Tax Alerts

22 Jan 20152015

PEZA importers are exempt from BIR ICC/BCC (Revenue Memorandum Circular No. 4-2015, January 5, 2015)

PEZA locators shall now be eligible for accreditation as importers with the Bureau of Customs Account Manager (BoC-AMO) without the need to secure an importer’s clearance certificate (ICC) or a customs broker’s clearance certificate (BCC). However, the BoC may still require them to submit documents and information before accreditation is granted.

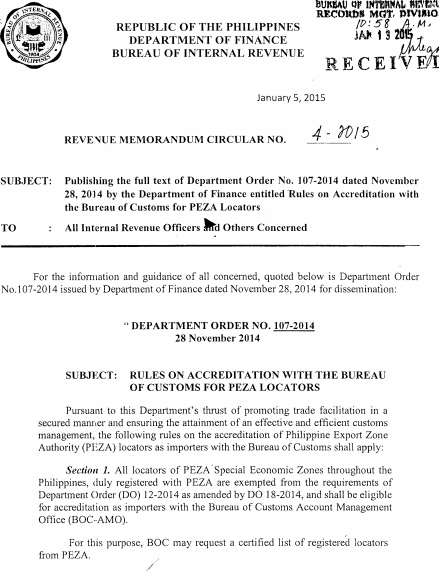

This was announced in BIR Revenue Memorandum Circular No. 4-2015 issued on 5 January 2015 which published the full text of Department of Finance Order No. 107-2014 which exempted all duly registered locators of PEZA Special Economic Zones from the requirements of Department Order (DO) No. 12-2014 as amended by DO No. 18-2014.

It may be recalled that as a pre-requisite for issuance of BOC accreditation, all importers must first secure a BIR-ICC and BCC as part of the revised rules on the accreditation of importers pursuant to the aforementioned DO's.

PEZA locators that will import goods into the Philippines will have to comply with the documentary requirements provided in the relevant rules of procedure of customs. Failure to do so will subject them to sanctions and penalties.

Please access the PDF for a copy of the RMC 4- 2015

Contact E-mail:

lina.figueroa@ph.gt.com