Tax Alerts

19 Mar 20152015

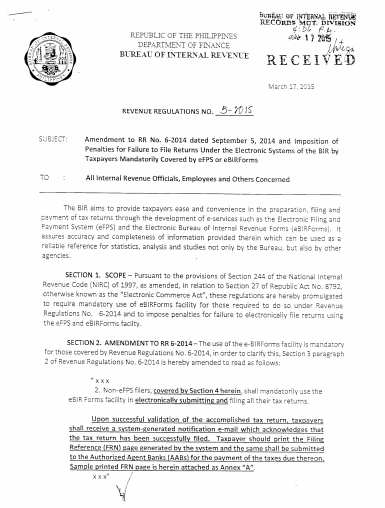

Imposition of penalties for failure to file returns under electronic systems of the BIR by taxpayers covered by eFPS and eBIRForms (Revenue Regulations No. 5-2015)

The BIR clarified the coverage of non-eFPS filers who shall mandatorily use the or Electronic Bureau of Internal Revenue Forms (eBIRForms) facility by electronically submitting and filing all tax returns for certain taxpayers. According to the RR No. 5-2015, filing electronically shall be mandatory only for accredited tax agents (ATAs), practitioners and all its client-taxpayers, accredited printers of principal and supplementary receipts and invoices, one-time transaction (ONETT) taxpayers, those filing no-payment returns, government corporations, local government units and cooperatives.

Covered taxpayers are also required to print the system-generated Filing Reference (FRN) page, upon successful validation of the tax returns, and submit to the Authorized Agent Banks for the payment of the taxes due thereon.

It may be recalled that the detailed procedures of the online account enrolment for the use of the online eBIRForms system was provided in Revenue Memorandum Order No. (RMO) 24-2013.

The BIR, on a separate announcement, also reminded the following taxpayers mandated to enrol, file, and pay tax returns EARLY using the Electronic Filing and Payment System (eFPS):

· Taxpayer Account Management Program (TAMP) Taxpayers;

· Accredited Importer and Prospective Importer required to secure the BIR-ICC and BIR-BCC;

· National Government Agencies (NGAs);

· All Licensed Local Contractors;

· Enterprise Enjoying Fiscal Incentives (PEZA,BOI, Various Zone Authorities);

· Top 5,000 Individual Taxpayers;

· Corporations with Paid-up Capital Stock of P10 Million and above;

· Corporations with complete computerized system;

· Procuring Government Agencies with respect to Withholding of VAT and Percentage Taxes;

· Government Bidders;

· Large Taxpayers; and

· Top 20,000 private corporations

It should be noted that the failure to file tax returns using eFPS or eBIRForms shall be subject to the imposition of a penalty of One Thousand Pesos (P1,000) per return. Additionally, for failure to file a tax return in a manner not in compliance with existing regulations tantamount to wrong venue filing pursuant to Section 248 (A)(2) of the NIRC shall incure civil penalty of 25% of the tax due to be paid.

Please access the PDF for a copy of RR 5-2015.

Contact E-mail:

lina.figueroa@ph.gt.com