the quarterly income tax returns (BIR Forms 1701Q and 1702Q) which are due on April 15 for taxpayers required to use eFPS or Online eBIRForms but were not successful in filing electronically.

As the RMC was released at a time when many taxpayers have already resorted to manual filing/payment, it is possible that these procedures were not performed prior to filing. Nevertheless, you are well advised to still perform the prescribed procedures (e.g., send email, call helpdesk, report to BIR contact Center) to establish the fact of system failure and protect the company from penalties. Proof of systems failure (printscreens) can be submitted together with the attachments that will be filed after April 15, if these were not attached to the filed returns.

These are the prescribed procedures:

1. No-payment returns shall be filed manually and re-filed electronically on or before June 15.

2. Taxpayers filing returns with payment shall follow the procedures under Annex D of RMC 14-2015, as follows:

a. After validating the return, click “FINAL COPY” and open the directory “C:\eBIRForms\IAF_RDO_Copy\” in the computer.

b. Look for the XML file of the encoded ITR with the following naming convention Filename = <9999 9999 9999-XXXXXX-9999.xml> wherein:

i. 9999 9999 9999 – First 12 Digits of the TIN including branch code

ii. XXXXXX – BIR Form Number

iii. 99999999 – Return Period/Taxable Year

iv. .xml – The file type extension

c. Attach the xml file to an email and send to the BIR using the following subject and address:

Form No. E-Mail Subject E-Mail address

1701Q RDO_1701Q_TIN_taxable period 1701Qv2008@bir.gov.ph

1702Q RDO_1702Q_TIN_taxable period 1702Qv2008@bir.gov.ph

d. Print email notification and the tax return and proceed to the Authorized Agent Bank (AAB) for payment.

3. Taxpayers mandated to use eFPS but who are unsuccessful after several attempts shall:

a. Print evidence of eFPS failure (e.g., prin tscreen of messages received from the system).

b. Report/call HELPDESK and get trouble ticket log (981-7050 to 51; 981-7107 to 08)

c. Report to BIR CONTACT CENTER 981-8888 and get reference number of the call .

d. Thereafter, manually file and manually pay on or before April 15 attaching proof of unsuccessful eFPS.

e. Re-file electronically on or before June 15.

.