Tax Alerts

14 Jan 20152015

Online submission of Certain Annual Income Tax and Excise Tax Returns (Revenue Memorandum Circular No. 2-2015, January 5, 2015)

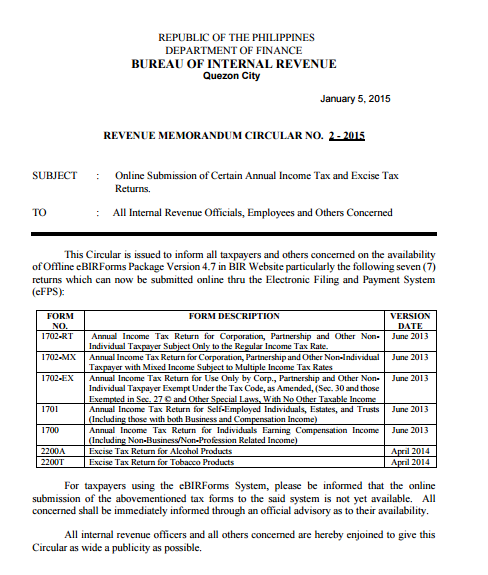

This circular was issued to inform all taxpayers and others concerned on the availability of Offline eBIRForms Package Version 4.7 in BIR Website particularly the following seven (7) returns which can now be submitted online thru Electronic and Filing Payment System (eFPS):

1. 1702-RT (Annual Income Tax Return for Corporation, Partnership and other Non-Individual Taxpayer Subject Only to the Regular Income Tax Rate);

2. 1702-MX (Annual Income Tax Return for Corporation, Partnership and other Non-Individual Taxpayer With Mixed Income Subject To Multiple Income Tax Rates);

3. 1702-EX (Annual Income Tax Return for Use Only by Corp., Partnership and other Non-Individual Taxpayer Exempt Under the Tax Code , as Amended, Sec. 30 and those exempted in Sec. 27 C and Other Special Laws, With No Other Taxable Income);

4. 1701 (Annual Income Tax Return for Self-Employed Individuals, Estates, and Trusts (Including those with both Business and Compensation Income);

5. 1700 (Annual Income Tax Return for Individuals Earning Compensation Income (Including Non-Business /Non-Profession Related Income);

6. 2200A (Excise Tax Return for Alcohol Products); and

7. 2200T (Excise Tax Return for Tobacco Products)

For taxpayers using the eBIRForms System, online submission of the abovementioned tax forms are not yet available. All concerned shall be immediately informed through an official advisory as to their availability.

Please access the PDF for a copy of RMC 2- 2015

Contact E-mail:

lina.figueroa@ph.gt.com